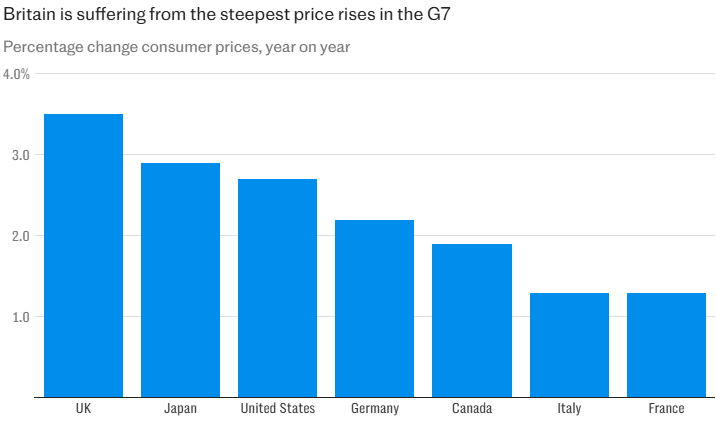

The United Kingdom is at the centre of an inflation storm, recording the highest price rises among the G7 nations, according to new data from the Organisation for Economic Cooperation and Development (OECD). In November, prices in the UK surged by 3.5%, a figure that dwarfs the G7 average of 2.6%. By comparison, inflation stood at a mere 1.3% in France and 2.9% in Japan, the G7 country with the second-highest rate. These statistics underline Britain’s prolonged struggle to rein in its economic challenges and inflationary pressures.

The OECD’s analysis, which uses the Consumer Prices Index including Housing (CPIH), provides a broader perspective by factoring in homeowner housing costs. While this differs from the more familiar Consumer Prices Index (CPI), it paints an equally concerning picture. Even when viewed through the lens of CPI alone, inflation remains alarmingly high at 2.6%, well above the Bank of England’s target rate of 2%.

Energy Costs and Interest Rates: The Culprits Behind Inflation

A significant portion of the inflationary pressures stems from persistently high energy costs and the impact of elevated interest rates. Energy prices, which had previously shown signs of stabilising, have once again begun to climb. This resurgence adds further strain on households and businesses already grappling with tight budgets. Simultaneously, the Bank of England’s sustained high-interest rates, aimed at tempering inflation, have had a dual effect: while curbing certain price increases, they have also raised borrowing costs, dampening consumer and business spending.

The government’s recent fiscal policies have not alleviated the situation. The Chancellor’s October Budget introduced £25 billion in corporate tax rises, leading many businesses to warn of imminent price increases to offset their higher tax burdens. This combination of rising costs, both at the consumer and corporate levels, suggests that inflationary pressures are unlikely to subside in the near term.

Broader Economic Strains: Borrowing Costs and Currency Weakness

Compounding the issue are rising borrowing costs, which have reached levels not seen in decades. The yields on UK government bonds—a key indicator of borrowing expenses—have surged, with long-term borrowing costs hitting their highest levels since 1998. Notably, yields on 10-year bonds are now at their highest point since the global financial crisis of 2008. This sharp increase erodes the fiscal space available to the government, limiting its ability to invest in growth-stimulating policies or provide relief to struggling households.

Adding to the financial strain is the pound’s continued weakness against the dollar, hitting its lowest level since 1993. This depreciation reflects waning investor confidence in Britain’s ability to manage its national debt and control inflation. Historically, higher bond yields have bolstered currency values, but the current scenario suggests deeper structural concerns about the UK economy’s trajectory.

Long-Term Concerns: Structural and Core Inflation

One particularly worrisome aspect of Britain’s inflation crisis is the persistent rise in core inflation, which excludes volatile components such as food and energy. This measure highlights underlying price pressures within the economy, suggesting that inflation is becoming entrenched. Businesses and households are not only facing higher costs today but are likely to see them persist over time.

The OECD findings confirm that inflation in Britain has consistently outpaced that of its G7 peers since mid-2024. After overtaking the United States last June, the UK has remained the leader in G7 inflation rankings, a title that signals deeper systemic issues rather than a temporary spike.

External Factors: Global Challenges and Political Uncertainty

Britain’s economic woes are also being shaped by external factors, particularly developments in the United States. The election of Donald Trump and his administration’s promises of blanket trade tariffs are expected to create inflationary ripples across the global economy. Such policies, aimed at reducing imports and prioritising domestic production, typically drive up prices globally, with the UK unlikely to escape these effects.

Domestically, political uncertainties add to the mix. The government faces growing pressure to present a credible plan for stabilising the economy and restoring confidence. As yields climb and the pound falters, investors are increasingly sceptical about the UK’s ability to balance fiscal discipline with measures that stimulate growth.

What Lies Ahead: Bracing for a Tough 2025

As Britain enters 2025, the economic outlook remains challenging. Households and businesses alike face difficult decisions as they navigate an environment of rising costs and stagnating growth. For the government, the twin challenges of controlling inflation and restoring investor confidence will require a delicate balancing act. Failure to address these issues risks deepening the economic malaise and prolonging the period of financial hardship for millions.

With inflation expected to accelerate further in the coming months, the UK is at a crossroads. Tackling the root causes of this inflationary spiral will require bold action and coordinated efforts from policymakers, businesses, and international partners. Whether Britain can rise to this challenge remains to be seen, but the stakes could not be higher.