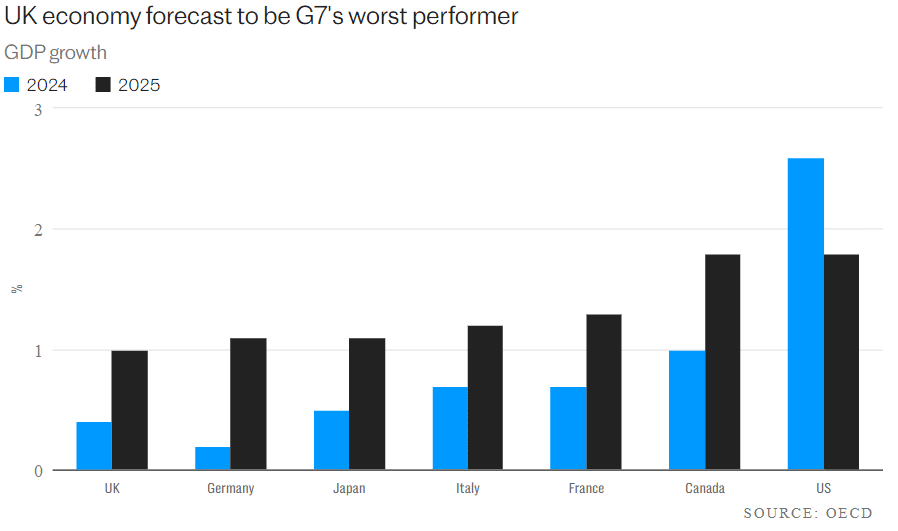

Taxes and high interest rates are set to make the UK economy the slowest growing in the G7 next year, according to forecasts by the Organisation for Economic Co-operation and Development (OECD).

Given the burden of borrowing costs and high taxes, economists from the Paris-based group downgraded Britain’s outlook on Thursday, estimating that the country’s GDP will grow by just 0.4% this year and 1% in 2025.

What’s more, with expected growth almost half that of the US, Britain’s economic outlook for 2019 is the worst among the OECD’s major developed economies. This is mainly because high taxes, interest rates and rising public spending are seen as major obstacles to economic growth.

Strategic Growth, Welfare and Tax

The OECD predicts that the triple freeze on pensions and the increase in health benefits will be the main drivers of growth in social spending, amounting to over 1% of GDP. Tax revenues continue to grow, albeit at a record level of around 37% of GDP.

However, even the permanent introduction of a temporary tax break for business investment would not fully compensate for the increase in the statutory rate of corporation tax.

“This forecast is not particularly surprising given our priority over the last year of using higher interest rates to combat inflation,” Mr. Hunt added “We must adhere to our strategy, which calls for comprehensive welfare reform, flexible labour markets, and competitive taxes.”

The Chancellor’s cuts to National Insurance have been hailed by the OECD as a prudent step to boost employment, but more needs to be done to tackle unemployment.

By 2029, Treasury spending will be 2.9 percentage points of GDP higher than pre-pandemic levels, according to OECD forecasts, if current trends continue…

Nevertheless, the Bank of England’s losses, which exceed 1.5% of GDP, are borne by the taxpayer. If elected, Sir Keir Starmer will have few fiscal options and will face economic challenges.

Global financial risks are alerted by the Co – Operation and Development organisation due to ongoing borrowing for healthcare and pensions.

Immediate action is needed to deal with the rising debt caused by an ageing population, climate change and defence. If the budget is to remain stable, cuts to pensions and sensible spending areas must be tackled.