U.S. consumer spending declined in January for the first time since March 2023, marking a shift that could signal economic weakness in the first quarter. The drop, accompanied by a record-high goods trade deficit, has raised concerns over how the economy will evolve in the coming months.

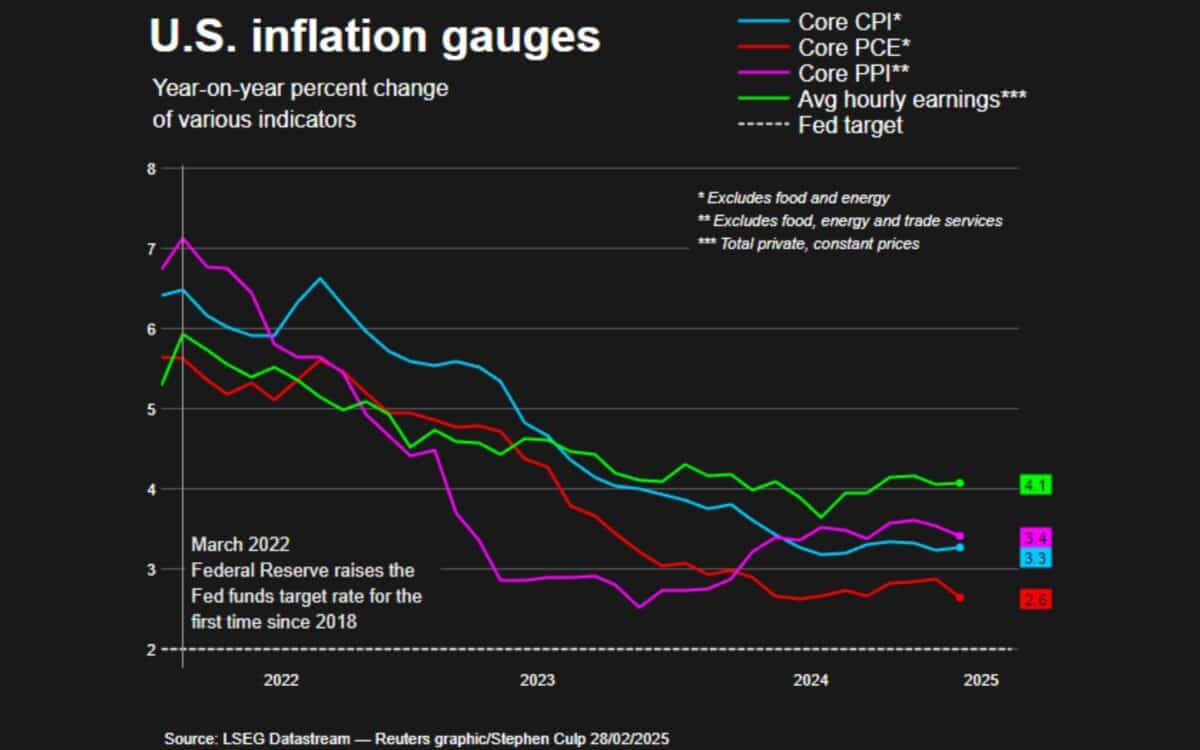

Reuters reports that while inflation is moderating on an annual basis, certain price pressures remain persistent. This combination of factors is adding complexity to the Federal Reserve’s policy decisions as it weighs the risks of slowing growth against the challenge of keeping inflation in check.

Consumer Spending Falls Unexpectedly

The Commerce Department reported a 0.2% decline in consumer spending last month, marking the sharpest drop in nearly four years. This came after an upwardly revised 0.8% increase in December, which had been bolstered by advance purchases ahead of expected tariff hikes.

Economists polled by Reuters had predicted a 0.1% increase, making the January decline an unexpected development.

