In a notable development directly impacting the London stock market, a senior executive at the Nasdaq stock exchange in New York has issued a direct warning to London’s financial leaders. With a clear intent, she has declared her pursuit of additional British companies to undergo public listings on the Nasdaq, introducing an intriguing dynamic to the ever-evolving narrative of the London stock market.

Arm’s US Triumph Spurs Nasdaq’s Attraction for British Firms

In a notable departure from traditional listings, Nasdaq, led by Karen Snow, has set its sights on luring additional British companies to the US, following the triumph of Arm, a prominent tech champion.

Arm’s decision to bypass the Prime Minister’s persuasion and go public in the US has fuelled Nasdaq’s ambitions, with the microchip designer experiencing a stellar reception, marked by a remarkable 50% surge in shares. This move has ignited discussions and prompted a wave of interest from other companies considering a similar transatlantic leap.

Arm’s Soaring Valuation Raises Questions About London’s Financial Future

In recent months, Arm’s surging share price, propelling its valuation to $130 billion, has led to substantial gains for SoftBank, marking a four-fold profit on their $32 billion investment in 2016.

The success of Arm in the US raises concerns about London’s appeal for businesses and investors, with some fund managers speculating about the future demise of the stock market.

The contrasting positive reception of Arm in the US, coupled with a prevailing sense of despair in London, underscores doubts about the city’s financial prospects. Amid a growing perception that the US is a more favourable destination, London faces challenges in maintaining its status as a global financial hub, necessitating strategic responses to emerging threats from various global financial centres.

