UK inflation fell to 2.3% in April, marking the lowest percentage for almost three years, but the fall was less than expected, dashing expectations of an interest rate cut much sooner.

Markets lowered expectations that the Bank could cut interest rates from their current level of 5.25% as early as next month, and forecasts of an August cut were also revised downwards. City analysts had forecast that annual growth in the value of goods and services could fall to 2.1%, close to the Bank of England’s 2% target.

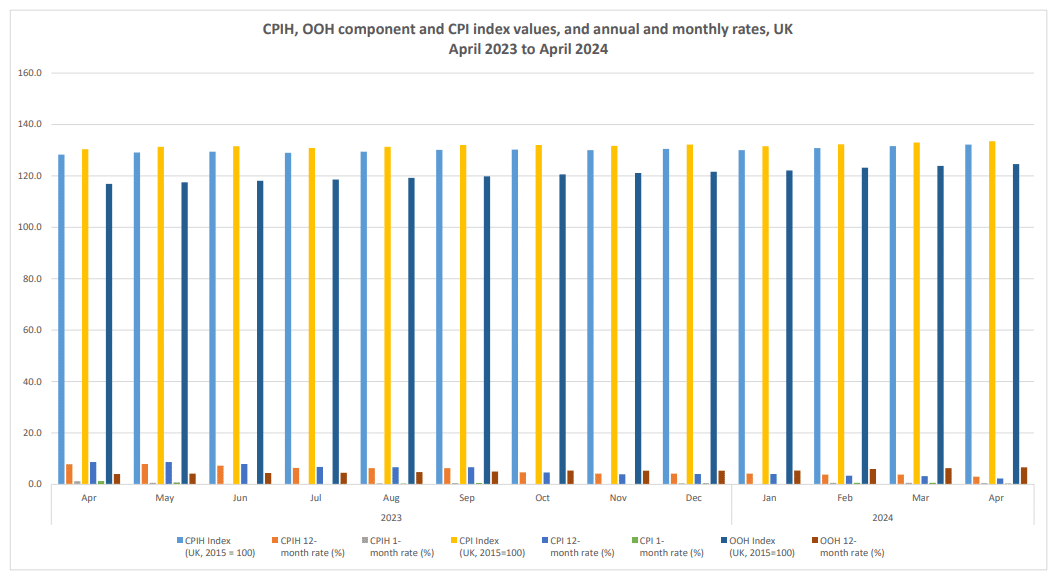

The Consumer Price Index (CPI) fell by 2.3% last month, down from 3.2% in March, generally due to lower electricity and meals prices. July 2021 became the last month in which inflation fell.

Over the past year, the fall in fuel and energy prices has been the biggest on record at 27%, while the annual increase in meals and soft liquids prices was 2.9%, the lowest level since November 2021.

Household Budget Pressures Persist Amid Inflation

The value of all items fell by 0.8% month-on-month, as accessory shops reduced their spending by 0.9% between March and April to reflect the strain on family budgets and consumers’ reluctance to buy expensive items.

However, annual inflation in services, which mainly represents spending that businesses impose on each other, stood at 5.9%, slightly down on March’s 6%.

In addition, the degree of inflation that includes housing prices remains well above the headline CPI due to a sharp rise in rents over the past year. The 3% annual rise in the ONS’s CPIH is also explained by the improvement in loan prices.

Rising Fuel Costs Stall Inflation Slowdown

The Office for National Statistics (ONS) has revealed that although Brent Crude Oil has stabilised at around $83 (£65) a barrel, rising petrol and diesel prices prevented inflation from slowing further last month.

KPMG UK chief economist Yael Selfin said that as falling inflation approaches the Bank of England’s target, an early cut in charges may not be necessary.

According to Paula Bejarano Carbo of the National Institute of Economic and Social Research, before the major financial institution considers cutting rates, central inflation, currently at 3.9%, must continue to fall.

“Coupled with last week’s pay rise data, we believe that long-term bid inflation will continue to pose a threat to inflationary pressures in the second half of this year. As a result, the MPC may also caution at its next meeting and keep interest rates on hold, despite today’s encouraging fall in the headline interest rate.”

Steady Eurozone Inflation and UK Fiscal Challenges

The 20-member eurozone recorded steady inflation of 2.4% in April compared with the previous month. The UK public budget increased more than expected, according to separate ONS figures.

The monthly deficit reached £20.5 billion, the fourth-highest amount of borrowing since the start of the information in 1993, and was £1.9 billion higher than legitimately forecast.

Nevertheless, the deficit was caused by high debt servicing costs. It is lower than forecast, but still higher than expected. Analysts are questioning the tax cuts ahead of the election. Martin Beck is disappointed that borrowing has exceeded expectations.