The UK government has confirmed significant changes to the Motability Scheme set to take effect from 1 July 2026. The reforms will directly impact tax exemptions for leased vehicles and insurance under the scheme, which currently benefits over 800,000 disabled people across the country.

The Motability Scheme allows eligible individuals to lease a car, powered wheelchair or scooter using their qualifying mobility allowance. While leases often involve an additional upfront payment, many users have relied on the scheme’s favourable tax treatment to access mobility solutions at a manageable cost. The updated regulations are expected to increase the financial burden for those leasing higher-cost vehicles that are not specially adapted.

VAT Exemption on Top-up Payments to End for Non-adapted Vehicles

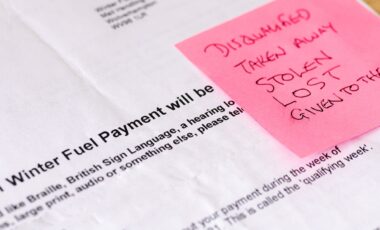

From July 2026, the existing zero-rate VAT relief on top-up payments made by customers to lease higher-cost vehicles through the Motability Scheme will be withdrawn. Currently, users can apply their full mobility allowance, such as the higher rate component of Personal Independence Payment (PIP) or Disability Living Allowance (DLA), towards the lease cost, and any additional payment made to upgrade to a more expensive vehicle has not been subject to VAT.

According to HM Revenue and Customs (HMRC), these top-up contributions will in future be taxed at the standard VAT rate of 20 per cent, unless the vehicle is “substantially and permanently adapted” for wheelchair or stretcher use. Adapted vehicles will continue to be zero-rated. The policy change is intended, as stated by HMRC, to “promote fairness and value for money for taxpayers” by limiting reliefs to cases involving clear medical necessity.

This shift means that many Motability users who currently choose to lease larger or more feature-rich models, but which do not meet the threshold for permanent adaptation, may face significantly higher costs. Vehicles designed or modified to accommodate wheelchairs will remain exempt under the revised scheme. According to the reports, the exemption on the mobility allowance itself when applied to lease costs will remain in place.

Insurance Tax Exemption Restricted to Adapted Vehicles Only

The government also plans to revise the treatment of Insurance Premium Tax (IPT) for vehicles leased under the Motability Scheme. Presently, all vehicles leased through qualifying schemes enjoy full exemption from IPT, regardless of whether they are adapted or not.

According to official guidance cited by the Daily Record, this exemption will be limited from July 2026 to insurance policies linked specifically to vehicles that are either permanently adapted for wheelchair or stretcher users, or originally manufactured for this purpose. All other vehicles leased under the scheme will become liable for IPT at the standard rate of 12 per cent.

Importantly, the new IPT rules will only apply to insurance policies for vehicles leased after the July 2026 deadline. Insurance on vehicles leased before that date will retain their exemption under the current rules.

Eligibility criteria for joining the Motability Scheme will remain unchanged. Applicants must continue to receive one of several qualifying mobility allowances with at least 12 months remaining on their award. These include PIP, DLA, the War Pensioners’ Mobility Supplement (WPMS), and the Armed Forces Independence Payment (AFIP).

The Motability Foundation has stated it will continue to provide means-tested grants to help eligible users cover costs for essential adaptations. According to the scheme’s official guidance, a typical lease package includes servicing, insurance, RAC breakdown cover and a mileage allowance of 60,000 miles over three years, or up to 100,000 for wheelchair-accessible vehicles.