The Department for Work and Pensions (DWP) has confirmed that from April 2026, it will introduce new powers allowing officials to access bank account data in an effort to clamp down on benefits fraud. The plans form part of the Public Authorities (Fraud, Error and Recovery) Bill, which aims to strengthen the government’s ability to recover public funds lost to fraudulent claims.

The move comes amid a broader effort by the new Labour government to reform the welfare system and curb misuse. Ministers argue the measures are necessary to prevent abuse, while critics have raised concerns about privacy and the risk of overreach by the state. The reforms have been described by the DWP as the “biggest fraud crackdown in a generation.”

New Measures Will Give DWP Access to Bank Account Data

From April 2026, the DWP will be legally empowered to obtain data from banks to identify suspected fraud among benefits claimants. According to government documents, banks will not be expected to monitor account activity continuously, but rather to share relevant data at the department’s request under strict legal criteria. The DWP maintains that no data will be shared on the presumption of guilt.

The policy is aimed at addressing what the government describes as widespread abuse of the welfare system. In 2024 alone, £7.4 billion was lost due to fraud and error in benefit claims, according to official figures. The DWP estimates that the new powers could help recover £1.5 billion over five years. Minister for Work and Pensions Liz Kendall defended the initiative in Parliament, stating that the existing system is “failing the very people that it is supposed to help.”

The bill also includes provisions allowing courts to impose penalties on individuals found guilty of fraud, including the option to ban them from driving for up to two years.

Privacy Concerns Raised by Civil Liberties Groups

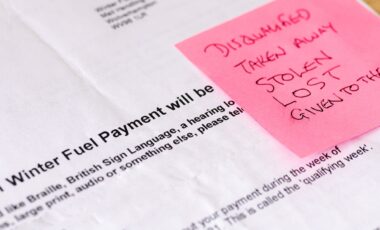

The announcement has drawn criticism from rights advocates who warn that the powers risk enabling “mass financial surveillance.” In a letter addressed to Liz Kendall in 2024, the directors of Big Brother Watch and Age UK described the bill as a disproportionate intrusion into personal privacy. They argue that granting government departments access to private financial data could undermine public trust and civil liberties.

The DWP insists the powers will be used selectively and lawfully, and will not involve “real-time surveillance” or automatic checks on all claimants. According to government statements, only those flagged through risk-based criteria will be subject to data access requests, which will still require oversight and legal authorisation.

Despite these reassurances, privacy campaigners have urged Parliament to scrutinise the bill closely before its implementation. The debate reflects a growing tension between the need for efficient governance and the protection of individual rights in an increasingly digitised welfare state.