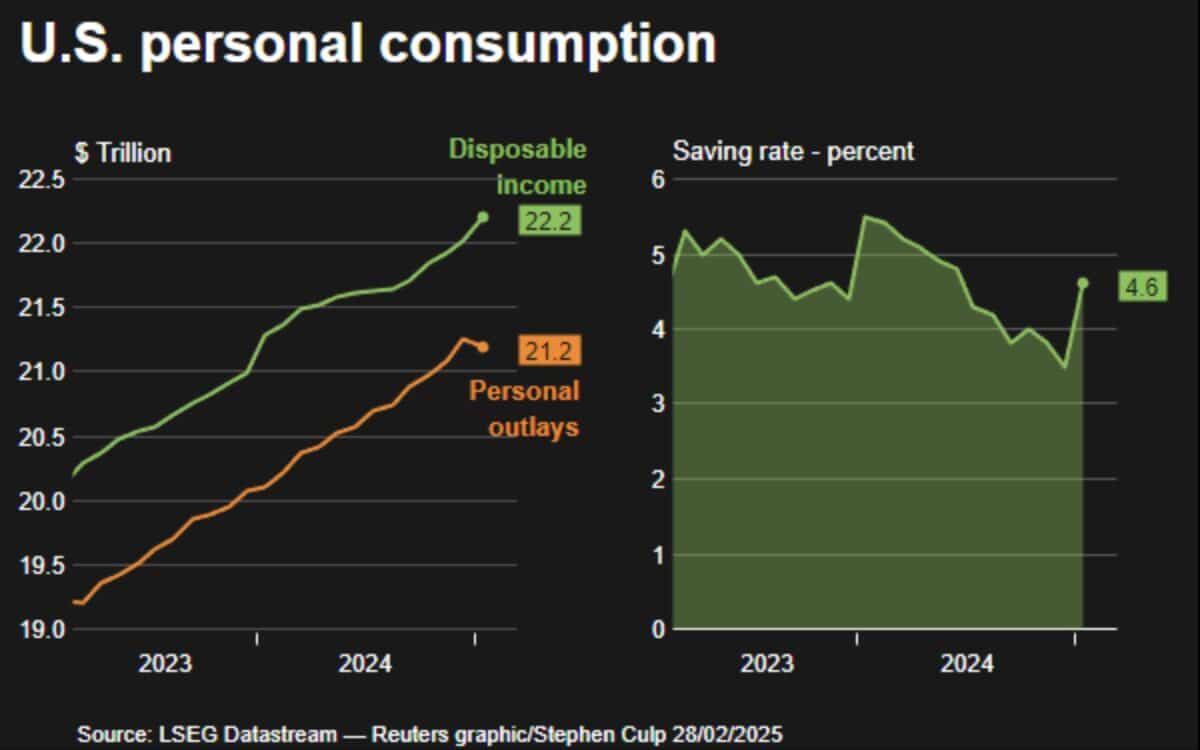

When adjusted for inflation, real consumer spending fell 0.5%, the steepest drop since February 2021. The decrease was driven by a 1.2% decline in goods purchases, with categories such as motor vehicles, household furniture, clothing, and food all seeing reduced expenditures. Spending on services, however, remained positive, rising 0.3%, with gains in housing, utilities, and food services.

Unseasonably cold temperatures, snowstorms, and wildfires in Los Angeles are believed to have contributed to the downturn in consumer spending, as adverse weather conditions disrupted shopping patterns and economic activity in affected regions.

