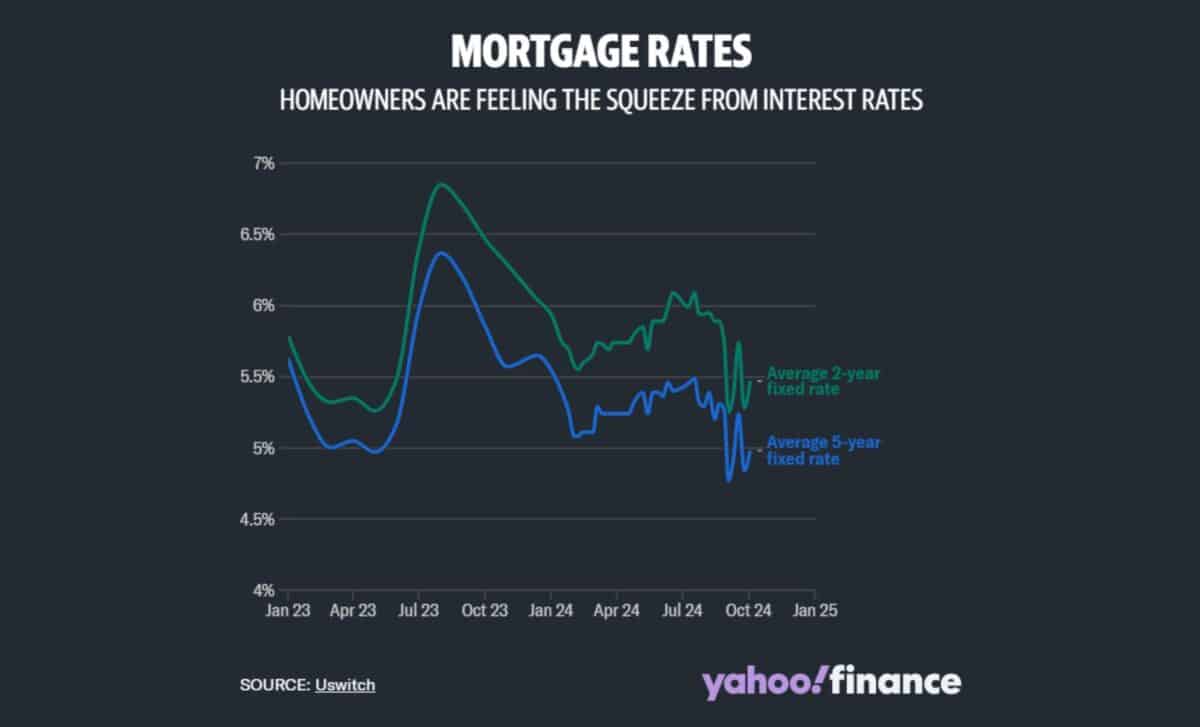

Although the Bank of England opted to keep interest rates at 5%, there has been an increase in the average mortgage rates this week. Two-year fixed deals have risen to 5.47%, up from 5.28%, and five-year deals now average 4.98%, compared to last week’s 4.84%, according to Uswitch data.

Despite these slight increases, expectations for upcoming rate cuts provide hope. Investors forecast two interest rate reductions before the end of the year, with the first anticipated in November. This has triggered increased competition among lenders, leading to more attractive mortgage offers on the horizon.

Market Outlook

Inflation remained stable at 2.2% in August, which is encouraging news for mortgage holders. According to Alice Haine, personal finance expert at Bestinvest, stable inflation and competitive mortgage rates are gradually improving affordability for both homeowners and first-time buyers. She notes that this allows buyers’ budgets to stretch further.

Experts predict that mortgage rates could fall as low as 3.5% by the end of the year, as financial markets are pricing in two rate cuts. This has prompted several banks to start lowering their mortgage rates in anticipation.

Major Figures in the Mortgage War

- Virgin Money announced reductions across both its purchase and remortgage ranges.

- Santander cut its buy-to-let (BTL) fixed rates, targeting both new customers and those seeking product transfers.

According to Mark Harris, CEO of SPF Private Clients, lenders are gradually lowering their rates to compete for business, signaling that the market direction is clearly heading downwards.

New Offers Target First-Time Buyers

The competition to attract first-time buyers has escalated. Nationwide, one of the UK’s largest building societies, introduced a new offer allowing first-time buyers to borrow up to six times their income with a 5% deposit. However, this option is restricted to those opting for a five- or ten-year fixed deal.

Sarah Coles, a finance columnist for Yahoo Finance UK, pointed out that expectations of future rate cuts have already been priced into many mortgage products. This has spurred a resurgence in mortgage approvals, with buyers returning to the market thanks to these slightly more affordable deals.

