UK Financial Britain’s top financial regulators have decided to withdraw proposed diversity and inclusion (D&I) rules for financial firms, citing concerns over regulatory burdens, costs, and industry pushback.

This significant development, reported by The Epoch Times, marks a notable retreat from efforts to enhance diversity within the sector.

The move reflects a broader shift in corporate policies both in the UK and the United States, where businesses are increasingly rolling back diversity programmes amid growing political and economic pressures that have led to a reassessment of such initiatives.

Financial Watchdogs Withdraw Proposed Rules

The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), the regulatory arm of the Bank of England, announced that they would not move forward with planned requirements that would have obliged firms to collect and report demographic data annually.

Companies were also expected to set representation targets for underrepresented groups, including women and ethnic minorities.

In a joint statement, the regulators said :

In light of the broad range of feedback received, expected legislative developments and to avoid additional burdens on firms at this time, the FCA and PRA have no plans to take the work further.

The decision aligns with the UK government’s wider efforts to reduce corporate regulations, with Chancellor of the Exchequer Rachel Reeves urging regulators to limit additional administrative constraints on businesses.

Industry Concerns Over Regulatory Costs

The FCA, which supervises around 42,000 financial services firms, had previously introduced measures requiring UK-listed companies to report on gender and ethnic diversity in leadership.

Under these 2022 rules, firms were expected to ensure that at least 40% of board members were women. Additionally, at least one senior board position (chair, CEO, CFO, or senior independent director) had to be held by a woman.

The rules also required that at least one board member came from a minority ethnic background, excluding white ethnic groups, in line with UK Financial regulations.

However, financial firms pushed back against the expansion of these measures, warning of excessive costs and duplication of existing reporting obligations.

Sam Woods, CEO of the PRA, explained that while diversity is beneficial for corporate culture, imposing additional rules could contradict efforts to enhance competitiveness by reducing red tape.

In a letter to the UK Treasury Committee, Woods stated :

There is also a growing emphasis in our work on reducing regulatory burdens on firms while still delivering our objectives, and adding significant new requirements in this area could be seen as in tension with that approach.

Broader Pushback Against Diversity Initiatives

The decision also coincides with a wider global retreat from diversity, equity, and inclusion (DEI) programmes.

Reboot, an organisation advocating for greater diversity in financial services, criticised the decision, pointing to a 2024 survey which found that among 800 mid-to-senior level employees, 70% of “ethnic minority and white employees” believed that “little to no real progress” had been made in improving representation since the 2020 Black Lives Matter movement.

In response to the announcement, Reboot stated :

We’ve seen growing pushback against DEI this year, fuelled by geopolitical uncertainty and mounting pressure across the ESG landscape,” the group wrote in a LinkedIn post.

“While we understand the challenges regulators are facing, this decision risks reinforcing the wrong message at a time when meaningful progress is needed most.

This resistance to DEI initiatives is not limited to the UK. In the United States, major corporations including Meta, Goldman Sachs, and Boeing have rolled back their diversity programmes. The shift has been accelerated by policy changes under President Donald Trump, who has signed executive orders limiting DEI programmes in federal agencies.

During his inaugural address, Trump declared :

We will end the government policy of trying to socially engineer race and gender into every aspect of public and private life.

We will forge a society that is colorblind and merit-based.

Abandonment of “Name and Shame” Policies

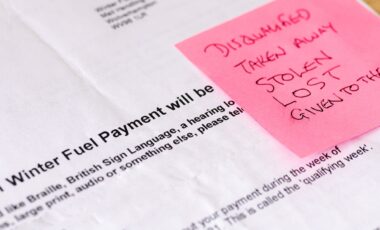

Alongside the scrapping of mandatory diversity reporting, the UK Financial FCA and PRA have also dropped plans to introduce a “name and shame” mechanism, which would have publicly identified financial firms failing to meet D&I standards.

The Bank of England maintained its stance on the importance of diversity, stating :

We see diversity and inclusion as an important driver of healthy cultures, so this should be embedded throughout firms.

However, industry groups have pointed to a growing backlash against DEI policies, as some critics argue they impact profitability or result in positive discrimination.

In its 2024 annual report, UK Finance noted a

Hardening of anti-DEI views by those who fear DEI detracts from profitability or positively discriminates against others.

Despite the regulators’ decision, there remains uncertainty about the future of D&I policies in UK financial services. Noline Matemera, a partner at Osborne Clarke LLP, noted:

Developments across the pond and the repeated push back on publishing final rules by the FCA and PRA mean today’s statement does not come as a surprise at all.

Whether [it] is the death knell for focusing on D&I in financial services in the UK is yet to be seen.

Meanwhile, the Bank of England continues to grapple with economic pressures, offering its employees a 3% salary increase for 2025-26, a rise in line with current UK inflation levels but lower than the previous year’s increase.

While the FCA and PRA insist that diversity remains an important corporate value, their decision leaves the future of diversity initiatives in the UK financial sector largely in the hands of individual firms.