Nationwide’s New ISA Offer Sparks Fierce Competition Ahead of Tax Deadline

With the tax-year deadline approaching, Nationwide has introduced new ISA products and raised some rates. The move comes as banks intensify their fight for savers during the annual ISA season,…

Last Chance for Couples to Claim £1,260 Tax Allowance, as Deadline Looms

Martin Lewis has issued a warning to couples who may be missing out on a £1,260 tax saving. As the tax year deadline nears, many could qualify for the Marriage…

VED Tax Bombshell: £6,000 Levied on 59 Popular Cars from April

From April 2026, 59 high-emission cars, including well-known models from brands like BMW, Mercedes, and Porsche, will be hit with a £5,690 VED tax. This steep rise is part of…

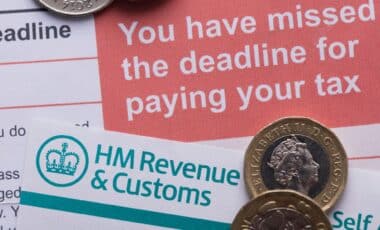

One Million Taxpayers on the Brink of 5% Tax Penalty

Time is running out for taxpayers who missed the January 31 deadline. With only one day left to pay, they risk facing a 5% surcharge on unpaid taxes and additional…

Cash ISA Limits Slashed: How to Maximise Your Savings Before the Big Change

With a major change coming to Cash ISAs in April 2027, savers have a rare opportunity to deposit up to £40,000 tax-free before the rules are slashed. Experts urge Brits…

Inheritance Tax to Hit Thousands of Families Harder: What You Need to Know

Inheritance tax is on the rise, with more families set to face higher tax bills as property values increase and pension assets are brought into the equation.

Speed Limit: Council Tax Raised for Controversial 20mph Zones

Council tax is set to rise as local authorities implement new 20mph speed limits, sparking backlash among residents. The increased tax will fund these changes, but not everyone is on…

Major Tax Cuts Coming for 20-39 Year Old Cars: Here’s What You Need to Know

A crucial update on Vehicle Excise Duty (VED) could spell trouble for owners of 20-39 year old vehicles. With tax rates on the rise, many drivers are left wondering if…

UK Tax Overhaul Triggers Warning of Rising Fees for Small Businesses

More than 860,000 landlords and sole traders must prepare for digital tax reporting from April. But experts warn that over 200,000 who currently file alone could face higher accountancy fees.

Savers Race Against Time as New ISA Rules Approach

Savers are being urged to review their ISA plans before time runs out, as fresh industry data highlights a widening divide between saving strategies and policy changes scheduled for 2027…

HMRC Steps Up Inheritance Tax Probes: Thousands Of Families Could Be Affected

HMRC is increasing scrutiny of inheritance tax returns, examining bank statements, investment income and overseas transactions to uncover potential underpayments and undisclosed assets, as part of a broader push to…

Frozen Tax Thresholds: Workers’ Pay Gets Erased by Hidden Tax Hikes

As wages rise, workers will find themselves paying more in taxes without any rate hikes. The government’s freeze on tax thresholds means millions will see a larger share of their…

Is Your Tax Bill Going Up? Seven Councils Allowed to Raise Taxes Beyond 5%

The UK government has granted permission for seven councils to raise their council tax rates beyond the usual 5% cap, sparking debate. With financial pressures mounting, these councils face significant…

The Vehicle Tax That Could Change the Way You Drive in the UK by 2028

UK drivers will soon face a new pay-per-mile tax set to add hundreds to vehicle running costs by 2028. While the government insists it’s fair, critics warn the move could…

HMRC’s New Penalty Points System: Will You Pay the Price for a Missed Tax Deadline?

HMRC's new penalty points system has arrived, replacing automatic fines with a points-based structure. If you miss a deadline, you'll receive a penalty point. Accumulate enough points, and you'll face…

IFS Uncovers Massive Tax Burden Shift, Middle Class to Take the Biggest Hit

A quiet tax freeze is triggering a big shift, and middle earners are footing the bill. IFS data shows those on £48,000 could lose more than some top earners.

