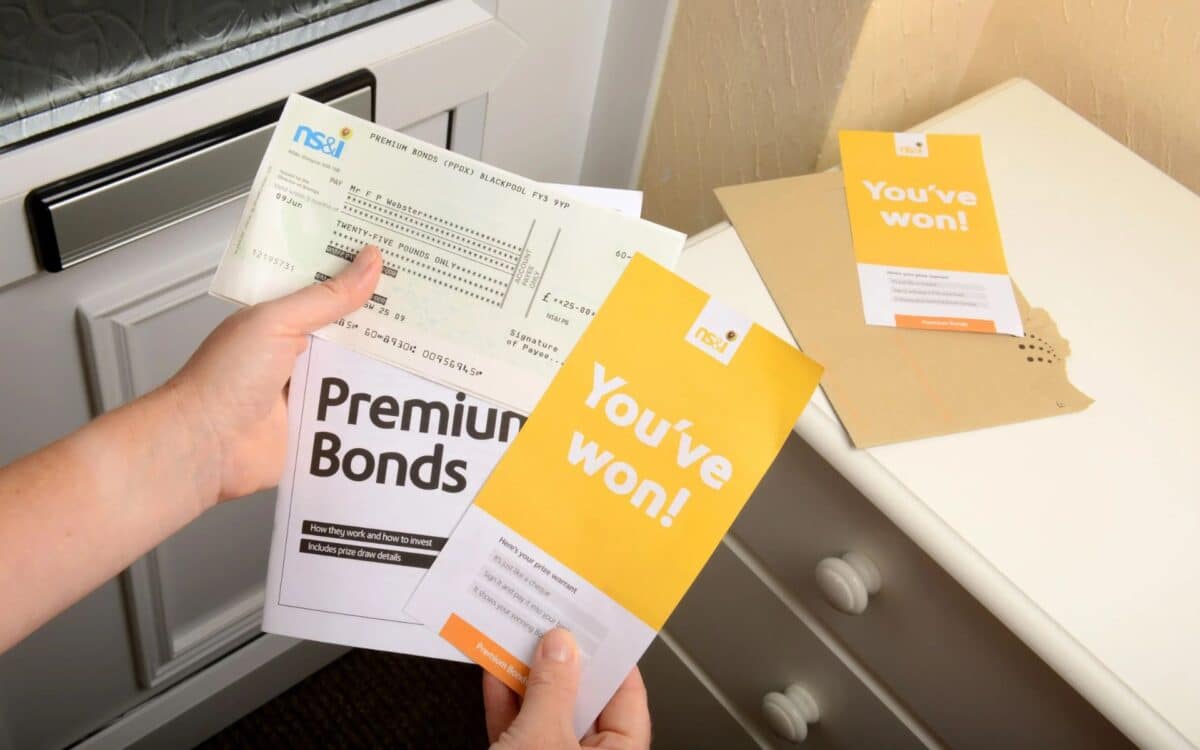

Millions of UK citizens holding Premium Bonds have recently received a crucial reminder from HMRC regarding the tax status of their winnings.

The reminder clarifies that any prizes won in the monthly draws are completely tax-free. This announcement comes in response to growing concerns and confusion among bondholders about whether such winnings are subject to any form of taxation.

According to the Birmingham Mail, HMRC’s confirmation should ease the worries of those unsure about their tax obligations related to the bonds. The clarification aims to ensure that people fully understand their entitlements when participating in the NS&I Tax-Free prize draws.

What Is the Tax Status of Premium Bond Winnings?

HMRC issued a statement confirming that Premium Bond prizes are not subject to any form of tax, including capital gains tax, under current UK law. This applies to both individual holders and those holding bonds as part of an estate. The clarification came in response to a query from a social media user asking whether winnings above £500 could be taxed.

Premium Bond wins received during administration period of an estate of over £500 – are they due capital gains tax for a simple estate return?

one Twitter (now X) user wrote to HMRC this week. HMRC responded, confirming that Premium Bond wins are tax-free and do not need to be declared.

Premium Bond holders participate in a monthly prize draw where the odds of winning are 22,000 to 1 for every £1 Bond. The prize fund is variable, with an annual rate of 3.80%. Unlike traditional savings accounts, Premium Bonds do not offer interest but instead fund a series of tax-free prizes ranging from £25 to a £1 million jackpot.

While the bonds offer the allure of tax-free prizes, they may not be suitable for everyone. The NS&I cautions that Premium Bonds are not ideal for individuals seeking regular income or guaranteed returns. Additionally, the impact of inflation can reduce the real value of savings over time, a factor investors should consider when choosing this savings product.

What does NS&I advise about investing in Premium Bonds?

For those with £25 or more to invest, NS&I encourages people to consider Premium Bonds if they want to participate in the excitement of tax-free prizes. However, the bonds may not be the best option for those concerned about inflation, seeking stable returns, or wishing to invest jointly with someone else.

The Treasury states :

You fancy winning tax-free prizes, up to £1 million. You have £25 or more to save. You want to make the most of tax-free saving.

However, NS&I also warns that the product may not be for you if :

- You want a regular income,

- You’re looking for guaranteed returns,

- You’re concerned about inflation, or

- You want to save jointly with someone else.

Although NS&I promotes the potential of winning a tax-free sum of up to £1 million, it is essential for investors to weigh the pros and cons before committing their money, as the prizes are never guaranteed.

How to Buy Premium Bonds

You can buy Premium Bonds online using NS&I’s secure online system. Be ready with your debit card details, as they do not accept credit card payments. When buying bonds for someone else’s child, it’s important to note that you cannot make the purchase by phone.

NS&I says :

We’re here in the UK every day except bank holidays. Please have your debit card details ready.

To complete the process, NS&I suggests filling out an application form and sending it along with a cheque payable to them.