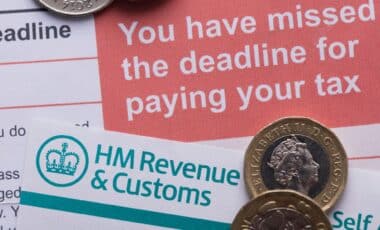

A temporary shutdown of HM Revenue and Customs’ (HMRC) helplines on Thursday has sparked concern among taxpayers, as the 31 January self-assessment deadline approaches. The glitch left users unable to access phone support for over two hours at a critical time in the UK tax calendar.

While services were restored later in the afternoon, the disruption affected many seeking assistance with their returns. With over 5.6 million submissions still outstanding, the timing of the outage prompted frustration, particularly from those without access to digital alternatives.

Over 5.6 Million Taxpayers Yet to File Returns

According to HMRC figures released on 5 January, more than 6.36 million taxpayers have already submitted their self-assessment tax returns for the 2024 to 2025 tax year. However, nearly 5.65 million are still required to file before the end-of-January deadline to avoid automatic penalties.

The standard initial £100 late filing charge applies even if no tax is owed or if the tax has been paid on time. Beyond this, more severe penalties come into effect, £10 per day after three months (up to £900), followed by further charges of £300 or 5% of the tax due at six and twelve months, respectively. HMRC also applies interest on unpaid tax and late payment surcharges.

In an effort to manage demand, HMRC is encouraging customers to use its digital services and the HMRC app for filing, tracking, and payment. Customers can save a draft of their return and return to it as needed. Payment does not need to be made at the time of filing but must be completed by 31 January to avoid interest and penalties.

Myrtle Lloyd, Chief Customer Officer at HMRC, stated: “New Year is a great time to start afresh. What better way than to ensure your tax affairs are in order for another year than completing your tax return.” The agency also reiterated that individuals unable to meet the deadline due to exceptional circumstances should inform HMRC before 31 January, assuring that it will treat those with “reasonable excuses” fairly.

Helpline Outage Met With Criticism as Digital Services Urged

The disruption on Thursday 11 January, which began at 11:40am and lasted until 2:15pm, was attributed to a “brief technical glitch”, according to an HMRC spokesperson. While the issue was resolved the same day, the shutdown affected all helplines, including those supporting self-assessment inquiries. In a statement, HMRC said: “We’ve now reopened our helplines – including for self-assessment. We thank people for their patience and are sorry for the inconvenience.”

Consumer groups expressed concern over the outage’s impact on those relying on phone support. Jenny Ross, Money Editor at Which?, remarked: “With the self-assessment tax deadline rapidly approaching, it’s hugely concerning to see that HMRC’s phone lines have gone down. This will be hugely frustrating to those needing help with their tax returns, and particularly disruptive to those unable to use digital services.”

HMRC maintains that a wide range of support is available online, including a detailed Self Assessment help section on GOV.UK. The department also reminded users to stay vigilant against scams, warning that self-assessment customers are often targeted by criminals during the busy January period.

With more than 12 million people expected to submit a self-assessment return this year, the pressure on systems and services is high. The recent outage has only intensified scrutiny of HMRC’s capacity to provide timely support as the filing deadline draws near.