Millions of UK pensioners are set to see a higher-than-expected increase in their state pension next year. This boost, resulting from a 4.8% rise in average earnings, will provide vital extra income for those reliant on this government payment. But with tax implications looming, pensioners should start considering how to protect their income ahead of 2027.

A Promising Rise in the State Pension

In a welcome development for UK pensioners, the state pension is set to rise by 4.8% in April 2025, exceeding earlier predictions. Under the government’s triple lock policy, the state pension is increased annually based on whichever is highest: inflation, average earnings growth, or 2.5%. According to the Office for National Statistics (ONS), the growth in average earnings for the three months leading up to July 2025 was revised upwards to 4.8% from an earlier estimate of 4.7%, triggering a slightly higher than expected increase.

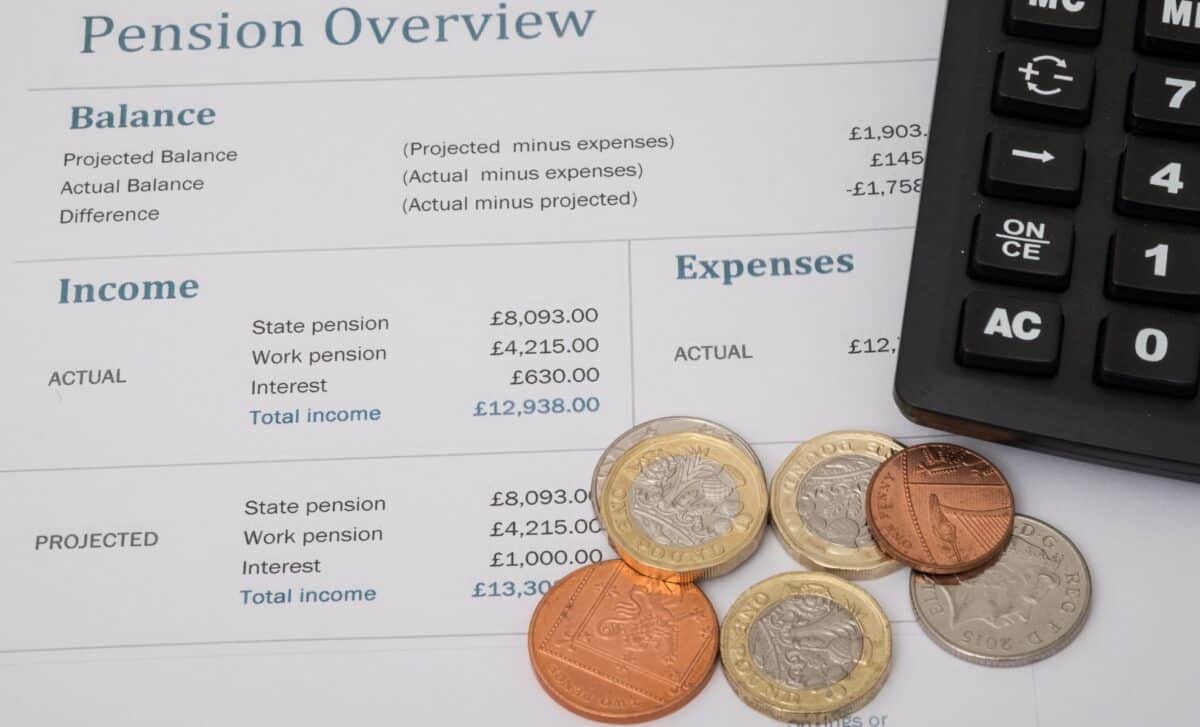

The new state pension will rise to £241.30 per week, an additional £11.05 a week, taking the total annual payment to £12,534.60. Meanwhile, those on the older, basic state pension will see their weekly payment increase to £184.90, adding up to an annual sum of £9,614.80. This significant rise will provide a much-needed financial cushion for pensioners, particularly those dependent on the state pension as their main source of income.

Tax Implications and the Looming Freeze

While this increase in pension payments is positive news, it also brings pensioners closer to the income tax threshold, currently frozen at £12,570. As a result, some pensioners could find themselves paying income tax from 2027 onwards unless tax allowances are adjusted. In light of the state pension rise, which places many closer to the threshold, it’s crucial for pensioners to consider how to shield their income from potential tax increases.

In particular, taking advantage of tax-efficient savings and investment schemes could help mitigate the financial impact. For instance, Individual Savings Accounts (ISAs) allow individuals to deposit up to £20,000 per year, with the added benefit that any interest or returns are tax-free. Furthermore, contributing to a pension pot remains one of the best ways to grow savings without facing tax penalties.

Financial experts are advising pensioners to review their savings strategies now, to avoid being caught off guard by potential tax liabilities in the near future. As Steve Webb, a partner at pension consultancy LCP, notes, “This will keep the headline rate of the state pension below the income tax threshold for one more year, but it will go above the tax threshold in 2027 if allowances do not rise.”