Housing affordability in England and Wales is showing signs of change, with new figures suggesting a shift in the balance between wages and property prices.

According to Manchester Evening News, recent data paints a more complex picture than expected. While some regions are improving, others remain well out of reach for average earners. The broader national trend may suggest a return to past levels, but key indicators still point to persistent challenges.

For many prospective buyers, the landscape remains difficult to navigate despite encouraging signs in the latest statistics released by the Office for National Statistics (ONS).

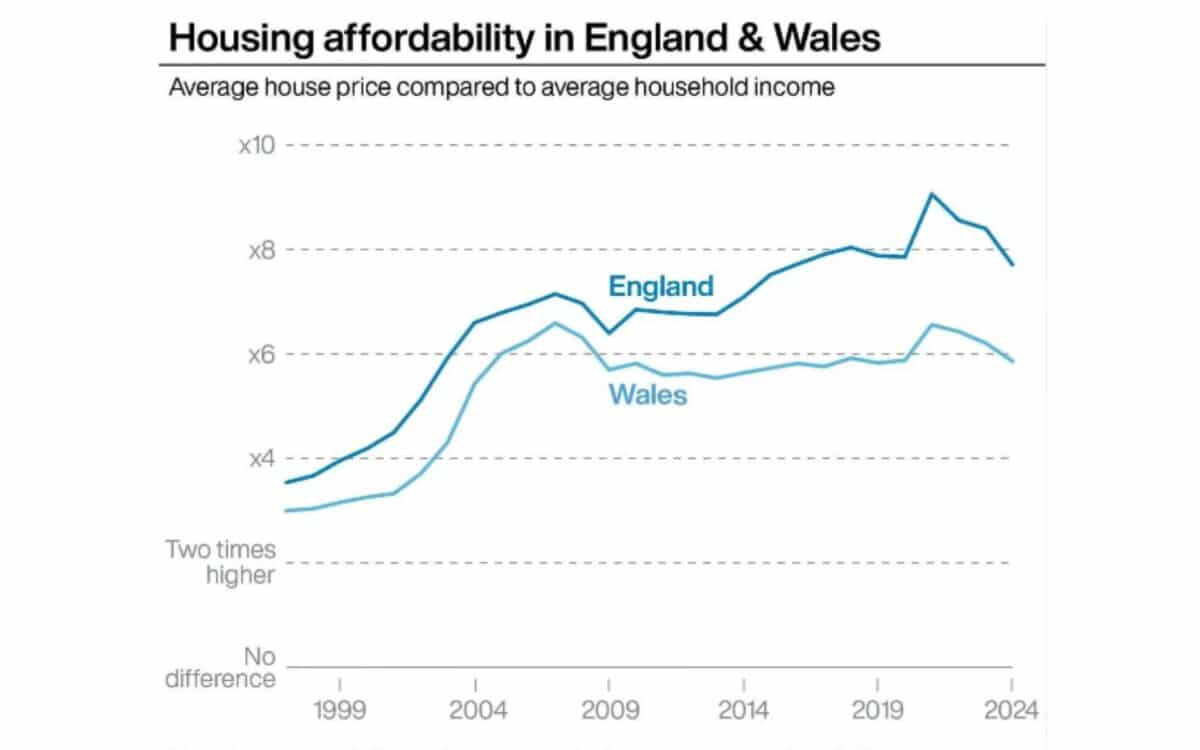

Average House Price-To-Earnings Ratio Falls to 7.7 in 2024

In 2024, the average house price in England stood at £290,000, while the average full-time earnings reached £37,600, resulting in a house price-to-earnings ratio of 7.7.

This marks an improvement from the ratio of 8.4 recorded in 2023, and from the 2021 peak of 9.1, when housing prices surged as markets reacted to the economic repercussions of the pandemic.

In 2019, before the crisis, the ratio was 7.9, indicating that affordability has now not only recovered but slightly improved compared to the immediate pre-COVID landscape.

According to the ONS, average earnings have grown by 20 percent since 2021, while average house sales prices have only risen by 1 percent. This disparity has narrowed the affordability gap that widened sharply in 2020 and 2021.

Sarah Coles, head of personal finance at Hargreaves Lansdown, noted :

Wages have risen faster than house prices in recent years, so would-be buyers are inching slightly closer to being able to afford a home of their own. House prices are up 1 percent since 2021 and wages are up 20 percent.

Still, she emphasized the ongoing strain on buyers :

Housing is considered affordable when it costs five times earnings, and still fewer than one in 10 areas have reached this level.

Fewer Than 10 Percent of Local Areas Are Classed as Affordable

In 2024, only 9 percent of local authority areas had homes priced below the affordability threshold of five times local earnings. This is an improvement from 6 percent in 2023 and represents the highest proportion since 2015. Yet it remains far from the 88 percent of areas classified as affordable in 1997, when records began.

Affordability has improved in 91 percent of local authorities in England and Wales compared to 2023. The remaining 9 percent saw a decline. The most affordable regions in 2024 were Blaenau Gwent in Wales, Burnley, and Blackpool in North West England, each with a house price-to-earnings ratio below 4.

At the opposite end, Kensington and Chelsea in London was the least affordable area, with homes costing 27.1 times average earnings. While still exceptionally high, this represents a decline from 33.4 in 2023 and a peak of 44.0 in 2018, indicating some long-term relief.

While the national trend shows improvement, some local authorities have seen a notable decline in accessibility. In Staffordshire Moorlands, located in the West Midlands, the price-to-earnings ratio has increased from 5.8 in 2019 to 7.3 in 2024, showing a sharp deterioration over five years.

Buyers Urged to Save Larger Deposits and Seek Support

Despite the progress, owning a home remains a financial stretch for many. Sarah Coles offered practical advice to those planning to buy :

If you’re planning to buy, the best protection from being overstretched is to build as big a deposit as you can manage.

It’s worth getting all the help you can from wherever it’s available – whether that’s from the bank of mum and dad, or by saving into a Lifetime Isa and getting a 25 percent bonus of up to £1,000 a year from the Government.

Nothing will make buying a property a doddle, but the less you have to borrow to get you there, the less vulnerable you will be.

The narrowing gap between wages and house prices marks an encouraging shift for buyers after years of declining affordability. Yet most regions remain far from the benchmark of affordable housing, and large regional inequalities persist.

Sustained improvement will likely depend on the evolution of interest rates, local housing supply, and the trajectory of wage growth in coming years.