Monzo is bringing back its automated 1p savings challenge for 2026, offering users a simple way to build daily saving habits over the course of a year. The initiative has already seen strong engagement, with millions of customers taking part in previous editions.

This time, the challenge includes a new incentive: a £10,000 prize for one participant who completes the full year. Premium users will also gain access to added features aimed at boosting their savings potential.

Monzo Aims to Make Saving Simple and Sustainable

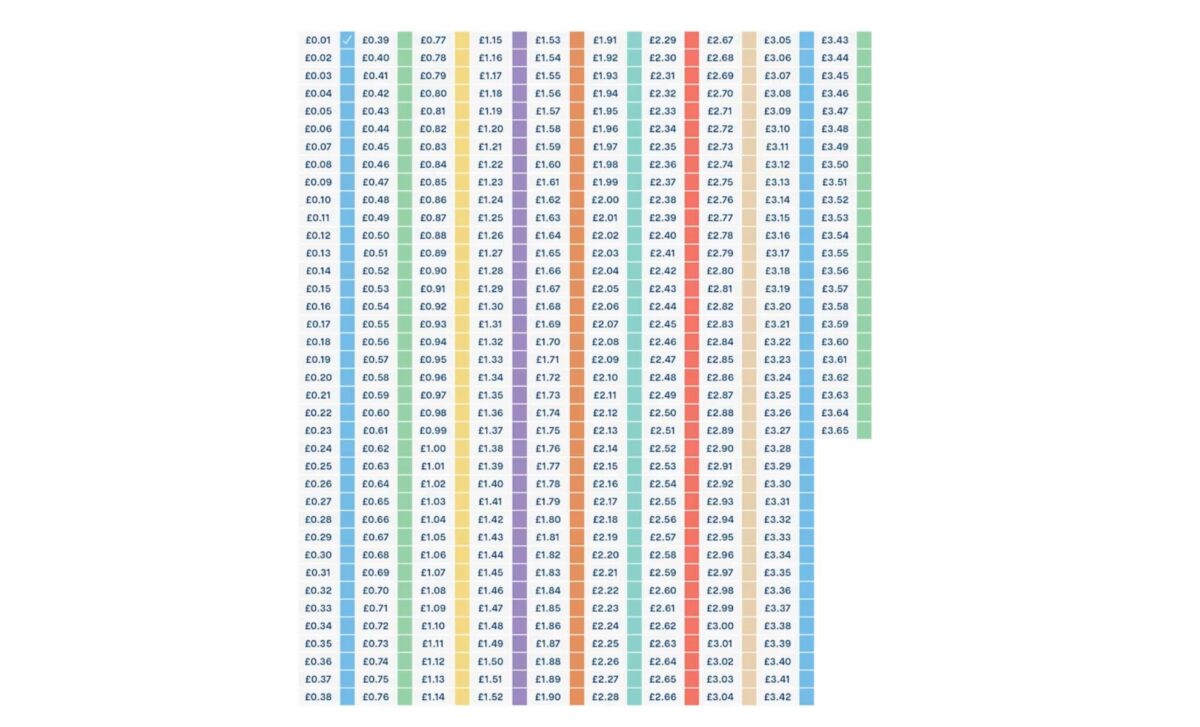

Monzo has reintroduced its 1p Savings Challenge for 2026, allowing users to develop consistent saving habits while gradually increasing the amount set aside each day. The initiative begins with a modest deposit of one penny on 1 January and adds a further penny each subsequent day, culminating in £3.65 on the final day of December. If followed without interruption, the challenge will total £667.95 saved by the end of the year.

The challenge is open to Monzo customers who subscribe to the Extra, Perks or Max tiers of the banking app. Once enrolled through the app, a Challenge Pot is automatically created, enabling the savings to be transferred daily without manual input. The pot remains flexible, users can pause, stop or withdraw funds at any time, giving them full control throughout the year.

According to Monzo, customers have until 31 January 2026 to join, and each challenge runs for 365 consecutive days from the starting date. A shorter commitment is also available, with those completing six months projected to save £168.36. The initiative has gained significant traction, with 1.7 million customers participating in 2025 and collectively saving more than £360 million by November, according to the bank.

Monzo’s Product Director, Marc Sfeir, highlighted the appeal of this approach by stating that most people “start the year with big financial resolutions” that are difficult to sustain. Instead, he said, the key to lasting financial change lies in micro-habits that “start small, stay consistent, and let progress compound over time.”

New Incentives and Higher Savings Potential for Premium Users

This year’s challenge includes an added incentive: one participant who completes the full 365-day challenge in 2026 will be randomly selected to receive £10,000. This prize draw aims to motivate more users to stick with the challenge for the entire duration.

To qualify for Monzo’s £10,000 prize draw, customers must start the 1p Savings Challenge by 11:59pm on 31 January 2026 and complete the full 365 days with at least £667.95 saved (excluding interest). Eligibility is limited to UK residents aged 18 or over with a Monzo personal current account or a paid plan such as Extra, Perks or Max.

In addition to the core offering, Monzo has introduced a “turbo” version of the challenge, available exclusively to Extra, Perks and Max customers. This allows users to begin with a higher daily saving increment, either 2p or 4p on day one, doubling each day. Over the course of a year, this enhanced version could result in a total saving of £2,671.80, as reported by Monzo.

Premium account holders also benefit from 5% interest on their Challenge Pot, helping to grow their savings passively. They are also entered into a monthly prize draw, where 100 winners each receive £100, another effort by Monzo to add layers of motivation.

Marc Sfeir emphasised that the goal is to make saving “accessible and even fun”. He noted that “when saving feels effortless, it becomes habit-forming,” which supports the bank’s broader objective of helping users establish sustainable financial habits.

The 1p Savings Challenge reflects a broader trend in personal finance where gamification and automation are being used to encourage better money management. By integrating behavioural insights and offering flexible saving tools, Monzo aims to make long-term saving achievable for a wide range of users.