Over the three months to March, wage growth in the UK remained strong despite the slowdown in the labour market. Members of the Bank of England’s Monetary Policy Committee had even more reason to wait to raise interest rates until they had more evidence that inflationary pressures were easing.

The pay rises, according to Chancellor Jeremy Hunt, “will help address the cost of living pressures on families”. “We are facing difficult labour supply situations, not least because of the pandemics, but I am confident that we can start to see an increase in the number of people in work as our reforms to childcare, pensions, tax and welfare take effect,” he continued.

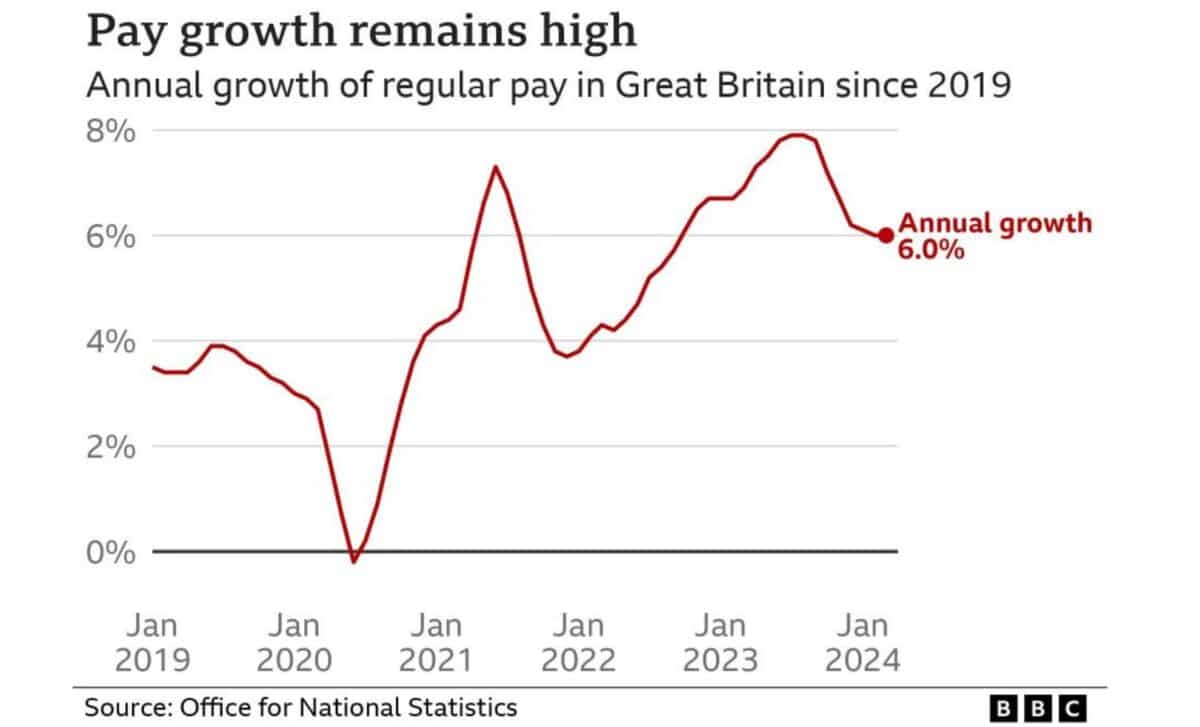

Average weekly earnings, which include bonuses, continued to rise gradually over the three months to March, according to data published on Tuesday by the Office for National Statistics. The annual growth rate for this salary was 5.7%.

This is higher than the 5.5% slowdown predicted by analysts. Furthermore, after deducting bonuses, ordinary pay rose by 6% over the same period last year, exceeding the 5.9% growth expected and corresponding to an upwardly revised estimate for the three months to February.

These pay rises coincided with a slowdown in the labour market, marked by falling job openings, relatively robust levels of paid employment and a surge in the number of people claiming unemployment benefit.

UK Unemployment Rises But Employment Stays Solid, Rate Cut Expected

The ONS reports that although the unemployment rate rose to 4.3%, in line with analysts’ expectations, the employment rate remained strong at 74.5%, a considerable fall on the previous sector and on the previous year.

A slight increase in the likelihood of the BoE cutting interest rates by June was indicated by 50% of swap market traders. Punters were betting that the central bank would cut interest rates twice between now and the end of the year. Rejecting these figures, sterling ended the day unchanged against the dollar at $1.256.

The ONS Labour Force Survey is problematic, and the volatility of earnings data has made Bank of England officials cautious. Nevertheless, data from other sources is consistent with a general slowdown in hiring and continued pressure on wages.

MPC Members Unlikely to Agree on Interest Rate Cut

The members of the Monetary Policy Committee, who voted last week to keep interest rates at 5.25%, their highest level for 16 years, by seven votes to two, are unlikely to reconcile despite the statistics. The minutes of the meeting indicate that before starting to cut rates, some members of the Monetary Policy Committee asked for further evidence that wage pressures were easing.

BoE Governor Andrew Bailey said the MPC expected inflationary pressures to ease “slightly faster” than expected, which would make it harder for companies to pass on higher costs to customers. According to Capital Economics economist Ashley Webb, Tuesday’s data release could see the following.

“The broader measures of wage increases are, in all likelihood, a little too robust for the Bank of England, despite the fact that the similar easing of daily personal area wages in March shows that wage pressures have eased a little faster than the Bank of England had expected.”