In its latest economic outlook, the EY ITEM Club said the UK economy had shown “resilience” in 2024 but warned that conditions are likely to tighten in the coming months. The consultancy expects a modest pace of growth through 2025 as firms adjust to ongoing uncertainty, elevated interest rates and global trade pressures.

Labour Market Under Pressure Amid Hiring Slowdown

The UK’s unemployment rate, currently at 4.8%, has been gradually rising over the past year, up from 4.4%. According to EY, the figure is expected to peak at 5% by mid-2026, reflecting a broad cooling of the labour market triggered by weaker demand and changes in fiscal policy.

This upward trend is partly attributed to the £25 billion increase in national insurance contributions (NICs) announced by the Chancellor, which many businesses say has dampened hiring appetite. In various surveys, employers have cited rising payroll costs as a key reason for delaying recruitment or making redundancies.

Matt Swannell, an economist at EY, said the economic outlook remains under strain as “the combination of potential tax rises, global trade disruption and high interest rates is still anticipated to put a brake on economic momentum and produce modest growth over the next year.”

The latest data suggest that this slowdown is beginning to be felt in the labour market, where companies are becoming more cautious in their hiring strategies. Although the job market held up better than expected earlier in the year, EY predicts wage growth will gradually ease, with average pay increases likely to fall to 3.5% by the end of 2025.

Business sentiment mirrors this cautious outlook. According to the Institute of Directors (IoD), confidence among business leaders has hit record lows, with its index sitting at -73 in October after touching -74 the previous month. Smaller and medium-sized enterprises, in particular, reported cost pressures outpacing revenue growth, leading to hiring freezes and shorter planning cycles.

Growth Expectations Remain Modest Despite Early Resilience

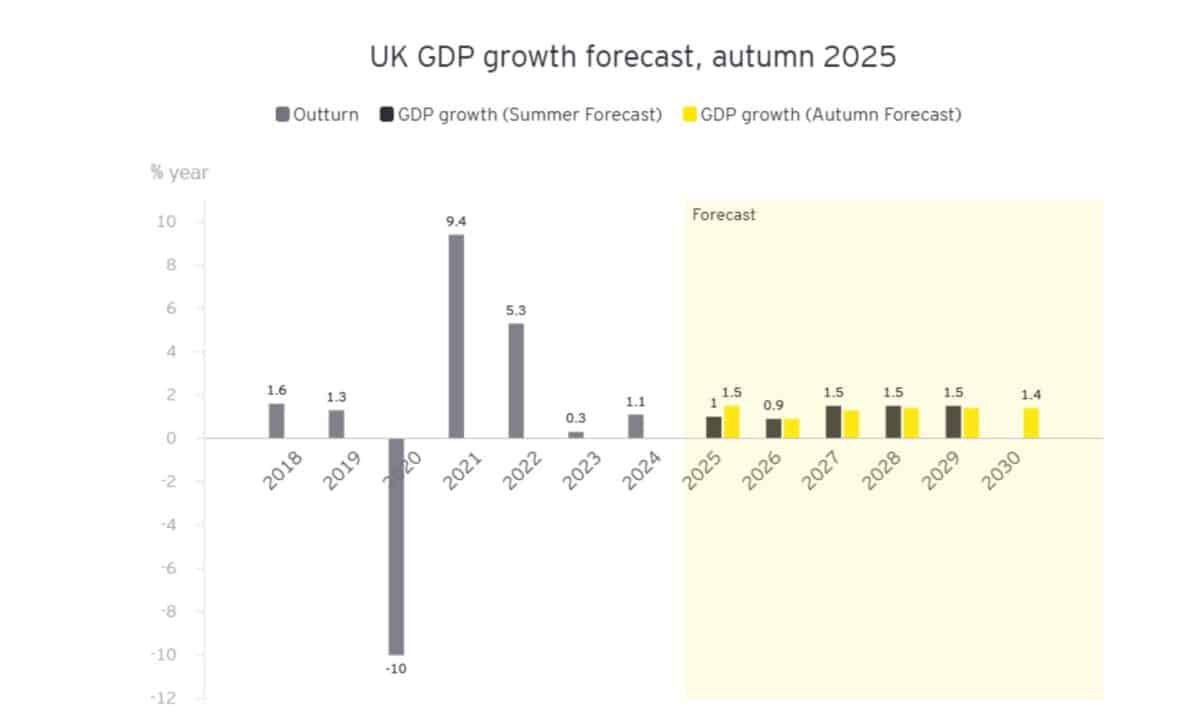

While the economy is on track to grow by 1.5% in 2024, this momentum is unlikely to carry into next year. EY forecasts GDP growth of 0.9% in 2026, with modest improvements expected thereafter. This relatively weak outlook is shaped by slowing investment, fiscal tightening and persistent global uncertainties.

One area of concern is business investment, which had surged by 3.7% this year, but is now forecast to decelerate sharply. Companies are reportedly scaling back plans in response to higher effective tariff rates and policy ambiguity ahead of the upcoming Budget.

Inflation also remains an issue. Despite easing from its peak, it is still expected to stay above the Bank of England’s 2% target well into 2026. That could limit the central bank’s flexibility on interest rates, prolonging tighter financial conditions.

At the same time, the fiscal landscape is becoming increasingly constrained. Swannell forecast a £30 billion budget shortfall for Chancellor Rachel Reeves, warning that significant tax or spending adjustments may be required to maintain balance.

Anna Anthony, managing partner at EY, said the economy had shown “encouraging resilience and momentum this year, particularly in the face of significant global disruption.” She added that maintaining investor confidence would depend on how policymakers handle the challenges ahead. In her view, the Chancellor should “strike a balance between managing the deficit and measures that stimulate growth” to preserve the UK’s appeal to global capital.

While the economy has shown unexpected resilience this year, the next phase is set to test that durability. High borrowing costs, weakening business sentiment and tighter public finances suggest a slow and uneven recovery may lie ahead.