The UK is taking steps to keep up with the rising cost of living by significantly increasing the legal minimum wage. However, the question remains: will it be enough?

9.8% Minimum Wage Rise

With a 9.8% increase in the legal minimum wage, the UK has taken a major step towards addressing the rising cost of living by raising the minimum wage to its highest level since the start of the new millennium. Specifically, the new rate will rise from £10.42 to £11.44 an hour.

Keerthi Subramanian, a shop assistant from South London, commented: “My previous earnings were barely enough to cover my expenses as the cost of necessities has skyrocketed in recent years.”

The National Living Wage (NLW) is a response to the financial struggles of low-income workers in the UK. Despite a significant 9.8% increase, it may not be sufficient for those grappling with the increased cost of living resulting from the COVID-19 pandemic.

In 2019, the Conservative Party has pledged to increase the National Living Wage (NLW) to two-thirds of the average wage. As a result of this latest adjustment, the NLW will increase by around £1,800 a year and should benefit around 2.7 million employees.

With the support of the independent Low Pay Commission, this policy development aims to reduce pay inequality and raise living standards across the UK4. The National Living Wage (NLW) now applies to workers aged 21 and over, with different increases for younger workers.

Current National Living Wage Rates

| 21 and over | 18 to 20 | Under 18 | Apprentice | |

|---|---|---|---|---|

| April 2024 | £11.44 | £8.60 | £6.40 | £6.40 |

Previous Rates

| 23 and over | 21 to 22 | 18 to 20 | Under 18 | Apprentice | |

|---|---|---|---|---|---|

| April 2023 to March 2024 | £10.42 | £10.18 | £7.49 | £5.28 | £5.28 |

| April 2022 to March 2023 | £9.50 | £9.18 | £6.83 | £4.81 | £4.81 |

| April 2021 to March 2022 | £8.91 | £8.36 | £6.56 | £4.62 | £4.30 |

The unions have generally accepted this development. However, they emphasise the need for more substantial pay rises to keep pace with inflation.

Inflation’s Role in Monetary Policy

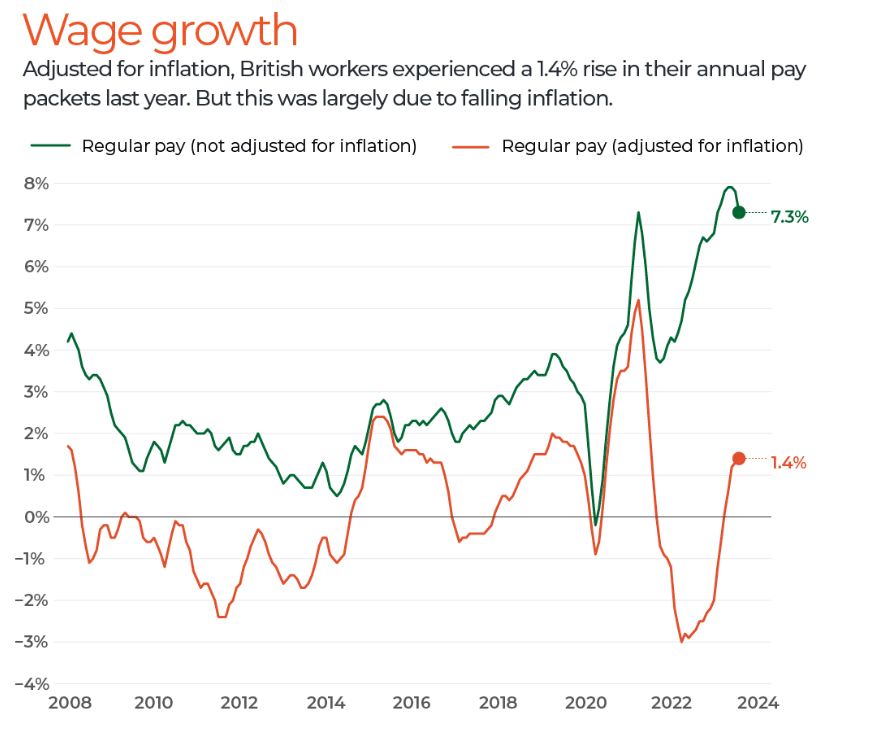

The last period of strong real wage growth in the UK ended at the end of 2023. In October 2022, inflation had fallen to 3% after peaking at 4% in February, mainly due to a fall in consumer prices caused by rising energy costs.

As the Bank of England is concerned that inflation could rise above its 2% target, it will be keeping a close eye on the inflationary impact of pay rises.

“The central bank officials worry that the NLW increase could trickle up the wage scales as employers compensate their higher-ranking staff.” warns Edward Allenby, analyst at Oxford Economics.

True Living Wage in the UK

The real Living Wage differs from the NLW. This wage, set by the Living Wage Foundation charity, is £12 nationally and £13.15 in London. Employers are free to pay this voluntary rate. So far, around 14,000 UK businesses have committed to the Living Wage.

According to Gail Irvine, Policy Manager at the Living Wage Foundation, around 3.7 million people, or 13% of the working population, earn less than the real Living Wage.

“The Living Wage is about creating a fairer society,” says Gail Irvine. “We have a long way to go in Britain.”

A value of zero represents total equality, with income shared equally between all households. Higher scores indicate greater income inequality. To give a rough idea, the UK’s Gini coefficient was 25.3 in 1979.

Reflecting wage inequality in the UK, the Gini coefficient currently stands at 3510. This is higher than in all other EU countries except Latvia and Lithuania.