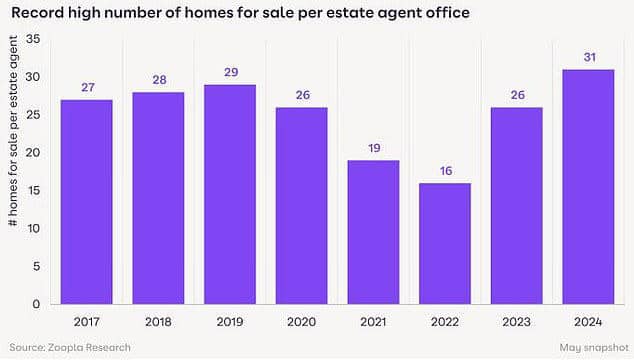

The housing market has seen a significant increase in the number of homes for sale, reaching its highest level for eight years, according to recent data from Zoopla.

This increase is attributed to a growing number of sellers returning to the market. Zoopla says that the increased choice available to buyers is helping to stabilise house prices, which have fallen by 0.1% in the year to April.

Rising Stock Levels and Market Stability

The property portal points out that the average estate agent now has 31 homes for sale, an increase of 20% on the same period last year.

This increase is largely due to the influx of three- and four-bedroom family homes, a category that saw a significant shortage during the pandemic.

In monetary terms, Zoopla estimates that there are currently £230 billion worth of homes on the market, an increase of 25% on the previous year.

Over the past year, many homeowners have postponed their plans to move home due to volatile mortgage rates and concerns about house prices.

However, with mortgage rates falling slightly and the market stabilising, more homeowners who were previously reluctant are now deciding to move.

Most homes for sale are new listings, but almost a third were also on the market in 2023 but have not been sold. To attract buyers, the asking price for 43% of these homes has been reduced by more than 5%.

Consequences for the Housing Market

An increase in the number of homes on the market generally corresponds to an increase in the number of potential buyers, as sellers are often looking to acquire another property.

However, the increase in the number of homes for sale outstripped the increase in completed sales, which were only 13% up on last year, with significant regional variations. For instance, the North East of England saw a 22% increase in completed sales, while Wales saw an increase of just 1%.

According to Zoopla, changes in tax regulations for holiday lets and the possibility of double council tax on second homes may encourage some owners to sell, particularly in the South West, which has the highest concentration of holiday homes. This region saw a 33% increase in the number of homes for sale compared with the previous year.

Regional Variations in House Prices : South and North of England

Property prices remain largely unchanged year-on-year, according to Zoopla, with a marginal fall of 0.1% in the 12 months to April. There is, however, a notable north-south divide, with prices falling in the south of England and rising in the northern regions.

For example, Ipswich saw a 3% fall in house prices, while Belfast recorded a 3% rise. Burnley and Bolton also recorded modest rises of 2.5% and 2.4% respectively. Norwich, on the other hand, fell by 2.4% and Hastings by 2.7%.

According to Donnell, these variations can be attributed to differences in house prices and affordability against a backdrop of rising mortgage rates.

He notes that coastal towns and those that experienced increased demand during the pandemic’s ‘race for space’ are seeing above-average price falls as these factors fade.