Chancellor Rachel Reeves has emphasised the necessity of reassessing the state pension age to ensure its sustainability and affordability, particularly in light of the rising life expectancy in the UK. She has highlighted that this review will play a crucial role in maintaining the long-term viability of the state pension system.

The government is set to release its findings in March 2029, focusing on whether the current pension age remains appropriate for future generations. According to DevonLive, the Chancellor supports the initiative to examine pension adequacy and the state pension age, reflecting concerns over the growing fiscal pressures.

A Comprehensive Review

The government is set to release a comprehensive review of the state pension age in March 2029. This review, strongly supported by Chancellor Reeves, will reconsider the age at which individuals are eligible to claim the state pension.

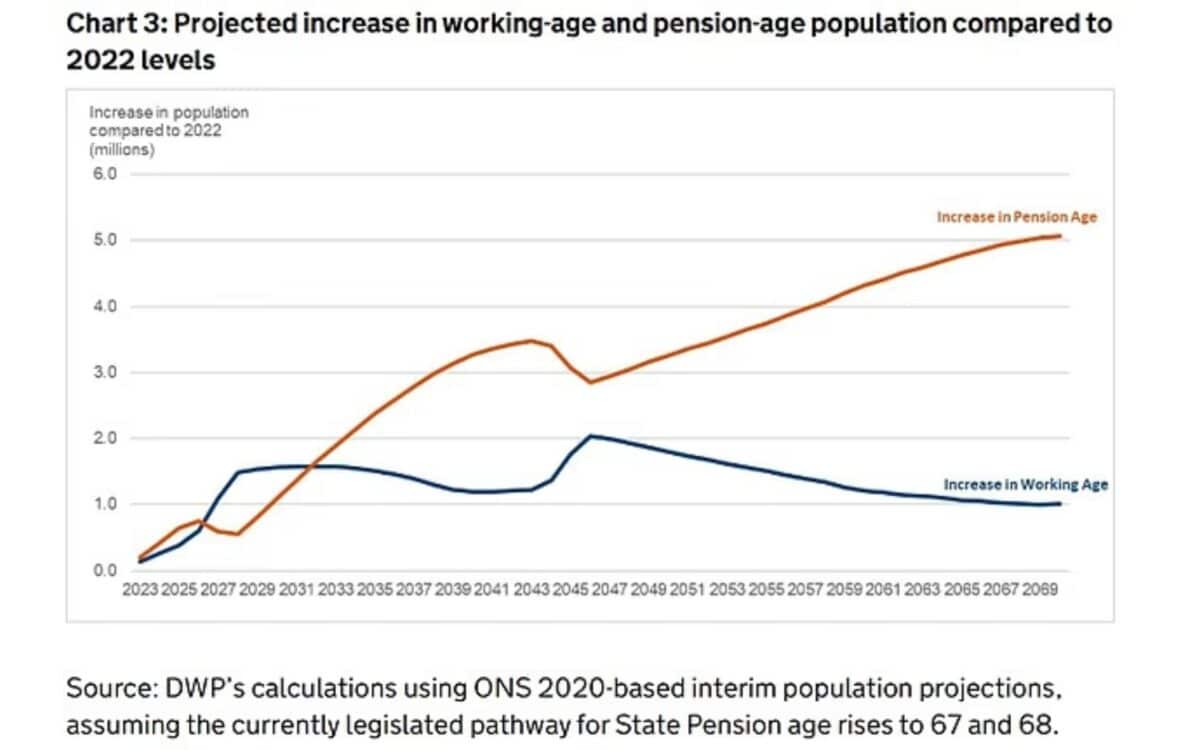

Currently, the state pension age stands at 66 years and is scheduled to rise to 67 years by 2028, in line with government projections. However, with life expectancy steadily increasing, Reeves believes it is “right” to re-evaluate the eligibility age to ensure future sustainability.

Speaking to journalists, the Chancellor remarked:

We have just commissioned a review of pensions adequacy, so whether people are saving enough for retirement, and also the state pension age.

She further explained:

As life expectancy increases it is right to look at the state pension age to ensure that the state pension is sustainable and affordable for generations to come.

That’s why we have asked a very experienced set of experts to look at all the evidence.

The Department for Work and Pensions has launched this review, which includes an independent report by Dr. Suzy Morrissey, focusing on the most recent life expectancy data and other factors surrounding pension adequacy. The Government Actuary’s Department will also contribute with detailed analysis.

Pressure on Fiscal Health

Reeves’ call for a review comes amid mounting scrutiny over the UK’s fiscal health. Government borrowing has surged, with the Office for National Statistics (ONS) reporting June borrowing levels of £20.7 billion, a £6.6 billion increase from the previous year.

This marks the second-highest June borrowing on record, only surpassed by the figures during the peak of the pandemic in 2020.

In particular, the Retail Prices Index (RPI) inflation has driven a surge in interest payments on government debt, which soared to £16.4 billion. These payments are largely tied to index-linked government bonds, which are affected by inflation.

Moreover, total borrowing for the first quarter of the financial year reached £57.8 billion, a £7.5 billion increase compared to the same period in 2024, highlighting the strain on public finances.

Richard Heys, the acting chief economist at the ONS, commented:

The rising costs of providing public services and a large rise this month in the interest payable on index-linked gilts pushed up overall spending more than the increases in income from taxes and national insurance contributions, causing borrowing to rise in June.

The Chancellor remains committed to ensuring the long-term sustainability of the state pension but acknowledges the need to adjust for changing economic conditions and demographics.