Currently, the State Pension age is set to increase from 66 to 67 by 2028, with further hikes planned in the coming decades. But as this transition approaches, the government faces growing pressure from experts, particularly in relation to individuals who may struggle with the prospect of working longer due to ill health or other challenges. Calls for early access are being backed by organisations like Aegon, which argues that people should have the option to access their pension early, albeit at a reduced annual amount.

Early Pension Access for Greater Flexibility

The Department for Work and Pensions (DWP) has been urged to consider offering early access to State Pension payments, with pension provider Aegon suggesting that people could start receiving their pension payments up to three years earlier, but at a lower rate. According to Aegon’s pensions director, Steven Cameron, this approach would allow individuals approaching retirement to better manage their financial needs and address disparities caused by differing life expectancies.

Rising life expectancy across the UK has led to the scheduled increases in the State Pension age, but experts point out that this has a disproportionate impact on certain groups. Cameron explained that those with lower life expectancies, often linked to lower-income backgrounds or more physically demanding jobs, are particularly disadvantaged by having to work longer before accessing their pension. For these individuals, an extra year of waiting for pension payments could mean a significant financial loss, particularly if their health is deteriorating.

While the proposal would provide more flexibility, it also raises concerns about fairness. Cameron advocates for a minimum of 12 years‘ notice before any changes are implemented to the State Pension age, ensuring people have sufficient time to adjust their retirement plans. He also suggests that early access should be offered on the condition that payments are reduced, making the policy financially sustainable for the government.

The Risks of Reducing State Pension Payments

While some have welcomed the idea of early pension access, the proposal is not without its critics. Former pensions minister Steve Webb, now a partner at consultancy Lane Clark & Peacock, has warned that such a policy could have serious unintended consequences. He argues that the UK’s State Pension is already one of the lowest in the developed world, and reducing it further by offering early access could lead to many retirees living below the poverty line.

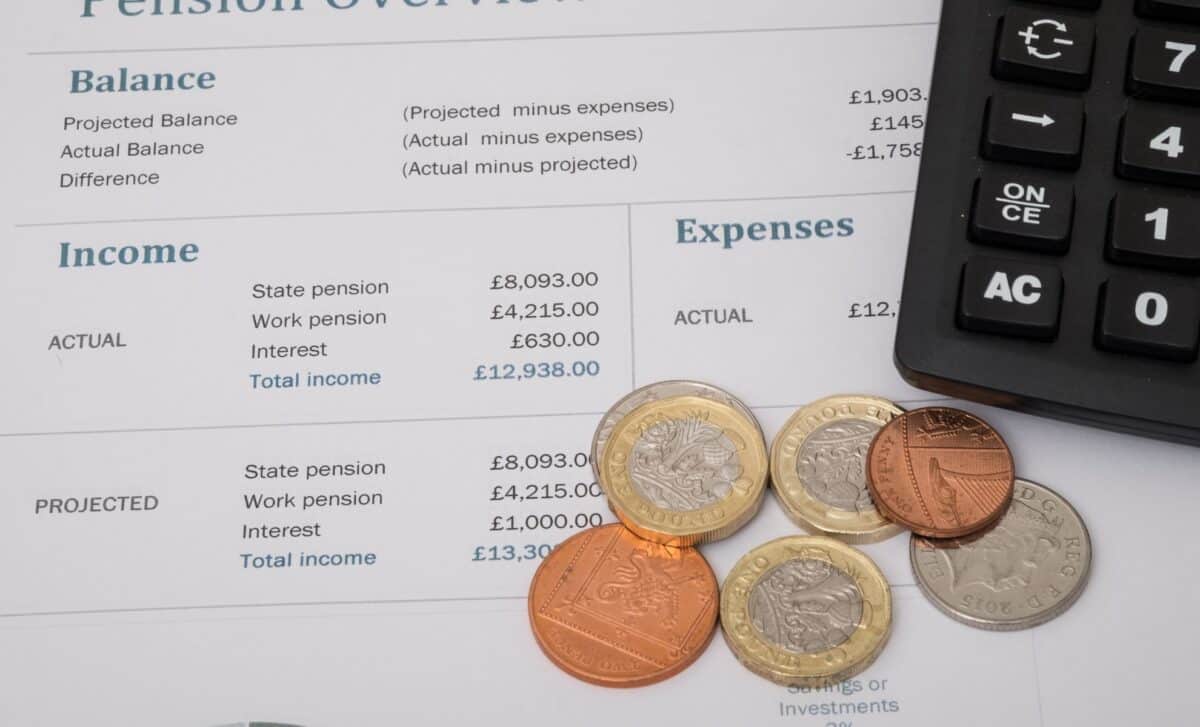

Webb cautioned that taking the pension early and locking in a permanently reduced amount would risk plunging a large portion of the population into financial hardship. The current State Pension, even when paid in full, is often insufficient to provide a comfortable retirement, leaving many pensioners dependent on additional private or workplace pensions to meet their basic living costs.

Additionally, the increasing reliance on the State Pension as a primary source of retirement income has led some experts to question the sustainability of further changes to the pension age. While the Triple Lock system, which guarantees annual increases to the State Pension, provides some financial security, it also creates a growing fiscal burden on the government. Critics argue that more fundamental reforms are needed, particularly given the complex social and economic factors that influence life expectancy across different regions and demographics.