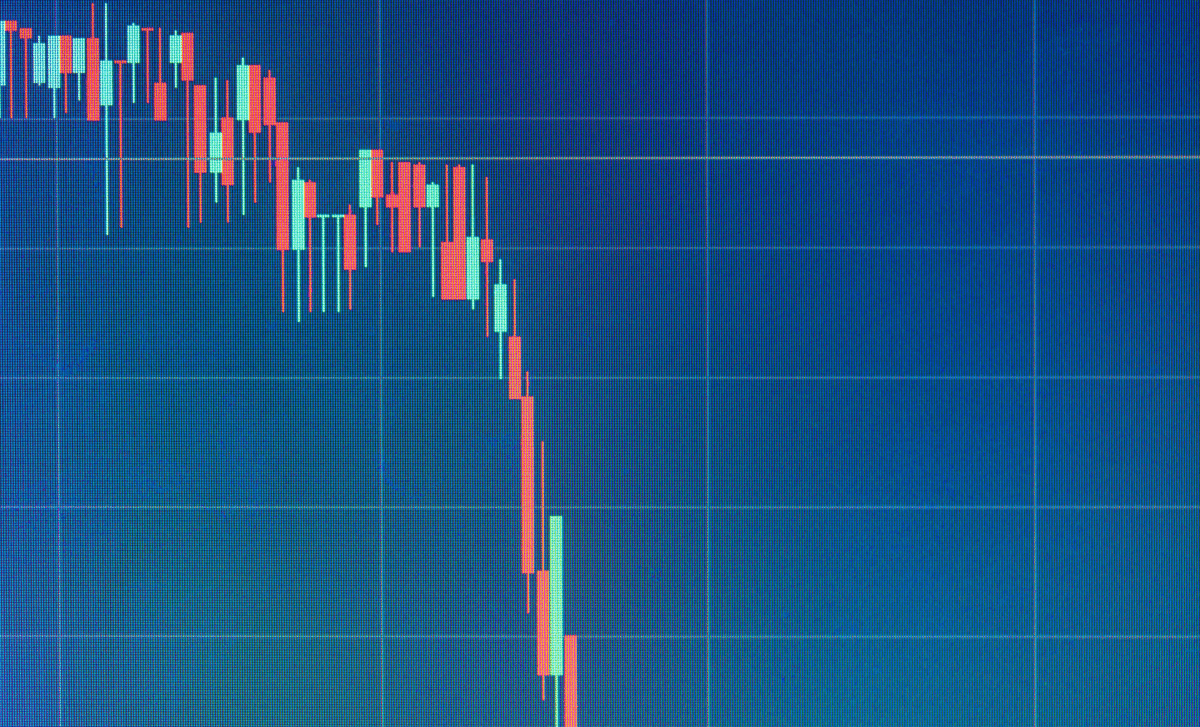

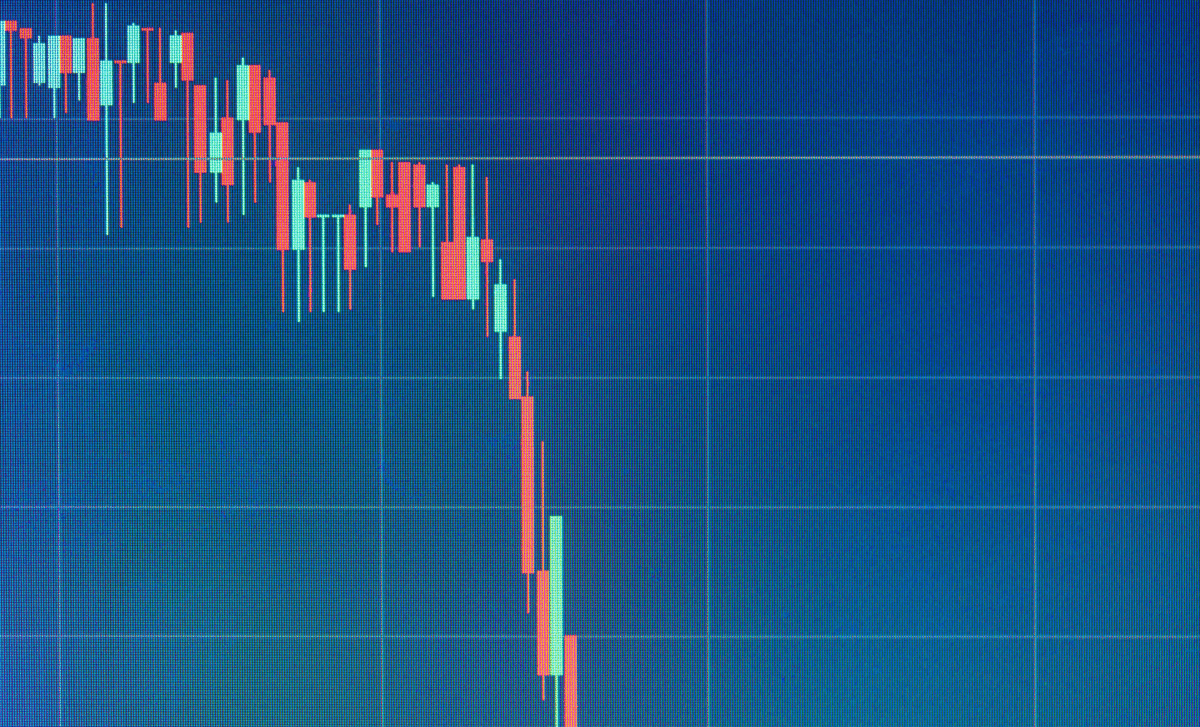

Declining London Stock Market Listings

The London stock market faces challenges with a diminishing number of listings attributed to a lack of investor interest in UK stocks, particularly in high-growth tech companies. Managers at Baillie Gifford’s UK Growth Trust criticize fellow investors for a “gloomy” outlook, emphasizing a short-term focus over future prospects.

The decline in UK stocks’ share in pension funds, dropping from half at the turn of the century to less than 10%, adds to the market’s woes. Peel Hunt analysts warn of a ‘doom loop,’ citing low valuations, decreasing liquidity, and a shrinking pool of UK-listed companies. This predicament is further intensified by foreign acquisitions, private equity transactions, and a dearth of new companies entering the public market.

The London Stock Market appears Stagnant Compared to the Dynamic Growth in the US

The decline of UK-listed companies by 40% since 2008 contrasts sharply with Nasdaq’s impressive $13 billion in new share issues for 2023, while the London Stock Exchange (LSE) struggled to raise a mere $972 million, failing to breach the $1 billion mark for the first time since records began in 1995, as per Dialogic data.

Blaming the investment community, the issue extends beyond regulatory barriers, requiring a fundamental shift in the demand side. If fund managers shy away from backing risk, London’s appeal for listings diminishes. The U.S. offers a stark contrast, encouraging ambitious ventures with robust financial support and a wealth generation appetite absent in the UK, where cynicism often prevails.

This trend spells potential doom for the London stock market, with economic gravity pulling companies toward New York. Historical examples, like the now-defunct Leeds stock exchange, serve as cautionary tales.

Addressing this challenge goes beyond mere government intervention; it calls for a comprehensive cultural shift. If the prevailing investor apathy in London persists, there is a looming risk that companies, following in the footsteps of Arm, will keep departing, potentially leaving the London stock market with only a handful of remaining entities. This underscores the urgency of fostering a more dynamic and supportive investment environment to retain and attract businesses on the London stock market.