Top Accountant Reveals 5 Silent HMRC Traps Every UK Business Owner Should Know

With the tax deadline looming, a UK accountant reveals five unexpected red flags that could trigger an HMRC investigation. From late filings to mismatched income, the warning signs aren’t always…

VED-Free and Legal: The Vehicles That Escape Road Tax Completely

Not every car on UK roads is paying VED this year. Thanks to DVLA exemptions, three types of vehicles remain fully tax-free. Are you missing out on legal savings?

Personal Tax Allowance Set to Rise to £16,000 for Selected UK Households

Many UK households are missing out on up to £16,000 in potential tax-free income. Experts reveal five overlooked allowances that could drastically reduce your tax bill.

You Could Be Fined £100 Instantly, HMRC’s Urgent UTR Alert Explained

Millions of UK taxpayers are being warned by HMRC just days before the deadline. A vital 10-digit code is now at the centre of a national rush.

Council Tax Expected to Rise by 4.99% for Thousands in 2026

Annual increase aimed at balancing the 2026/27 budget amid rising service costs. No cuts to services planned despite growing financial pressures across key departments

HMRC Interest Penalties Rise Ahead of Tax Deadline

A sharp rise in HMRC’s late payment interest rate has sparked widespread criticism among UK taxpayers. While those missing the deadline face charges nearing 8%, refunds come with a far…

Millions Could Lose Out as HMRC Eyes Radical Cash ISA Overhaul

Proposed reforms could limit returns on cash ISAs and reshape the UK savings landscape. The Treasury aims to close ISA loopholes, but industry voices warn the changes may backfire.

HMRC Tax Code Chaos Leaves UK Workers and Pensioners Billions Out of Pocket

A total of 5.6 million UK taxpayers paid too much in income tax during the 2023–24 financial year. Errors in HMRC systems and outdated tax codes were cited as key…

New HMRC Move Ends Traditional Tax Returns for Millions Starting This Year

New digital scheme set to replace Self Assessment process for many UK taxpayers. Quarterly income reporting and software-based record keeping will be introduced under Making Tax Digital.

HMRC Warning: Millions Could Be Hit with £100 Penalties This Week

HMRC just released a critical update that’s caught many taxpayers off balance. With the filing deadline closing in, the timing has fuelled anxiety and frustration.

Thousands Missing Out on £1,000 Council Tax Discount, Check If You Qualify!

An error affecting nearly half of all UK local councils could mean unpaid carers have missed out on up to £1,000 annually. Outdated or missing information on council websites has…

1.3 Million Britons Hit by Frozen Tax Threshold as HMRC Letters Land

With income tax thresholds frozen since 2021, more than a million extra people have received demands from HMRC. Rising pensions and savings interest are pushing individuals over the personal allowance…

12 Million People at Risk of Heavy Fines Under New HMRC Penalty Rules

HMRC’s updated penalty system is set to hit millions of taxpayers across the UK. With escalating fines and interest rates, late tax returns could cost you more than ever.

HMRC Delivers 300,000 Brown Envelopes with ‘Trivial’ Demand, What You Need to Know

HMRC has issued over 300,000 "simple assessments" to UK taxpayers, demanding small sums of tax, with some amounts under £100. These assessments are part of efforts to collect unpaid taxes.

HMRC Hits Brits with Unexpected 150% Tax Charges

HMRC’s payments on account system is pushing newly self-employed workers to pay in advance for income they haven’t yet earned, raising confusion and financial pressure across the country.

HMRC Targets Old Debts with New Tax Code, Find Out if You’re Affected

An unexpected tax code is reducing income for workers and pensioners across the UK. HMRC is using a little-known method to collect debts directly from your pay.

