The U.S. national debt has reached new heights as it hits a record-breaking $34 trillion. Experts in economy have become increasingly concerned about the debt crisis in the United States and have consequently asked the government to issue solutions in order to limit its high spending.

These new heights are a direct consequence of legislators raising the debt level in the previous year in order to avoid failure. According to the Congressional Budget Office, the debt situation will only get worse in the next few years. This means that the U.S.’s mandatory spending and net interest payment might surpass the government total revenue in the next 6 years—by 2030.

U.S. Debt Crisis to Spiral Beyond Control by 2030

According to an article from Business Insider, citing experts from JPMorgan, the escalating debt situation in the U.S. can be likened to a “boiling frog” scenario. This metaphor describes a situation where a significant crisis, like the financial one at hand, is not addressed promptly or effectively. In the analogy, a frog placed in boiling water will immediately try to escape, but if it’s put in water that heats up gradually, it won’t perceive the danger until it’s too late.

Similarly, the U.S. debt crisis has been developing slowly over time, making it harder to recognize and address. Without timely intervention, it’s feared that the situation may reach a point where it becomes uncontrollable, much like the frog that doesn’t realize it’s being brought to a boil.

What’s at Stake With Rising U.S. Federal Debt?

By 2030, the Congressional Budget Office projects that the U.S. mandatory spending and net profit payments are going to exceed the government’s income. “The problem for the U.S. is the starting point; every round of fiscal stimulus brings the U.S. one step closer to debt unsustainability,” argued Michael Cembalest, a tactician at JPMorgan.

The bank had already predicted a similar scenario for 2023 and 2024. Cembalest asserts that the possibility of an economic decline—or a recession—is still to be feared for current year, although it might be “mild”.

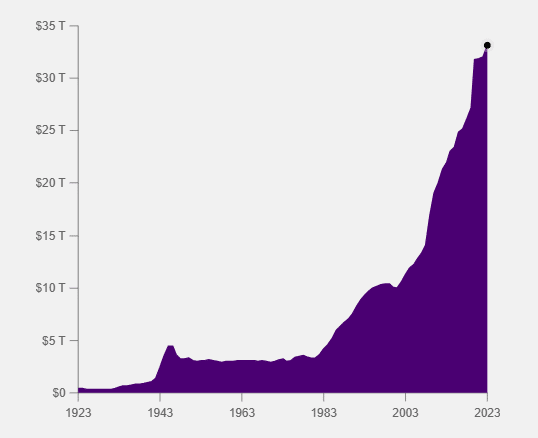

The bank’s debt tracer displays that the federal debts have highly increased, reaching 34 trillion dollars for the very first time. Moreover, JPMorgan points out that the U.S. is unlikely to significantly pull back its discretionary spending. This persistent increase in federal debt not only reflects the government’s financial practices, but also hints at potential long-term economic repercussions that could affect everyone from policy-makers to the average citizen.

Tracing the U.S. Debt’s Unprecedented Growth

The federal debt includes the totality of the sums that the government has taken on loan in order to cover its expenses. The loans often came under the form of notes or Treasury bonds that are fixed-interest U.S. government security with maturity of more than a decade.

The level of debt has been increasing gradually since the beginning of the 1980s. It surpassed 10 trillion dollars for the very first time in 1996. By 2008, it reached 14 trillion USD, breached to 20 trillion USD in 2011 and has been skyrocketing ever since.

Last Updated: September 30, 2023. Data: U.S. Department of the Treasury.

The dramatic increase in the U.S. debts can have risky consequences on both national markets and economy. As a matter of fact, when a nation’s debts reach a high limit, they can reduce business investments and slow economic growth. The Council on Foreign Relations has issued in December that the debts of the U.S. Federal Department have reached a remarkably high level of GDP since the Second World War; a staggering 123%.