Select Fashion, a UK high street retailer specializing in affordable clothing, is set to close 35 stores across the country by mid-March. The move comes as part of a financial restructuring effort following the brand’s 2019 administration and subsequent Company Voluntary Arrangement (CVA) last year.

Following these closures, Select will have just 48 stores left, a sharp decline from its pre-2019 total of 169 stores.

The Impact of Financial Difficulties on Select Fashion

Select Fashion has been gradually reducing its store count over the past few years. The company entered administration in 2019, citing challenging retail conditions, and was later acquired by Genus UK Limited, a company owned by Turkish entrepreneur Cafer Mahiroğlu.

In 2023, Select Fashion opted for a CVA, a legally binding agreement that allows struggling businesses to restructure their debt and negotiate new terms with creditors. The CVA, however, has not prevented further store closures.

Before the most recent announcement, the company had already shut down stores in Ipswich, Kent, Cwmbran, and the Erith Riverside Shopping Centre in London earlier in 2024. More recently, Kidderminster and Thornaby stores were permanently closed.

Full List of Store Closures

The 35 stores set to close include locations across England, Wales, and Scotland, with most shutting down by March 15.

Among the affected locations are Runcorn, Ashton-under-Lyne, Accrington, Preston, Birkenhead, Thornaby, Middlesbrough, Hull Hessle, Scunthorpe, Peterlee, Hull St Stephen’s, Scarborough, Hatfield, Wellingborough, Witham, Bristol Broadmead, Bristol Broadwalk Shopping Centre, Torquay, Newport, Eastleigh, Southampton, Chippenham, Port Talbot, Merthyr Tydfil, Hemel Hempstead, Worksop, South Shields, Coalville, Kidderminster, Crewe, Bletchley, Wolverhampton, Hartlepool, and Cowley.

Broader Challenges for UK High Street Retailers

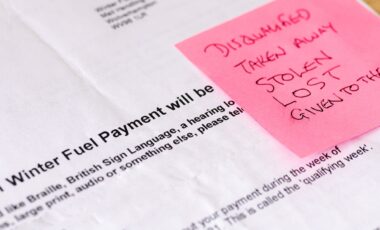

The difficulties faced by Select Fashion reflect broader trends in the UK retail sector, where businesses are struggling with a combination of declining footfall, rising operational costs, and economic pressures such as inflation and reduced consumer spending power.

Recent data from the Centre for Retail Research highlights the scale of the crisis, with 13,479 stores shutting down in 2024, an average of 37 per day. Of these, 11,341 were independent shops, while 2,138 belonged to major retailers.

Over half of these closures were due to retailers undergoing insolvency proceedings, and projections for 2025 suggest 17,350 more store closures, potentially leading to 202,000 retail job losses.

The economic situation has also forced several other major high street chains to reduce their store footprint. Homebase closed 33 stores in February after falling into administration.

Dobbies, a well-known garden centre chain, has shut 24 locations since October 2024. WHSmith permanently closed four branches in February, while New Look is set to shut multiple stores by April 2025. Meanwhile, Hollister has announced the closure of a flagship store in Aberdeen by the end of February.

The Role of Rising Costs and Taxes

Retailers are not just facing reduced footfall; they are also struggling with rising business costs. The upcoming increase in National Insurance Contributions (NICs) in April 2025 is expected to cost the UK retail sector £2.3 billion.

A recent survey found that 55% of UK businesses plan to raise prices in the next three months to cope with rising expenses.

Inflationary pressures and higher operating costs have further worsened the financial strain on struggling retailers, making it more difficult for high street businesses to remain viable.