The UK’s rising state pension age risks creating a widening gap between declining health and access to retirement income. Experts warn that millions may face years in poor health before qualifying for payments from the Department for Work and Pensions (DWP).

As life expectancy shifts and healthy life expectancy falls, concerns are mounting that the system is becoming misaligned with the realities of later life. Analysts describe the situation as a “ticking time bomb” that could leave some people financially exposed in the years leading up to retirement.

The state pension age is due to reach 67 within two years. At the same time, data show that healthy life expectancy has declined to its lowest level since records began. According to Stuart McDonald, head of longevity at LCP, these figures should serve as a wake-up call for policymakers.

Men are currently living around 60 years in “good health”, while women experience only slightly longer, at 60.9 years. Yet eligibility for the state pension continues to move further away from the point at which many people’s health begins to deteriorate.

According to Steve Webb, former pensions minister and now a partner at pensions consultancy LCP, governments around the world are increasing state pension ages in response to fiscal pressures. He cautioned that this approach risks creating “a growing chasm of years in poor health before state pension kicks in”.

Declining Healthy Life Expectancy Raises Concern

The tension between rising pension ages and falling healthy life expectancy lies at the centre of the debate. According to Mr McDonald, healthy life expectancy “has fallen sharply in recent years and is now at the lowest levels recorded since the data series began”.

This decline means that a significant number of people may find themselves unable to work due to ill health while still being below pension age. The result, as critics argue, is a prolonged period in which individuals are neither fully supported by the labour market nor eligible for state pension payments.

Rohit Parmar-Mistry of Pattrn Data described the drop in healthy life expectancy as a “ticking time bomb”. In his words, it risks turning pensions into “emergency life support rather than actual retirement funds”.

The figures also underline a gender dimension. While women are living slightly longer in good health than men, the margin is measured in months rather than years. That modest difference does little to offset the broader structural shift created by the higher pension age.

Financial Pressures and the Risk of a Widening Gap

The increase in the state pension age to 67 forms part of broader efforts to manage long-term public finances. According to Mr Webb, fiscal pressures are prompting governments to push retirement ages higher, but he warned that such decisions must be handled with care.

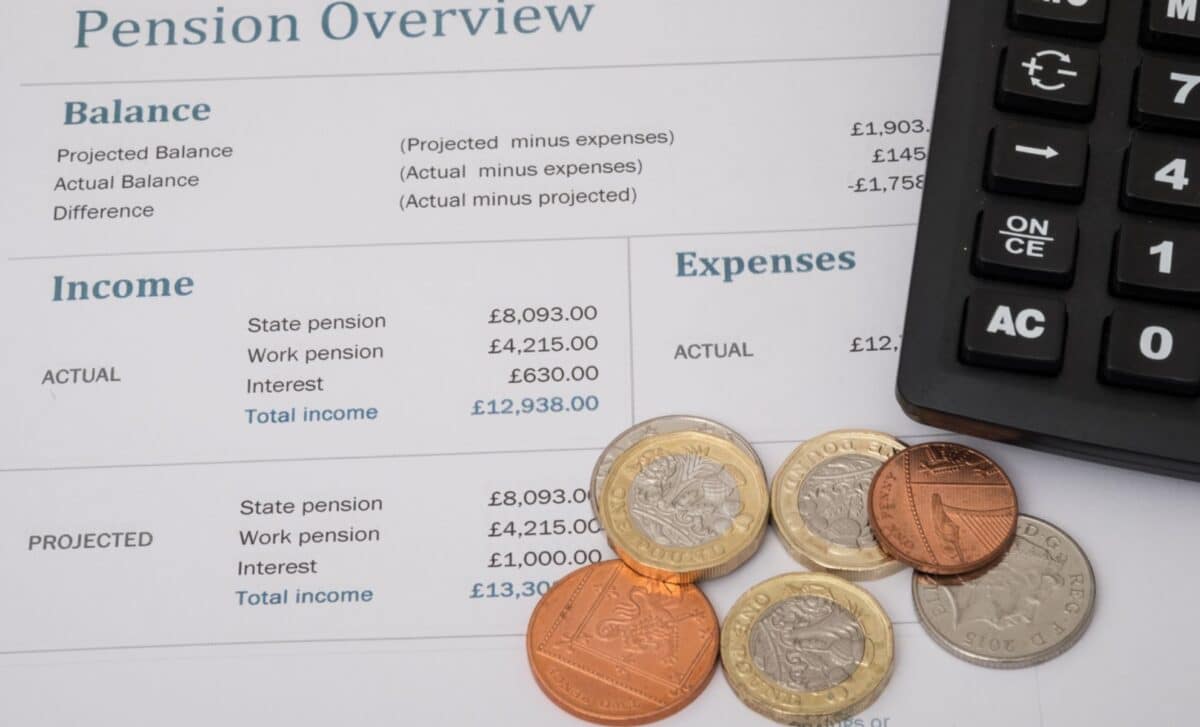

He pointed out that benefit support for those under pension age is “very meagre” and substantially below the rates available to pensioners. This disparity raises the prospect of individuals spending several years on limited support if they are too unwell to continue working but too young to draw their pension.

In theory, some people could face a wait of up to seven years between the end of their healthy working life and the point at which DWP pension payments begin. Mr Webb argued that further increases to the pension age could condemn growing numbers to living on the breadline in the run-up to retirement.

The debate comes against the backdrop of the Triple Lock, introduced during Mr Webb’s time in government, which ensures that state pension payments rise each April. Yet while payment levels may be protected, eligibility remains tied to an age threshold that continues to shift upwards.

For policymakers, the challenge is balancing fiscal sustainability with the lived realities of ageing. For those approaching retirement, the question is more immediate: whether the state pension will arrive when it is most needed, or several difficult years too late.