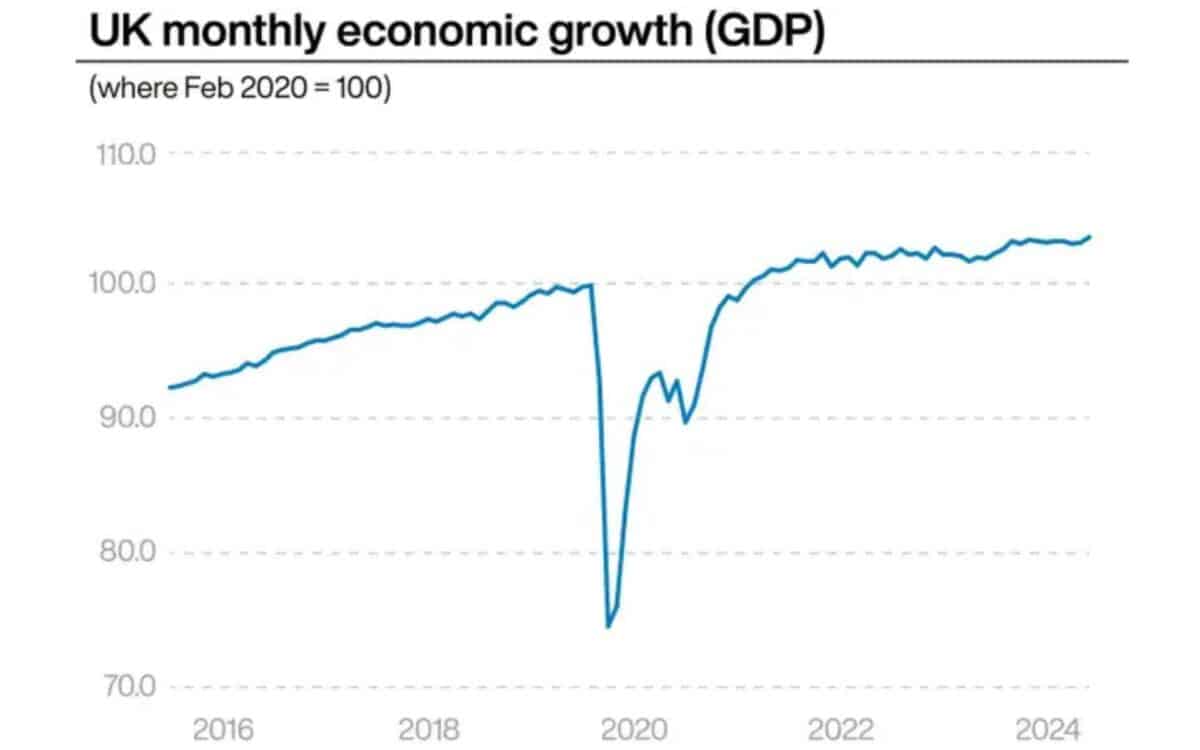

The UK economy managed to avoid a recession at the end of 2024, recording a 0.1% growth in the fourth quarter. This modest expansion defied earlier predictions of a contraction, yet concerns remain over sluggish long-term performance. Chancellor Rachel Reeves acknowledged the improvement but stressed that growth remains below expectations.

Economic Growth and Sectoral Performance

The final quarter of 2024 provided a modest but crucial boost to the UK economy, easing immediate fears of a technical recession. Although GDP growth remained weak, the latest figures suggest a gradual recovery compared to the zero growth recorded in Q3 2024.

Analysts note that while the economy is showing resilience, structural challenges such as stagnant productivity and weak consumer demand continue to weigh on long-term prospects.

A Better-Than-Expected End to 2024

Data from the Office for National Statistics (ONS) showed that GDP grew by 0.4% in December, following a 0.1% increase in November and a 0.1% contraction in October. This was the strongest monthly growth since March 2024, driven primarily by expansion in the services and production sectors.

Additionally, an upward revision of first-quarter growth from 0.7% to 0.8% contributed to a full-year GDP increase of 0.9% in 2024, a significant improvement from 0.4% in 2023.

Despite this progress, real GDP per capita declined by 0.1% in the last quarter and by 0.1% across 2024 as a whole, indicating that while the economy grew overall, many individuals have not experienced direct financial benefits.

Fiscal Challenges and Government Response

The Bank of England has halved its growth forecast for 2025 to 0.75%, citing concerns over sluggish consumer spending, business investment, and fiscal constraints.

The Office for Budget Responsibility (OBR) is expected to lower its growth projections in the upcoming spring statement on 26 March, potentially eliminating Chancellor Reeves’ £10 billion fiscal headroom.

This could force the government to adjust its spending plans or consider tax increases. According to economist James Smith at ING, “tweaks to future spending plans look likely in March.”

Policy Impacts and Opposition Criticism

The UK economy finds itself at a crossroads, balancing growth with fiscal stability, as government policies continue to face intense scrutiny. The tax and wage measures introduced in October 2024 have sparked significant debate about their long-term effects on businesses and employment.

Although aimed at boosting wages and funding public services, these policies pose potential risks, especially for small and medium-sized enterprises (SMEs), which may struggle to absorb increasing costs.

On top of this, consumer confidence remains weak, as households continue to deal with recession fears, inflationary pressures, and stagnant real wage growth.

Impact of Fiscal Policies on Businesses and Households

Economic pressures have been compounded by budget measures introduced in October 2024, including higher national insurance contributions and an increase in the minimum wage.

While these changes were designed to improve wages and fund public services, critics warn that they could lead businesses to raise prices or reduce jobs.

Concerns persist that these measures, combined with a weaker-than-expected economic outlook, could limit the government’s ability to stimulate further growth in the near term.

Political and Economic Reactions

Shadow Chancellor Mel Stride has strongly criticised Reeves’ economic strategy, stating that her budget is “killing growth” and that workers and businesses are already suffering from her policy choices.

In response, Reeves has reaffirmed the government’s commitment to economic growth and infrastructure investment, citing her recent decision to approve a third runway at Heathrow Airport as an example of the government’s ambition to enhance connectivity and boost long-term growth.

The UK’s unexpected growth in late 2024 has provided some reassurance, but the economy remains under pressure. With recession fears still looming, Slower-than-expected expansion in 2025, combined with fiscal challenges and cost-of-living concerns, means that significant uncertainty persists.

With the government gearing up for its spring statement, the emphasis will be on finding a balance between economic support and fiscal responsibility.