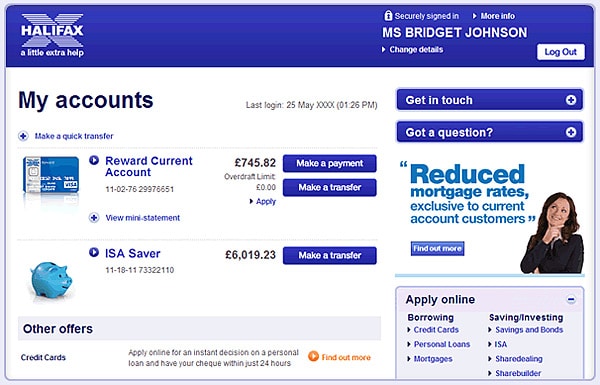

Halifax, part of Lloyds Banking Group, is set to close 61 branches across the UK in March, affecting towns and cities nationwide. The closures, attributed to the shift towards online and mobile banking, will impact customers who rely on in-person services, particularly in areas with limited alternative banking options.

The decision comes as part of a broader trend in the banking sector, where major high street banks are streamlining operations in response to declining branch usage. While Halifax has stated it will provide alternative solutions, concerns remain about accessibility for elderly and vulnerable customers who depend on physical branches.

Digital Shift Leads to Widespread Closures

Halifax’s decision to shut 61 branches reflects an industry-wide move towards digital banking, with fewer customers using traditional bank branches for everyday transactions.

According to Halifax, the closures were determined based on an assessment of customer behaviour, ensuring that alternative banking services remain available in affected areas.

Branches in Birmingham, London, Peterlee, and several other locations will shut their doors in March, with some of the first closures scheduled for early in the month. Halifax has not disclosed exact figures on footfall decline but cited an increase in mobile and online banking adoption as the primary reason for the decision.

Here is the list of Halifax branch closures in March:

- Nelson, 19 Manchester Road BB9 7JD – March 4

- Didcot, 7 Orchard Street OX11 7LG – March 10

- Birmingham, 580/582 Bearwood Road B66 4BW – March 2

- Hailsham, 54/56 High Street BN27 1AX – March 26

- Peterlee, 15 The Chare SR8 1EB – March 3

- London (East Central), 100 Cannon Street EC4N 6EU – March 28

- Burgess Hill, 11 Church Road RH15 9BB – March 4

- Camberley, 20/22 High Street GU15 3TG – March 11

- Gosport, 60/61 High Street PO12 1DR – March 12

- Normanton, 49/51 High Street WF6 2AF – March 27

Following branch closures, Halifax has indicated that customers may be able to access services through Community Bankers, Banking Hubs, or Deposit Services in select locations. These alternatives aim to mitigate the impact of closures, though their effectiveness in replacing full-service branches remains uncertain.

Customer Concerns and Banking Accessibility

The closures raise concerns about access to banking services, particularly for elderly and vulnerable customers who may struggle with digital banking. According to consumer advocacy groups, many customers still rely on face-to-face services for complex transactions, financial advice, and cash withdrawals.

While Halifax has highlighted efforts to support affected customers, including access to telephone banking and postal services, critics argue that these measures may not fully address the needs of those uncomfortable with digital banking.

The shift away from high street branches also affects local businesses that depend on in-person banking services for cash deposits and transactions.

The UK banking sector has seen a significant reduction in branch numbers in recent years, with major banks closing hundreds of locations nationwide.

Halifax’s latest wave of closures is part of this ongoing transformation, prompting discussions about the future of high street banking and the balance between digital convenience and essential in-person services.