Many future retirees underestimate the financial pressure of relying solely on the state pension. A leading financial planner urges Britons to act early and use the “6% rule” to strengthen their retirement outlook.

Planning for retirement often comes with uncertainty, particularly around income stability. While the UK’s full state pension currently stands at just over £230 a week, many retirees find this insufficient to maintain their desired standard of living.

A warning has now been issued by Cuan Tait, a Chartered Financial Planner at Raymond James Barbican, who cautions against waiting too long to plan ahead. As pension reforms remain a potential item in the upcoming autumn Budget, experts are highlighting tools and options that can help individuals take better control of their financial future.

Delaying State Pension Claims Could Increase Annual Payout

According to Cuan Tait, retirees should not overly depend on the state pension, as it may fall short of covering even basic living costs. Speaking to Express.co.uk, he said: “£230 a week isn’t much and it barely covers the basics.” His recommendation: start planning within ten years of retirement, and use all available options to strengthen one’s income base.

One of the lesser-known strategies Tait highlights is the potential benefit of delaying state pension claims. Under current UK rules, for every year a claimant defers their pension beyond state pension age, the amount received increases by roughly 6% per year. This is only applicable if individuals have other income sources to rely on during the delay.

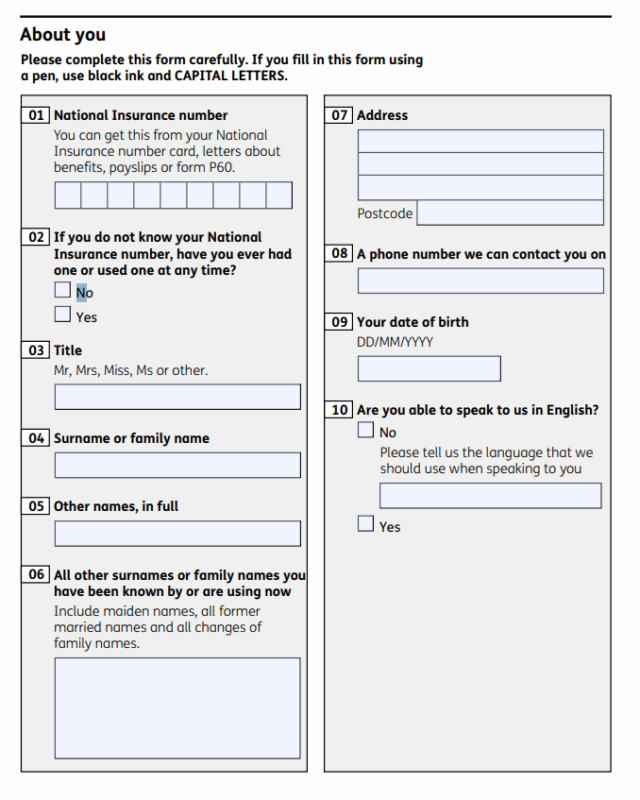

“If you can afford to delay taking your state pension, it goes up about 6% for each year you wait,” Tait explained. “But only do that if you’ve got other income to live on.” He also urges people to check their National Insurance (NI) contribution record and fill in any missing years to avoid reductions in their final entitlement.

Policy Uncertainty Ahead of November Budget

While individual choices can help strengthen retirement income, broader policy discussions may soon influence the UK pension landscape. The upcoming November Budget, led by Chancellor Rachel Reeves, could bring significant changes, particularly around pension contributions and incentives.

Former pensions minister Ros Altmann, writing for This Is Money, cautioned against overhauling the current system too abruptly. She warned: “Because so much public money is spent on pensions… damaging policy changes could also undermine the whole concept of pension saving and destroy confidence for the future.”

Altmann argued for a cautious approach, suggesting that encouraging pension contributions rather than adding new complexities could benefit the wider economy. With increasing calls to redistribute public spending between generations, the political climate surrounding pensions remains unsettled.