Recent changes to inheritance tax regulations are significantly impacting military families, particularly those receiving compensation for the death of a service member. This policy shift has sparked nationwide debate and concerns about the financial strain on those who have already endured the loss of a loved one.

The New Tax Regulations

The recent amendments to inheritance tax laws reflect a critical change in financial policies for military families. These adjustments aim to redistribute the economic burden but have raised concerns regarding their timing and disproportionate effect on certain groups.

Overview of Changes

Under the revised policy, compensation payments to military families are now subject to taxation under specific conditions:

- Taxable scenarios: The new tax applies when a service member dies off duty, such as from illness or an accident.

- Exemptions: Spouses or civil partners of the deceased remain exempt from this tax, offering partial relief amidst these changes.

Financial Impact on Families

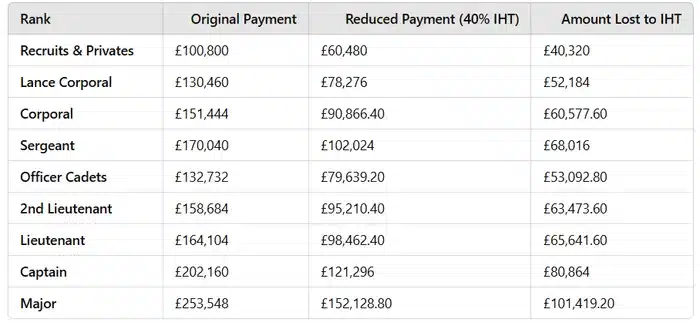

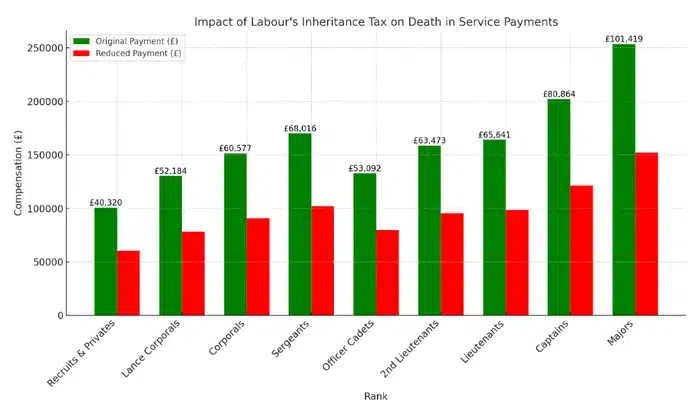

The policy introduces a substantial reduction in compensation payments due to inheritance tax. Previously untaxed, these payments are now reduced by up to 40%.

- Impact on lower ranks: For example, a Lance Corporal with a salary of £32,000 would have previously provided a compensation payment of £130,460. After taxes, this amount decreases to £78,276.

- Impact on higher ranks: For a Second Lieutenant, the payment drops from £158,684 to £95,210.40, highlighting the substantial financial impact across ranks.

Implications for Military Families

The introduction of these taxes creates both immediate and long-term challenges for military families, affecting financial stability and welfare.

Immediate Financial Strain

The reduction in compensation disrupts financial planning for families, particularly children and unmarried partners who now face diminished support.

- Benefit reductions: Families experience up to a 40% decrease in expected payments, leaving many financially vulnerable.

- Long-term challenges: This decrease in financial assistance may have enduring effects on the well-being of these families.

Societal Impact

The reduction in compensation disrupts financial planning for families, particularly children and unmarried partners who now face diminished support.

- Advocacy disparities: Unlike other sectors with strong unions, military families lack equivalent representation, leaving them more exposed to adverse policy changes.

- Public response: Critics view the policy as a breach of the Armed Forces Covenant, which pledges to support military personnel and their families.

Institutional Criticism and Advocacy

Major General Neil Marshall, CEO of the Forces Pension Society, has strongly criticised the policy, highlighting its detrimental effects on morale and fairness.

- Discriminatory impact: Marshall argues the tax discriminates against unmarried service members or those without a civil partner, undermining morale and operational effectiveness.

- Psychological toll: Concerns are rising about how the policy might discourage service members by reducing confidence in government support.

Political and Public Opposition

The policy has faced widespread condemnation from both political leaders and the public.

- Mark Francois’ criticism: The shadow Armed Forces minister has described the policy as a violation of the spirit of the Armed Forces Covenant, particularly for unmarried personnel.

- Comparison with other sectors: Critics draw parallels with controversies over inheritance tax changes in other communities, further fueling discontent.

Government’s Stance

The Treasury has defended the policy, emphasising that exemptions remain in place for deaths resulting from combat-related causes.

- Official assurances: Compensation for combat-related deaths remains untaxed, and pensions to spouses or civil partners are fully exempt under these conditions.

This tax reform represents a significant shift in the treatment of military compensations, raising concerns about the financial security of bereaved families and the potential impact on military morale and commitment.