With a 4.9 percent rise from the year prior, the UK’s green taxes revenue in 2023 was £52.5 billion, nearly returning to the pre-pandemic state.

The rate of corporation tax has risen, while thousands more people are now in higher tax brackets as a result of the thresholds being frozen. Furthermore, the Chancellor has subtly increased revenue to the Treasury by implementing dozens of other levies, such as inheritance tax and stamp duty.

The fact is, however, that the Ministry of Finance has just turned them into a new tax in disguise. This situation must be brought to an end before it does further damage to an already fragile economy burdened by an authoritarian government.

Economic Impact of Green Taxes Hikes

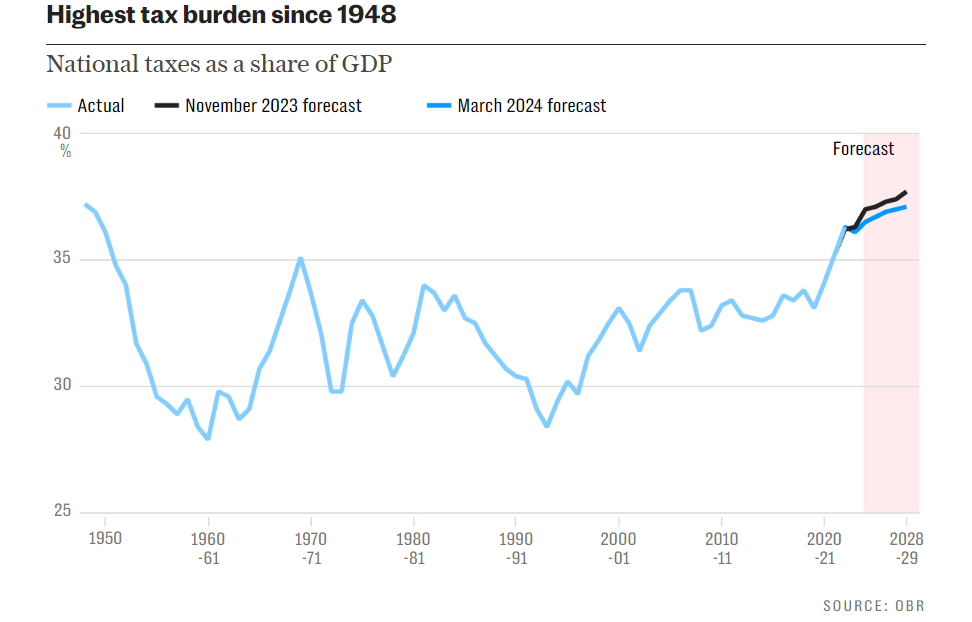

Certain tax advisers must find it difficult to keep up with the volume and speed of the levies imposed by the United Kingdom. The total tax burden has risen to around 40% of GDP, and will soon exceed its highest level in seventy years. Marginal rates for some people have reached 60% or 70%.

In these circumstances, it would be easy to ignore what has gradually become the biggest of all stealth taxes. The latest figures on environmental taxes were published this week by the ONS, and they are sobering.

With an increase of 4.9% on the previous year, revenue from ecotaxes in the UK will amount to £52.5 billion in 2023, a near return to pre-pandemic levels. Since 2000, the amount of green taxes has almost doubled. Most of this, almost £25 billion, comes from fuel duty.

These levies represented 5.5% of public revenue in 2022 and 2% of GDP overall. These taxes are expected to rise further, particularly in light of proposed Labour policies that could impose new taxes on air travel and limit tax benefits for non-green investment. Increasing the rate of environmental taxes poses difficulties for both individuals and businesses.

Climate Change Tax Levy

Many economists support the idea of higher environmental taxes as a direct means of influencing consumer behaviour and manufacturing practices, and thus reducing emissions. But it is how these taxes are applied and how they affect the economy as a whole that is problematic.

Ideally, to maintain a neutral fiscal effect, the revenues from environmental taxes should be offset by reductions in other sectors. For example, reductions in corporation tax or adjustments to income tax to compensate for air passenger duty could be used to balance the revenue from emissions trading.

There would be serious risks if environmental taxes continued to rise on the current trajectory without being reduced elsewhere. By imposing ever higher taxes on individuals and businesses, there is a risk of hampering economic growth by curbing prosperity and productivity.

In addition, public distrust and animosity towards decarbonisation initiatives may stem from the belief that such taxes are a means of raising general revenue rather than tackling environmental problems.

Nevertheless, policymakers need to explain openly how environmental taxes fit into wider fiscal plans in order to maintain public confidence and support for environmental initiatives.

Long-term sustainability goals may be undermined by growing scepticism and opposition to environmental taxes in the absence of convincing justification and concrete results.