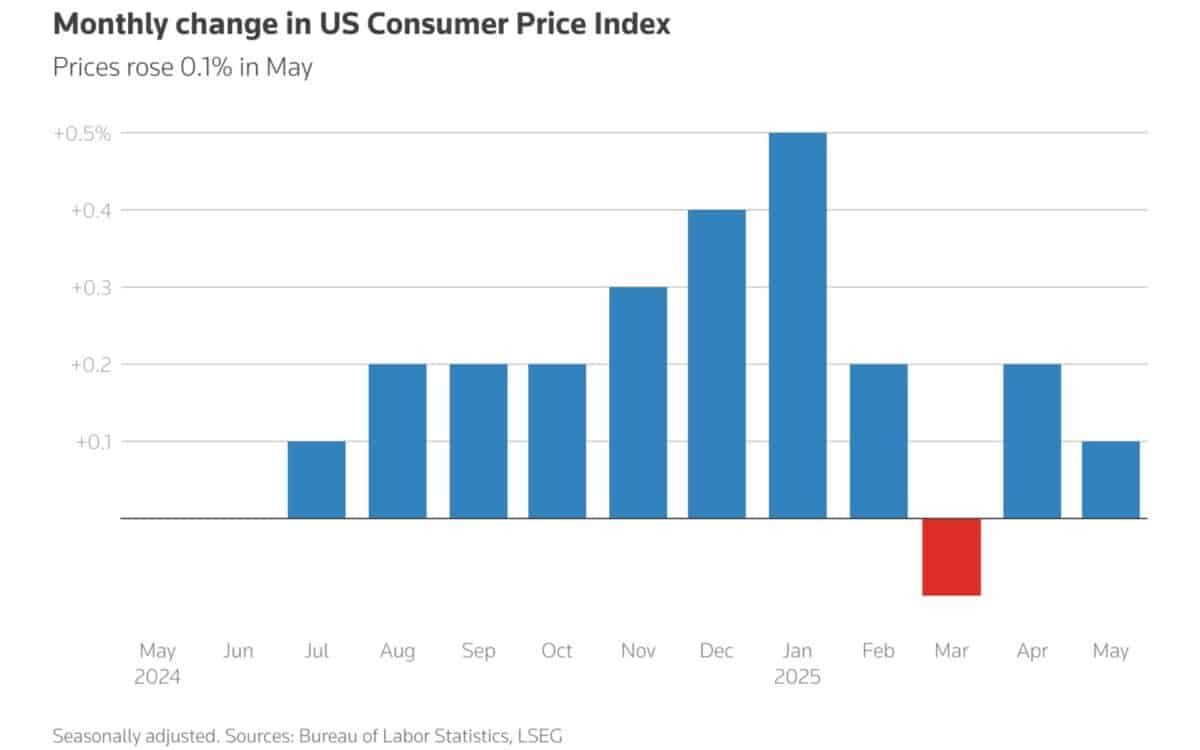

U.S. consumer prices rose by 0.1% in May, a smaller increase than anticipated, as cheaper gasoline helped offset higher housing costs. According to data published by the Labor Department, the monthly advance in the Consumer Price Index (CPI) was more modest than economists’ expectations.

Reuters reported that the slower pace of price increases reflects lingering effects from earlier inventory cycles and subdued service sector inflation. Despite this, broader inflationary trends remain under scrutiny.

Recent import tariffs introduced during the Trump administration are expected to gradually feed into consumer prices, potentially pushing overall inflation higher during the second half of the year.

Key Drivers Behind the Increase in Consumer Prices

The Consumer Price Index (CPI) rose by 0.1% in May, following a 0.2% increase in April.

The primary factor behind this was a 0.3% rise in shelter costs, mostly driven by rent increases. Food prices also rebounded with a 0.3% rise, while gasoline prices saw a decline of 2.6%. In the 12 months through May, the CPI advanced 2.4%, slightly higher than the 2.3% increase in April.

Impact of Tariffs on Inflation

Although inflation has been relatively muted, economists warn that the full impact of tariffs imposed by the Trump administration may begin to take hold in the coming months.

Companies like Walmart have already signaled price hikes, and the economic uncertainty stemming from tariffs may prevent businesses from lowering prices, resulting in gradual price increases through the year.

This report is another indicator that, before tariffs and economic uncertainty, we were well on our way to inflation falling back to target and that the main impediment to future progress is tariff-related price increases – said Daniel Hornung, a senior fellow at MIT.

