The start of 2025 may bring slightly higher take-home pay for many Americans, thanks to updated IRS federal income tax brackets and increased standard deductions. These changes reflect efforts to adjust for inflation, which has been cooling after significant peaks in recent years.

What’s Changing in 2025

The IRS announced new tax brackets for 2025, raising income thresholds by approximately 2.8%. This adjustment follows a 5.4% increase in 2024, reflecting a slowdown in inflation.

The consumer price index (CPI), a key measure of inflation, showed a 2.7% increase in November 2024 compared to the previous year, down from its high of 9.1% in June 2022.

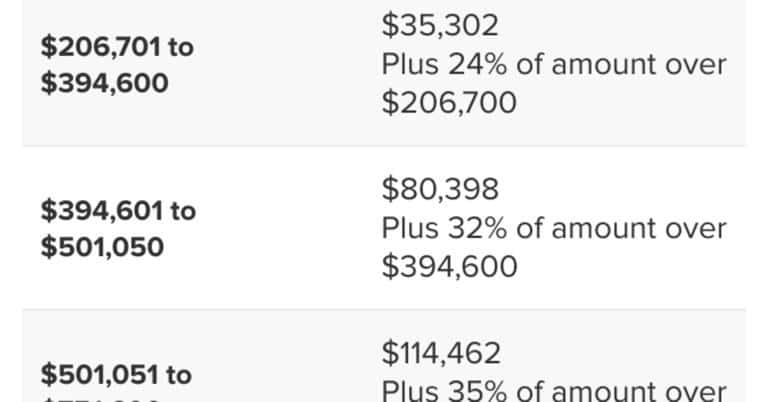

Adjusted Tax Brackets and Standard Deductions

The federal tax brackets determine how much tax you owe on different portions of your income. With higher income thresholds, individuals may find themselves paying less tax on their earnings compared to the prior year. For 2025, the standard deduction also increased:

- Married couples filing jointly: $30,000 (up from $29,200 in 2024)

- Single filers: $15,000 (up from $14,600 in 2024)

These increases mean more of your income is shielded from taxation, potentially reducing your overall tax liability.

Why Your Paycheck Could Be Higher

If your income remains consistent between 2024 and 2025, you could see a slight boost in your take-home pay. With higher tax brackets, a similar salary might place you in a lower tax bracket relative to the thresholds.

According to Brian Long, a senior tax advisor at Wealth Enhancement, “When all the tax brackets go up, but your salary stays the same, relatively, that puts you on a lower rung of the ladder.” Even small salary increases might not result in higher taxes due to these bracket adjustments.

The Inflation Balancing Act

Despite these changes, some Americans may not feel a noticeable difference in their finances. Elevated costs for everyday items, including groceries, gasoline, and cars, continue to offset income gains. Sheneya Wilson, a CPA, and founder of Fola Financial, noted, “It ends up nearly balancing out.”

While inflation has slowed, its lingering effects on household budgets remain a consideration for many.

Is 2.8% the amount the average senior will get on their social security checks?

i could not fill out the form. It would not load for me. Any more suggestion ?