A renewed push to reform the UK’s Personal Tax Allowance and broader income tax system is quietly gathering pace. A parliamentary debate is now on the table, and growing public engagement suggests the issue could gain further traction in the coming weeks.

As reported by DevonLive, recent developments are putting additional pressure on the Treasury in the lead-up to the Spring Statement on March 26. What’s at stake goes beyond thresholds—it touches the financial balance for millions of low earners and pensioners.

Campaign Reaches Parliamentary Debate After Public Support Surges

A public petition calling for a significant increase in the personal tax allowance has surpassed 211,000 signatures, more than double the 100,000 required to trigger a debate in Parliament. Created by Alan David Frost, the petition urges a revision of the tax threshold first frozen in 2021, citing the growing impact of inflation on low earners.

The petition reads :

Raise the income tax personal allowance from £12,570 to £20,000. We think this would help low earners to get off benefits and allow pensioners a decent income.

We think it is abhorrent to tax pensioners on their state pension when it is over the personal allowance. We also think raising the personal allowance would lift many low earners out of benefits and inject more cash into the economy creating growth.

A Commons debate on the issue has now been scheduled for May 12, marking a significant win for campaigners after months of delay.

Fiscal Drag Brings More Low Earners Into the Tax Net

Since the Personal Tax Allowance threshold of £12,570 for the basic 20% income tax rate was frozen in 2021, a growing number of workers have been pulled into the tax system as wages increase—a phenomenon known as fiscal drag. The higher 40% rate continues to apply from £50,270, also unchanged since 2021.

This stagnation is projected to raise around £1.2 billion for the Treasury by 2028, according to official estimates. Critics argue that fiscal drag disproportionately impacts low-wage earners and pensioners, by taxing individuals who previously fell below the threshold.

Treasury Cites Public Service Funding and Fiscal Discipline

Responding to the petition, the Treasury issued a formal statement explaining its opposition :

The Government has no plans to increase the Personal Allowance to £20,000. Increasing the Personal Allowance to £20,000 would come at a significant fiscal cost of many billions of pounds per annum.

This would reduce tax receipts substantially, decreasing funds available for the UK’s hospitals, schools, and other essential public services that we all rely on.

It would also undermine the work the Chancellor has done to restore fiscal responsibility and economic stability, which are critical to getting our economy growing and keeping taxes, inflation, and mortgages as low as possible.

The department’s stance underscores its focus on balancing tax reform with broader economic and budgetary priorities.

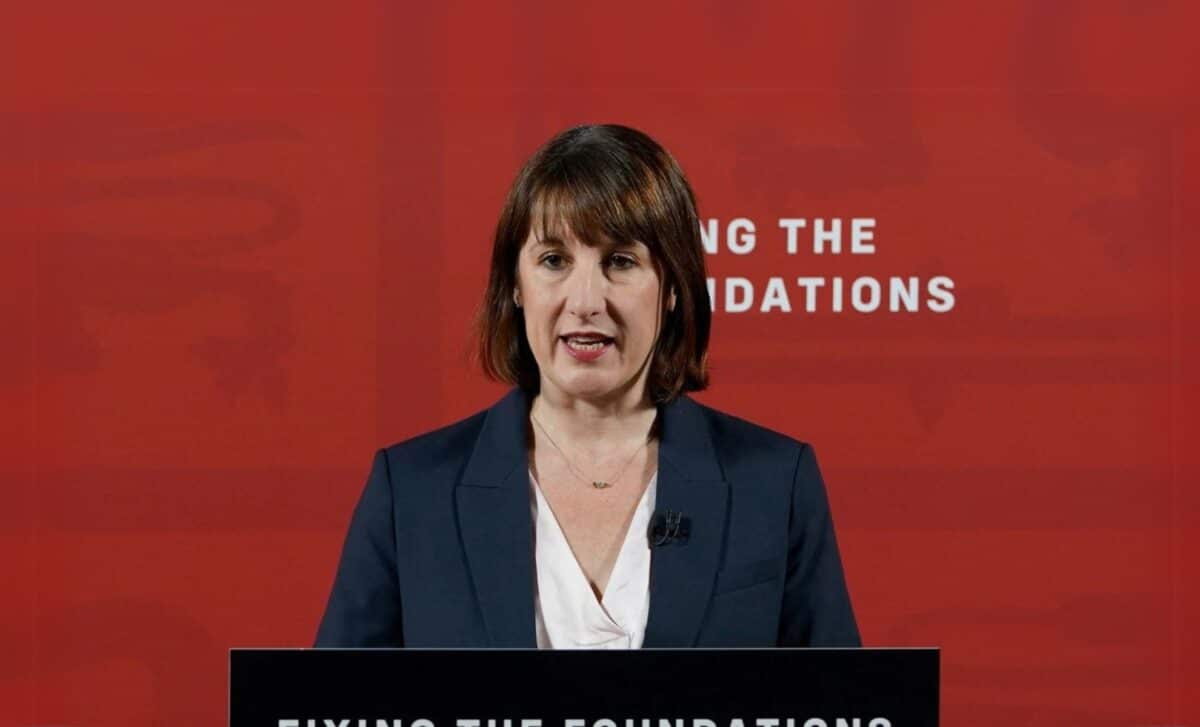

Political Tensions Rise Ahead of Spring Statement

The tax threshold freeze has become a flashpoint in Parliament. During Prime Minister’s Questions, Kemi Badenoch challenged Prime Minister Keir Starmer on whether the government would uphold its earlier pledge not to extend the freeze:

The Chancellor promised a once-in-a-parliament budget that she would not come back for more. And in that budget, she said there will be no extension of the freeze in income tax thresholds.

Ahead of the emergency budget, will he repeat the commitment that she made?

In response, the Prime Minister shifted focus, stating :

This Government has already delivered two million extra NHS appointments, 750 breakfast clubs, record returns of people who shouldn’t be here, and a fully-funded increase in our defence spending. That is the difference that a Labour Government makes.

Following the exchange, a Conservative Party spokesperson said :

The only logical conclusion is that at next week’s emergency budget, Labour are plotting stealth taxes to drag more people into paying higher tax rates.

The comments reflect growing speculation that Personal Tax Allowance threshold freezes may persist or expand, indirectly increasing tax burdens without raising nominal rates.

Millions Affected as Debate Reopens Fiscal Policy

Currently, anyone earning over £12,570 pays 20% income tax on earnings above that level. The campaign to raise this threshold highlights the tension between inflation, wage growth, and the static structure of the UK’s tax system.

While the Treasury remains opposed to the increase, the growing pressure from MPs and public signatories suggests the debate around personal tax policy is far from settled. Whether the government moves to ease the tax burden on the lowest earners will become clearer after the Spring Statement on March 26.