Council Tax Change: The New Rule That Could Cost You Thousands

Property owners in England with homes valued above £2 million will face additional charges from 2028. The new bands, unrelated to current council tax valuations, could cost some households up…

UK Savers Hit by New Tax Blow as ‘Threshold’ Change Triggers Surprise Bills on Savings

From April 2027, millions of UK savers will see higher tax bills on their savings interest as new fiscal rules come into effect. The basic, higher, and additional tax bands…

Hidden Inheritance Tax Rules Could Ruin Your Christmas Giving Plans

Families warned to take care with cash and large gifts this Christmas. Gifting above HMRC’s thresholds could expose loved ones to unexpected tax charges if not planned carefully.

Inheritance Tax May Destroy Your ISA – Martin Lewis Breaks Down the Hidden Dangers

Individual Savings Accounts (ISAs) have long been hailed as a popular and effective way for UK savers to grow their wealth without incurring tax charges. The promise of tax-free growth…

Hidden Tax Trap: Why Your Savings Interest Could Be Costing You More Than You Think

Martin Lewis, the founder of MoneySavingExpert, has issued a warning to UK savers, suggesting that many could be paying more tax than necessary on their interest earnings. The tax treatment…

Missed Out on Personal Allowance Savings? You Can Still Claim Up to £1,258

The UK’s tax system can be a maze, but for some married couples, a little-known scheme could offer significant savings. A method known as "backdating" allows couples to increase their…

Why 300,000 Remote Workers Are Facing a Tax Relief Cut in 2026

In a move that will affect hundreds of thousands of remote workers across the UK, the government has announced the cancellation of the £6-a-week working from home tax relief starting…

Council Tax Increases: Labour’s New Rule Shakes Up the System!

Labour's plans for a shake-up of the council tax system could significantly affect millions of homeowners across the UK. As the government prepares to unveil reforms, critics warn of potential…

Brits Face 27% Tax on Holidays as Government Plans Massive Levy

The Treasury is reportedly considering a new overnight stay levy for tourists, potentially raising £500 million a year. Industry leaders warn it could harm domestic travel, inflate costs, and threaten…

New Update on Income Tax: Rachel Reeves Confirms Last-Minute Policy Shift

With just days before the autumn Budget, Chancellor Rachel Reeves and Prime Minister Keir Starmer have reversed course on a controversial proposal to raise income tax, scrapping the plan after…

New Tax Code Changes from HMRC Could Hit Savers—What’s the Real Impact?

As HMRC works to catch up with the latest changes in personal circumstances, many individuals are receiving new tax codes, particularly those with savings interest. These updates come as the…

Income Tax Surge Incoming: The Silent Hit to Your Wallet

As the UK government prepares for its upcoming Budget, fears are growing that tax rises may be on the horizon. Among the most discussed proposals is a potential 2p rise…

Britons Warned to Act as Pensions Face 40% Inheritance Tax Charge

A proposal to include unused pension pots in inheritance tax (IHT) calculations is drawing growing concern from economists and pension experts. Rachel Reeves, Chancellor of the Exchequer, has indicated that…

Sweeping Tax Reform Could Shock Pensioners by Slashing 25 Percent Tax Free Perk

A potential overhaul of pension rules is raising concern among experts as changes to tax-free benefits for pensioners are being considered.

Stealth Tax Could Force Pensioners to Pay Tax for the First Time

The Stealth Tax is quietly affecting more pensioners as tax bands remain frozen. Find out how this could impact your finances in the years ahead.

How the State Pension Rise Could Drag Millions Into Paying Income Tax by 2027

Millions of Brits who rely on the state pension may soon find themselves facing income tax. As the state pension rises by 4.7% next year, many pensioners are just £35…

Tax Relief from HMRC: How to Claim £60 Back for Your Work Uniform

HMRC offers a way for workers to reclaim money on certain work-related expenses, including uniforms. Find out how you could benefit from this little-known tax relief.

How to Save Money on Your Council Tax Bill

Struggling with Council Tax payments? There are several ways to reduce your bill, including the Council Tax Reduction scheme. Find out how you could benefit.