A report by the UK’s spending watchdog, the National Audit Office, has revealed that taxpayers have spent the equivalent of 800 years on hold with HM Revenue and Customs (HMRC) in 2022-2023 and that the agency’s customer service is “in a downward spiral”.

The National Audit Office (NAO) said on Wednesday that HMRC’s call handling performance has declined due to financial constraints, staff losses and an effort to cut costs by encouraging people to manage their tax affairs online.

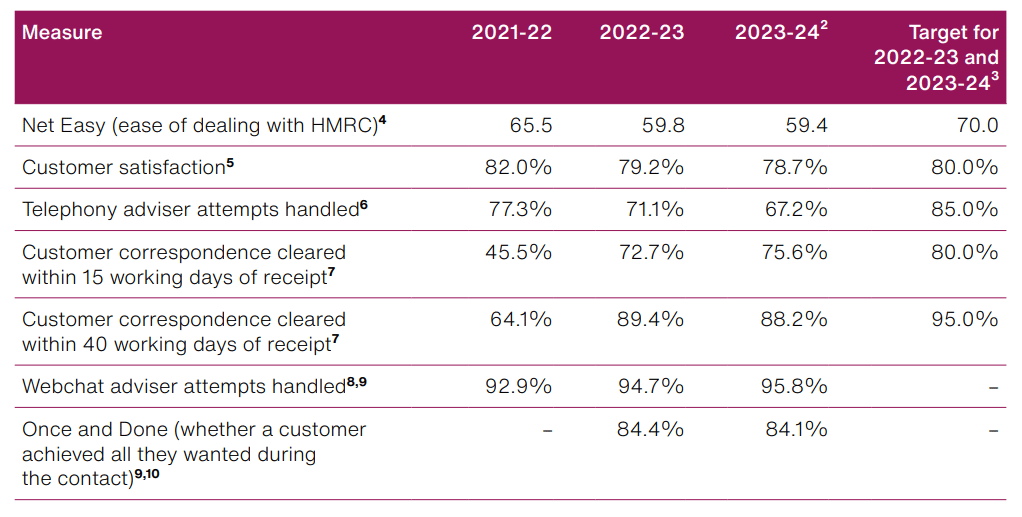

However, as the NAO noted, in the eleven months to February 2024, the average waiting time to speak to an adviser by phone was almost 23 minutes, significantly longer than the 5 minutes seen in 2018-19. During this period, HMRC answered only 67% of taxpayer calls, below its target of 85%.

For the most recent year with complete data, 2022-2023 saw taxpayers spend a total of seven million hours, or 798 years, on hold with HMRC – more than twice as long as in 2019-20, according to the NAO.

HMRC Service Slumps as Cost Cuts Take Effect

For a number of years, HMRC has fallen short of its targets when it comes to responding to taxpayer correspondence and telephone calls. The most recent annual targets for correspondence were met in 2018-19, and for telephone calls in 2017-18.

“Despite its poor performance, HMRC has continued to try to reduce its costs despite investment constraints. The paper concluded that HMRC and its customers are trapped in a spiral of stress and cuts.

The NAO said HMRC’s customer service spend in 2022-2023 was £881 million, a reduction in real terms of 6% compared to 2019-20. He said that by 2024-2025, HMRC should deliver £75 million of annual efficiency savings in customer services, as requested by the Treasury, to which the tax agency reports.

The Treasury increased this target to £149 million last year, but the tax office has struggled to meet the first target. By 2023-24, the tax office had saved just £53 million, according to the NAO.

Staff Cuts Call HMRC Customer Service Into Question

HMRC’s body of frontline customer support workers has noticed a reduction of 6% in 2023-24, down to 18,200 employees, in accordance with a National Audit Office (NAO) file. Overall call management performance has fallen significantly due to a 9% reduction in the number of customer support workers in recent years to 20,000 in 2019-20.

In addition, HMRC intends to reduce its frontline customer support staff by 14% in 2024-2025 (as well as the number of temporary workers) in response to budget constraints. The NAO has suggested that this strategy should be reassessed and warned that this extraordinary reduction could have a negative effect on service quality.

To address these issues, the Treasury has made an additional £51 million available to decorate HMRC’s customer service helplines, with the aim of improving the overall performance of the universal service, irrespective of non-structural barriers.

“We’re Making sturdy development in our efforts to enhance our purchaser service, and further investment has been showed via way of means of the authorities this week ” stated HMRC.