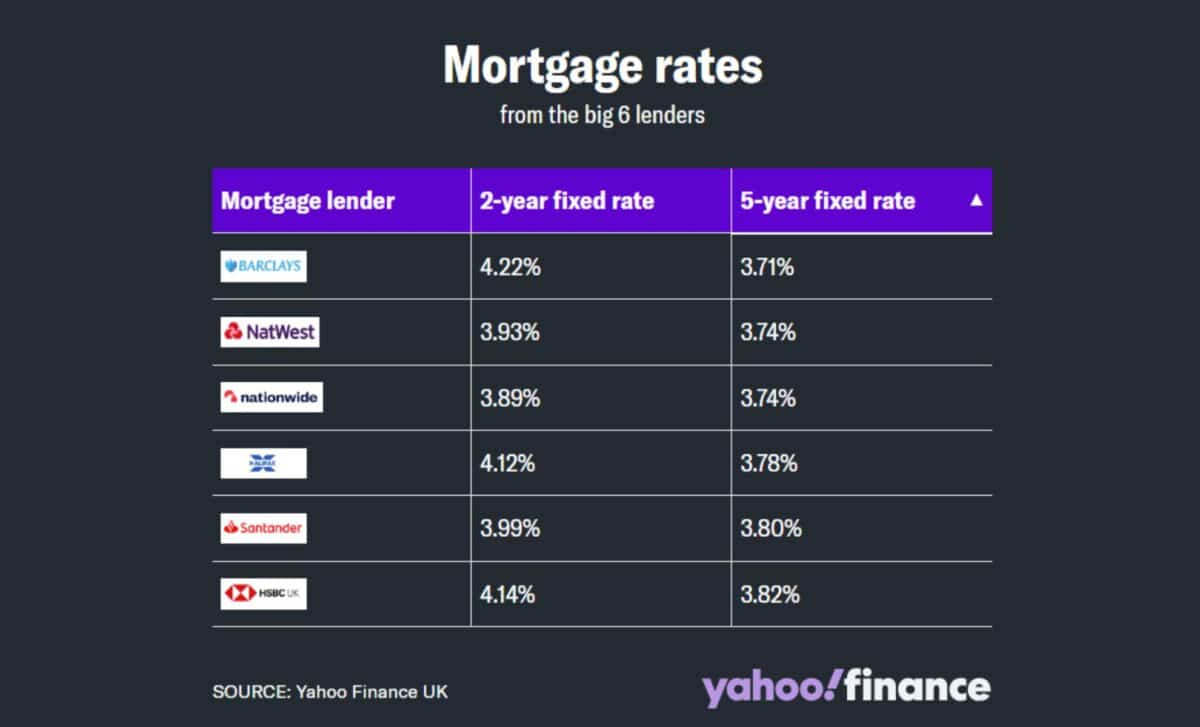

HSBC, NatWest, Santander, and Other Current Mortgage Offers

Several lenders have rolled out competitive mortgage deals:

- HSBC offers a five-year fixed rate at 3.82%, with slightly lower rates for Premier Standard account holders.

- NatWest provides a five-year deal at 3.74%, while its two-year fix now stands at 3.93%, a reduction from last week’s 4.05%.

- Santander offers a five-year fixed deal at 3.80%, while its two-year fix at 3.99% remains one of only two sub-4% deals available in this category.

Barclays leads with the cheapest deal on the market, offering a five-year fixed deal at 3.71%, though this requires a substantial 40% deposit.

Emerging Options for First-Time Buyers

For first-time buyers struggling with large deposits, several new options have emerged:

- Yorkshire Building Society now offers a product for buyers with just a £5,000 deposit, allowing purchases of homes valued up to £500,000, potentially lowering the deposit requirement to 1%.

- April Mortgages offers loans of up to six times a buyer’s income with a 5% deposit, with rates starting at 5.20% and loans fixed for up to 15 years.

- Skipton Building Society has adjusted its policies, allowing first-time buyers to borrow up to five-and-a-half times their income, providing further flexibility to potential homeowners.

Will Mortgage Rates Decrease in 2024?

In recent years, UK mortgage borrowers have encountered enormous repayment difficulties, mainly owing to the rising base rate imposed by the Bank of England (BoE).

This hike has taken its toll on customers as these costs have been passed on to them by banks and building societies. Most people were of the opinion that interest rates are at their highest, and many were predicting cuts in the year 2024.

At present, though inflation is approaching the target of 2% set by BoE, the market traders are now looking for only two rate cuts instead of the five that were anticipated at the beginning of the year 2024.

Matt Smith, a mortgage expert at Rightmove, remarked, “While those looking to take out a mortgage soon shouldn’t expect to see drastically lower mortgage rates, we would expect the downward trend we’ve started to see continue.”

He went on to say that as the base rate is reduced further, borrowers will start to see a difference positively. Nonetheless, it is important to appreciate that mortgage rates are expected to plateau at a higher rate than previous years, predictions indicates that the base rate will peak at around three and a quarter percent.

On top of that, this year’s additional 1.6 million existing borrowers are likely to reach the end of their cheap fixed-rate terms.