Trade Deficit Widens as Imports Surge

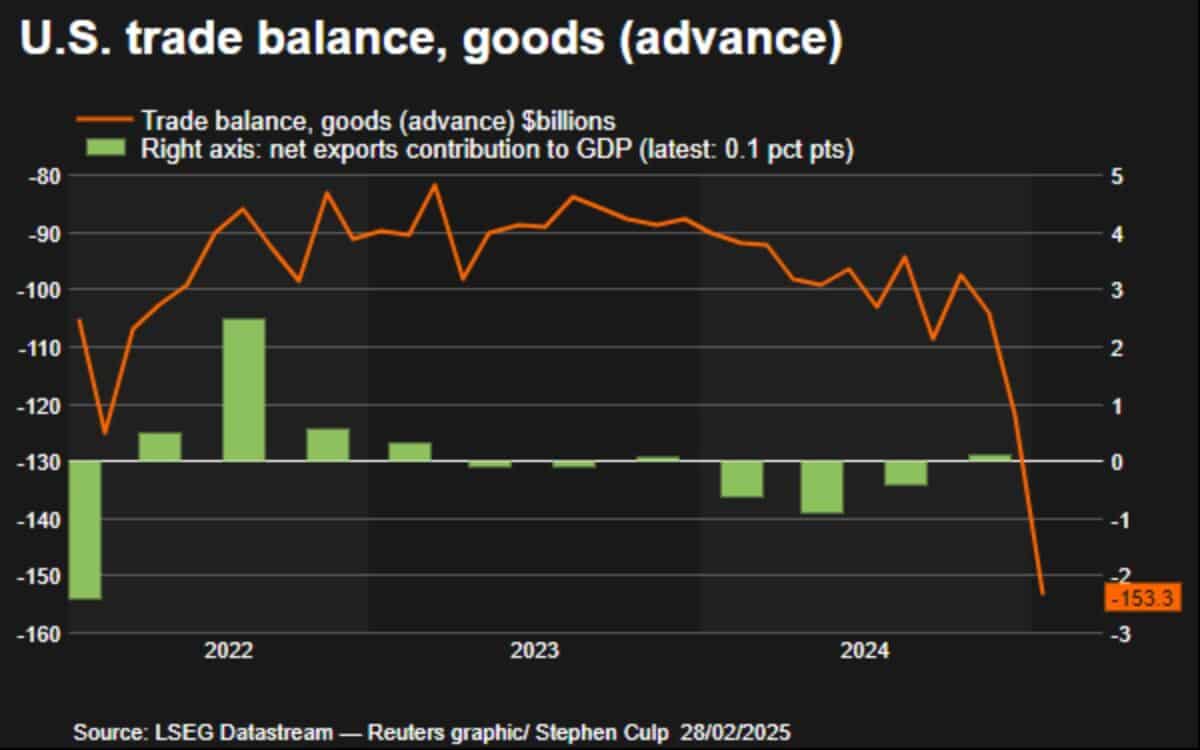

The latest data also revealed a 25.6% jump in the goods trade deficit, reaching a record $153.3 billion. The surge was fuelled by an 11.9% increase in imports, as businesses sought to stock up ahead of new tariff measures.

Exports rose 2%, but the imbalance adds to economic headwinds for the January-March quarter.

The economy expanded at a 2.3% rate in the fourth quarter of 2023, driven largely by consumer spending. However, with tariffs and trade policy changes now in focus, analysts warn that the first quarter of 2024 may see a sharp slowdown or even contraction.

The Atlanta Federal Reserve has already cut its GDP growth estimate for the quarter to -1.5% from a previously expected 2.3% expansion.

Inflation Moderates but Remains a Concern

Despite weaker spending, inflation data showed only a slight cooling. The Personal Consumption Expenditures (PCE) price index rose 0.3% in January, maintaining December’s pace. Over the past 12 months, the index increased 2.5%, slightly down from December’s 2.6%.

Excluding food and energy, core inflation rose 0.3% for the month and 2.6% year-over-year, showing some persistence despite a slowdown from December’s 2.9% rate.

- Goods prices increased 0.5%, largely due to higher vehicle and petrol costs.

- Service prices climbed 0.2%, with strong gains in recreational services, though healthcare prices declined.

The Federal Reserve, which monitors the PCE index as its preferred inflation gauge, has kept interest rates steady at 4.25%-4.50% after a total 100 basis points of cuts since September 2023. However, with inflation still above the 2% target, policymakers face a challenge in balancing growth concerns with price stability.

Policy Uncertainty and Economic Outlook

President Donald Trump‘s administration has intensified its use of tariffs, implementing an additional 10% levy on Chinese goods and planning a 25% tariff on Mexican and Canadian imports starting 4 March. Further duties on steel, aluminium, and motor vehicles are also in development.

These trade measures, alongside reductions in federal spending, are raising concerns among economists. The United States Agency for International Development (USAID) has seen budget cuts, attributed to the Department of Government Efficiency (DOGE) initiative.

The resulting reductions in nonprofit sector expenditures were reflected in the January consumer spending report.

The cuts to USAID, a programme that also funds domestic initiatives, have resulted in lower spending by nonprofit organisations, a trend that economists warn could have further knock-on effects.

Meanwhile, the labour market remains a stabilising force. Personal income grew 0.9%, buoyed by wage increases (+0.4%) and cost-of-living adjustments for Social Security recipients. This helped push the personal savings rate up to 4.6%, its highest level in seven months.

Financial Markets and Federal Reserve Response

Financial markets are adjusting to the shifting economic landscape:

- U.S. Treasury yields fell, reflecting investor concerns over slowing growth.

- The U.S. dollar remained stable against a basket of currencies.

- Stock markets showed a mixed reaction, with some sectors benefiting from falling bond yields while others reacted to weaker consumer spending data.

The Federal Reserve’s recent meeting minutes indicate that officials are increasingly concerned about inflationary pressures from tariffs. The central bank paused rate cuts in January but may be forced to resume easing as early as June if economic conditions deteriorate further.

“The combination of sticky inflation and a potential growth slowdown puts the Fed in a difficult position,” said Olu Sonola, head of U.S. Economic Research at Fitch Ratings. “If tariffs continue to pressure prices while dampening consumer confidence, we could see a more complex policy challenge emerge.”