The United Kingdom has seen a significant fall in its trade volumes in recent years, marking the biggest five-year fall on record. Economists attribute this decline largely to the impact of Brexit, which has led to a reduction in the flow of goods in and out of the UK.

UK Trade Volume Falls to Lowest Since June 2022

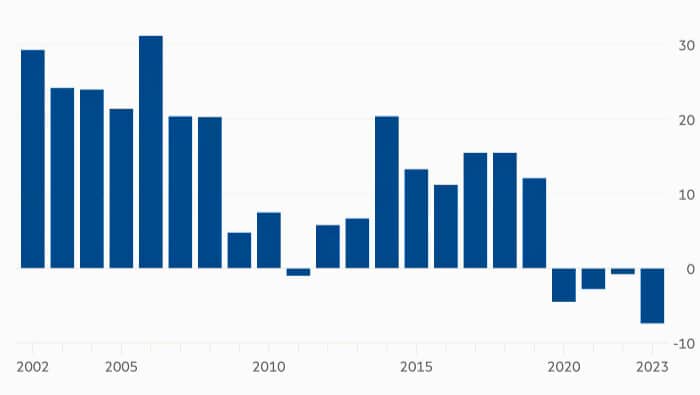

Based on data from the Office for National Statistics (ONS), the volume of UK imports and exports of goods fell by 7.4% between 2018 and 2023, according to calculations by the Financial Times. This is the biggest five-year fall in trade in goods since 1997, which is a worrying trend.

The ONS also reports that imports are down 7.4% on 2022 and 3.8% on 2018. Similarly, exports have fallen by 4.6% year-on-year, with significant reductions in exports to European Union (EU) and non-EU countries. Over five years, export volumes have fallen by 12.4%, painting a bleak picture of the UK’s trading landscape.

Brexit Implications Emerging

Economists have pointed to Brexit as a key factor contributing to the poor performance of the UK’s trade in goods. The implementation of new trade barriers following the UK’s departure from the EU’s single market and customs union in 2021 has made the flow of goods in and out of the UK more difficult. John Springford, deputy director of the Centre for European Reform, stated that ‘Brexit’ is the apparent cause of the UK’s weak trade performance, which is unusual among advanced economies.

Along these lines, the Office for Budget Responsibility noted that the UK’s trade intensity, measured as the share of trade in the overall economy, has fallen by 1.7% since 2019, while comparable G7 economies have increased their trade intensity by an average of 1.9% over the same period. The OBR concluded that Brexit frictions and post-pandemic disruptions have had a greater impact on trade in goods than on services.

Intra-EU Trade Dynamics

Springford suggests that the UK’s trade weakness with EU and non-EU countries may stem from the fact that it has missed the robust growth in intra-EU trade in recent years, implying a potential scenario in which UK goods exports to the EU might have flourished in the absence of Brexit.

High-Value Sectors Particularly Affected

The decline in chemical exports, which have fallen by 15% in real terms from 2018 levels, is particularly worrying. The Resolution Foundation’s Emily Fry points out that poor performance in industries such as chemicals that drive productivity and economic growth could have long-term negative consequences. Whereas exports of services have continued to grow strongly, the weakening of trade in high value goods poses risks to the UK’s future prosperity.

Taking it all together, the substantial decline in the UK’s merchandise trade volume highlights the significant challenges of navigating the new trading relationship post-Brexit. Rebuilding trade flows and minimising disruption will require ongoing negotiation and cooperation between Britain and its key partners in the years ahead.