Core CPI Shows Slower Price Pressures

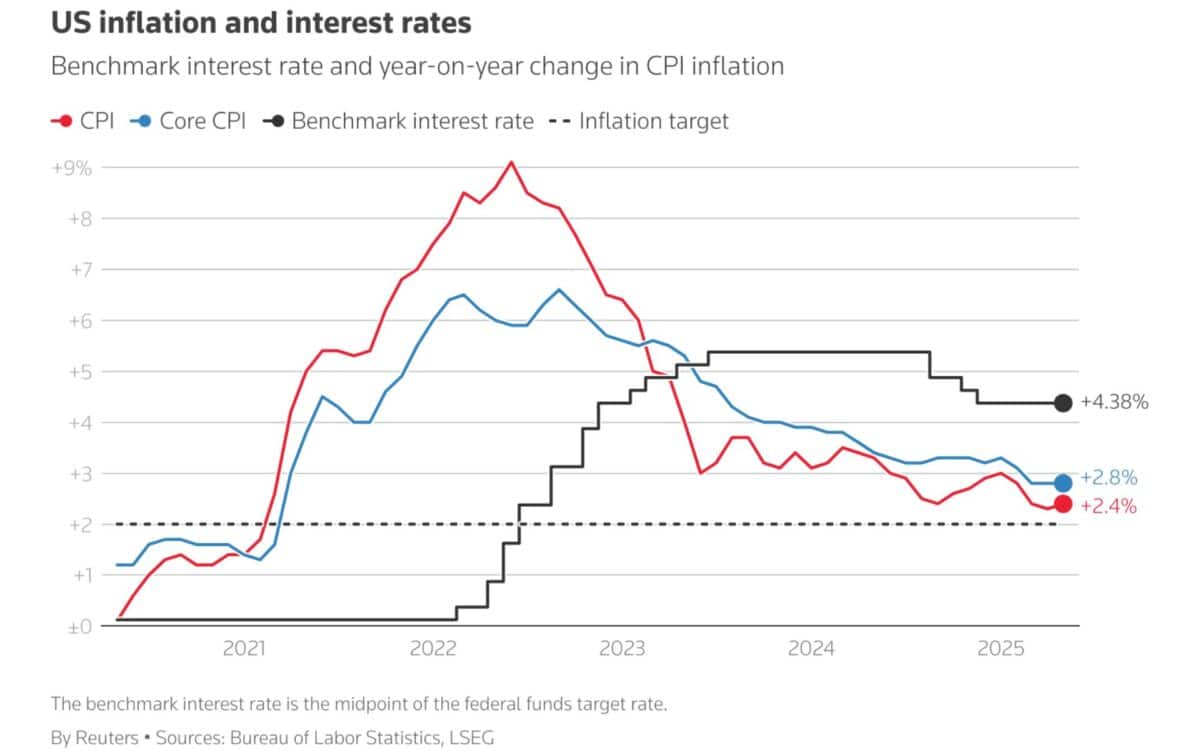

Excluding food and energy, the core CPI increased by 0.1% in May, indicating that underlying price pressures remain subdued.

While costs for healthcare, personal care, and household items rose, other sectors like airline fares and hotel costs showed signs of slowing demand.

The core CPI increased 2.8% annually, the same as in April.

The PCE (Personal Consumption Expenditures) price index, which the Federal Reserve tracks for its 2% inflation target, is expected to have risen by 0.2% in May, bringing the annual increase in PCE inflation to 2.6% from 2.5% in April.

Specific Tariff Impacts

In addition to the overall rise in prices, some products saw significant price increases due to the tariffs.

For example, major appliances saw a surge of 4.3%, the largest increase since August 2020, likely linked to tariffs on steel and aluminum. Prices for toys jumped 1.3%, marking the largest increase since February 2023.

Meanwhile, egg prices fell by 2.7%, and there were smaller decreases in prices for meat, fish, nonalcoholic beverages, and dairy products.

Federal Reserve’s Monetary Policy and Inflation Outlook

Despite concerns over rising inflation, the Federal Reserve is expected to keep interest rates unchanged in the short term.

However, economists predict that inflation will likely pick up in the second half of the year as businesses pass on higher costs to consumers due to tariffs.

Trump seized on the benign CPI report to demand that the U.S. central bank lower rates by “one full point.” However, the Federal Reserve’s Beige Book report last week indicated that there were

Widespread reports of contacts expecting costs and prices to rise at a faster rate going forward.

Challenges in data collection and potential implications

The Bureau of Labor Statistics (BLS) has faced staffing shortages and resource constraints, which have led to the suspension of CPI data collection in three cities.

While the BLS maintains that its published data meets rigorous standards, the reduced staffing levels have raised concerns about data quality.

Data quality is evaluated through measures of variance, bias studies, and assessments of survey methods – the agency said in a statement to Reuters.

BLS continues to evaluate data quality.

As the economy continues to navigate the impacts of tariffs and price adjustments, inflation is expected to be a key factor under close scrutiny in the months ahead.

The economy is primarily a service sector economy and the biggest cost input is the cost of workers – said James Knightley, chief international economist at ING.

A cooling jobs market implies that this too will help to mitigate the tariff impact.