UK Chancellor Jeremy Hunt’s Budget 2024 announcement may have left you wondering about the impact on your finances. Substantial changes are on the horizon, with key measures on tax, benefits, pensions and much more. Here’s a look at the key points and policy initiatives set out in Mr Hunt’s budget speech.

Jeremy Hunt’s Key Budget 2024 Announcements for the UK

Fuel and Alcohol Duty Freezes to Continue

Hunt’s budget extends the freeze on fuel duty, maintaining a 5p cut for an additional 12 months. This decision aims to ease the financial strain on motorists, with the average car driver expected to save £50 per year. Additionally, an alcohol duty freeze until February 2025 seeks to support the hospitality sector, particularly benefiting the 38,000 pubs across the UK. These freezes are expected to reduce headline inflation by 0.2 percentage points in the upcoming fiscal year.

National Insurance Cut

A major component of the recent Budget is a significant reduction in the National Insurance contributions paid by employees. The proposed reduction would lower the rate from 10% to 8%, potentially saving the typical employee £450 per year. Industry experts estimate that this measure, combined with past adjustments, could result in considerable savings for around 27 million workers when fully implemented.

The aim of the cut is to increase consumer spending and put more money back into the pockets of taxpayers. Policymakers assert that this move will improve both household finances and the nation’s fiscal position in the months and years ahead.

Tobacco and Flight Duties

From October 2026, an excise duty on electronic smoking devices will be introduced to promote wellness. Furthermore, tobacco duties will receive a one-time increase, and air passenger rates on non-economy flights will be adjusted. These fiscal measures demonstrate the administration’s commitment to considering both health-related risks and financial aspects in its efforts to improve well-being and sustainability.

Non-Dom Tax Status Abolished

Starting in April 2025, a fairer tax system will replace the current unique tax arrangement for non-domiciled individuals in the UK. This new system will require individuals to pay taxes on all earnings, regardless of where they are generated. The reformed structure aims to generate additional income to assist with reductions in household taxation. Her Majesty’s Revenue and Customs hopes to increase equity while continuing to attract high-net-worth residents from overseas.

WATCH LIVE: Chancellor @Jeremy_Hunt delivers the Spring Budget to the @HouseofCommons. https://t.co/LfmFTO5JYw

— HM Treasury (@hmtreasury) March 6, 2024

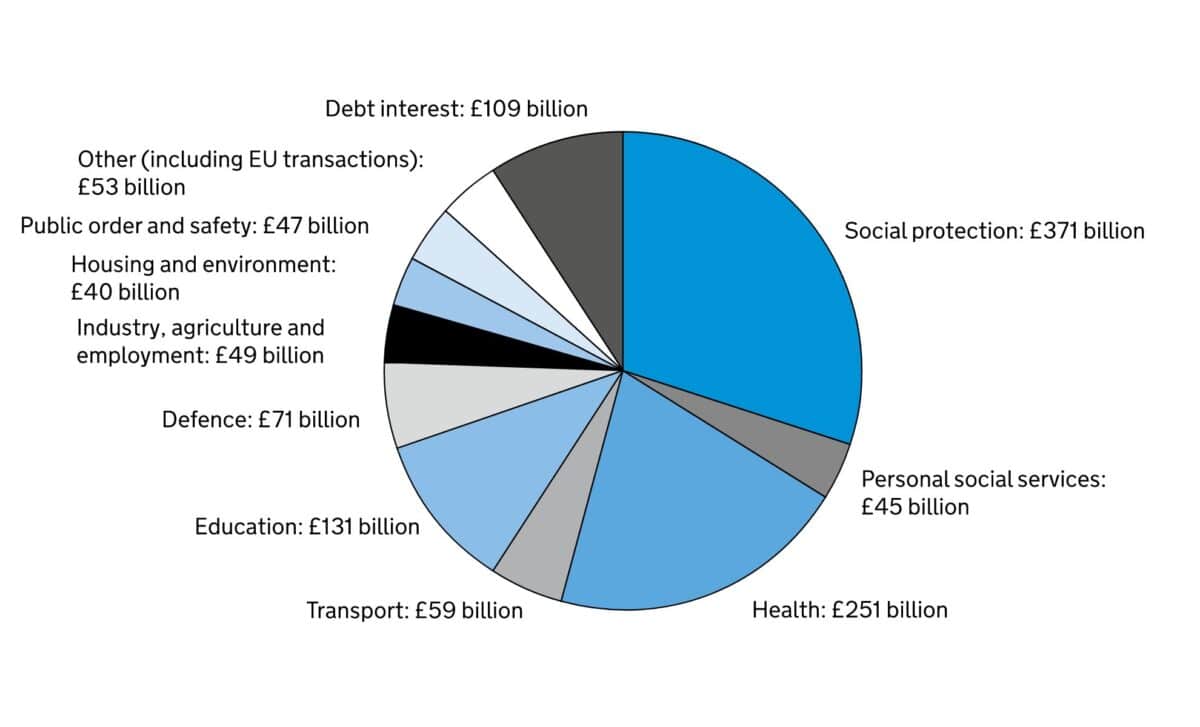

Improving Public Services and Healthcare

While day-to-day public spending growth will be limited to 1% in real terms, £3.4 billion will be allocated to improving NHS productivity. This will include doubling investment in the technological and digital transformation of the NHS, including upgrading vital MRI scanners, introducing universal electronic patient records and reducing the time frontline staff spend on administrative tasks. These measures will help unlock £35 billion in cumulative productivity savings from 2025-26 to 2029-30.

Childcare Support Program

The government has committed to guaranteeing funding rates for childcare providers for the next two years. This measure is part of the government’s childcare programme for children over the age of nine months. This programme aims to help more working-age parents return to the workforce while balancing caregiving responsibilities.

By stabilizing funding for childcare operators, more families will have access to affordable, quality care, enabling more individuals to participate productively in the labour market.

Household Support Fund

The government is providing an additional £500 million (including the Barnett Impact) to extend the Household Support Fund in England from April to September 2024 to address the challenges faced by vulnerable households. This initiative aims to assist with the costs of necessities and heating during the cost-of-living crisis, demonstrating the government’s commitment to supporting those most in need.

VAT Registration Threshold

The government remains committed to supporting small businesses. In the Autumn Statement 2023, it extended the 75% business rate relief for eligible retail, hospitality, and leisure properties through 2024-25, providing tax relief worth £2.4 billion. Additionally, the Spring Budget increased the VAT registration threshold from £85,000 to £90,000. This cuts taxes for small- and medium-sized enterprises (SMEs) and helps them grow.

Regional Investment Initiatives

The North East of England will benefit from a landmark devolution deal estimated to be worth more than £100 million. Additionally, the West Midlands Combined Authority is set to receive an extra fifteen million pounds for cultural, heritage, and investment initiatives. Counties such as Buckinghamshire, Warwickshire, and Surrey are positioned to obtain enhanced devolved authorities.