London’s stock market is facing mounting challenges, with a significant decline IPO listings and an increasing number of companies relocating to the US. Once a leader in global finance, London’s stock market is under pressure as it slides in the rankings, prompting calls for immediate government intervention.

Decreasing IPO Investments

In 2023, the amount raised through initial public offerings (IPOs) in London has significantly dropped. The figures speak for themselves :

- $1 billion (£790 million) raised through IPOs this year, down 9% from the previous year.

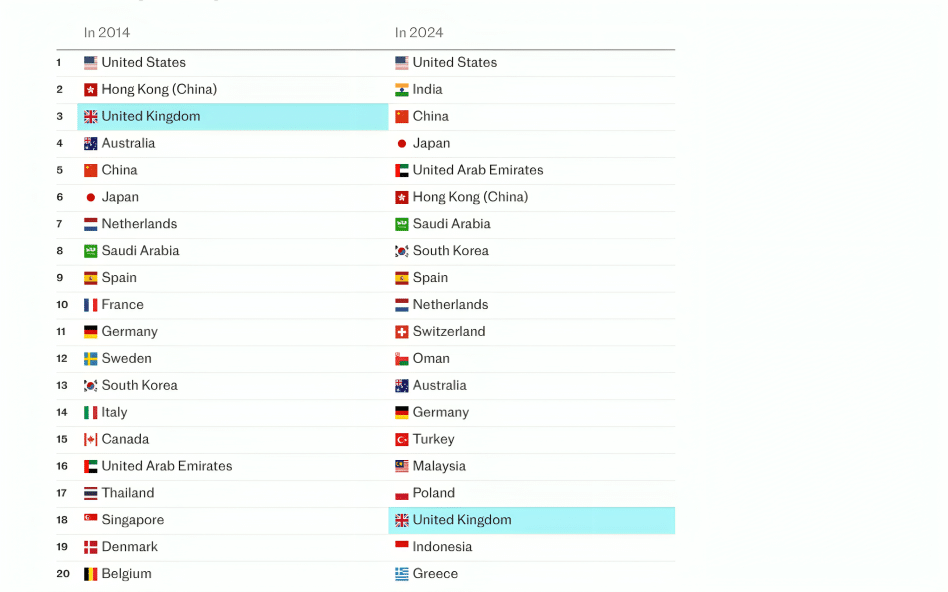

- London’s ranking has dropped to 20th in the global IPO league table, trailing countries like Oman and Malaysia.

- The UK is $40 billion behind the US, which remains the world’s top destination for IPOs.

While the London Stock Exchange remains the third-largest venue globally by capital raised, these numbers underscore the market’s growing struggles.

Major Drivers of Company Relocations

The slowdown in IPOs is compounded by the departure of established companies from the London market. Several firms have recently opted to list in New York, and others have sought secondary listings. Notable examples include:

- Ashtead, a major FTSE 100 company, shifted its listing to New York.

- Companies like CRH, TUI, Smurfit Kappa, and Flutter Entertainment have left London or are now listed elsewhere.

Additionally, the number of takeovers has surged to a 14-year-high, with companies such as Royal Mail, Hargreaves Lansdown, and Virgin Money either exiting or preparing to exit the market.

The Market Contraction : Lower Liquidity and Fewer Listings

A major factor in the market’s struggles is the “doom loop,” a vicious cycle where reduced listings and takeovers lead to even lower market liquidity. This, in turn, deters further investments. Analysts point to several reasons for this cycle:

- Underperformance of UK equities has led to lower allocations from global investors.

- As liquidity decreases, it becomes harder to attract new listings or keep companies from leaving.

Simon French from Panmure Liberum describes the situation :

“Fund managers are chasing performance, and performance is in the US, so they allocate to the US.” Simon French

Government Responses : Current Measures and Impact

The UK government has responded with reforms aimed at reviving the market, but their impact has been limited. Some main efforts include :

- Loosening of listing rules to make it easier for companies to go public in London.

- Proposals to encourage pension funds to invest more in UK companies, including merging local pension schemes into larger, more powerful investment funds.

However, the government’s measures have yet to generate significant results, and many believe that more aggressive policies are needed.

Pension Funds and the Case for Stronger Policies

One proposed solution is for the government to force pension funds to allocate a larger share of their investments to the UK stock market. Experts like Simon French argue that such a move could help restore investor confidence in London’s market.

“If UK pensions rotate more into the UK stock market, US investors would follow the performance.” Simon French.

Additionally, calls have been made for tax incentives to encourage more domestic investment, while simultaneously addressing the technological gap between London and Wall Street. In the US, high-frequency trading and new tech-driven market practices dominate, while London’s market lags behind.