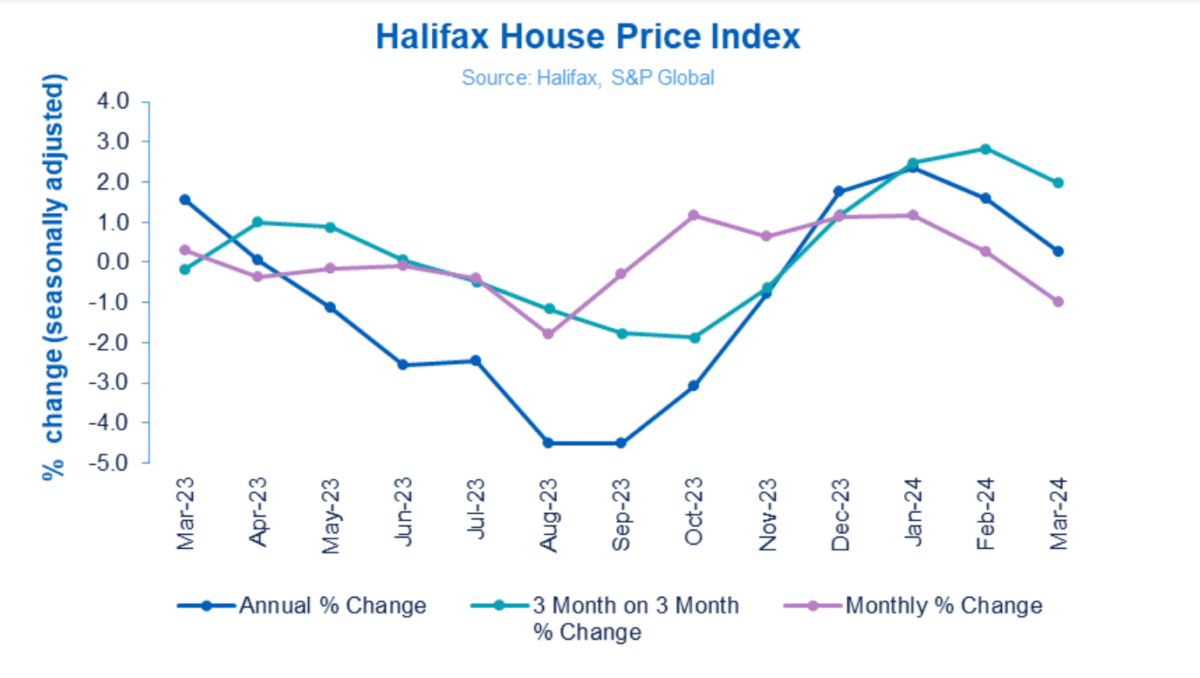

Halifax, a leading UK lender, reported that UK housing prices fell in March for the first time in six months, which surprised analysts and added to the indications of irregularity in the property market recovery.

In March, the average UK house price fell by 1% month-on-month to £288,430 compared with February, when prices reached a 16-month high of £291,338. That drop puts an end to five months of increases.

In addition, Halifax data revealed that prices in March rose by 0.3% year-on-year – a much smaller annual increase than the 1.45% predicted by economists in a Reuters poll.

“The limitation on affordability still poses a difficulty for potential purchasers,” stated Kim Kinnaird, director of Halifax Mortgages.

The statistics aligned with data released that week by mortgage provider Nationwide, also showing house prices unexpectedly fell in March. Further data from the Bank of England that week showed mortgage approvals rose to their highest level in 17 months in February.

“The overall picture shows that house prices are rising annually, which is a result of both relatively high interest rates and an easing cost of living squeeze as pay growth now exceeds overall inflation” claimed Kinnaird.

Rising Mortgage Rates Impact on Housing Prices

Considering that effective interest rates, i.e. the real interest rate paid, rose in March from what Bank of England data this week indicated was the lowest level for six months in February, therefore, some analysts have suggested that the fall in house prices indicated by the Nationwide and Halifax indices was the result of the rise in mortgage interest rates.

Mortgage rates rose in March, probably back to 5% from 4.5% in February, according to house price data released this week, which Andrew Wishart, senior economist at research firm Capital Economics, said had an impact on prices.

“I think what we are seeing in the house price data out this week is that mortgage rates ticked up in March, probably back up to 5 per cent from 4.5 [percent] in February, and those higher rates are weighing on price.” said Andrew Wishart, Senior economist of Capital Economics.

Economists predict that the trajectory of interest rates, currently at a 16-year high of 5.25%, which influences the way lenders set mortgage rates, will determine the duration of house price fluctuations.

Perspectives on Upcoming Mortgage Rates and Housing Market Patterns

Rob Wood, chief UK economist at Pantheon Macroeconomics, has predicted that mortgage rates would fall gradually from now on, as markets expect the Bank of England to loosen its policy restrictions gradually. “This will reduce affordability, which should put the brakes on house price rises.

Nonetheless, there are indications homeowners may receive relief more quickly than later. A recent Bank of England survey of UK businesses showed wage growth expectations hit a two-year low in March, supporting the assumption the central bank will start cutting interest rates this summer.

Wishart predicted “we will see mortgage rates come down below 4 per cent, and a near-term flatlining in house prices” if the Bank of England’s benchmark dropped more swiftly by the end of 2024.