Rishi Sunak cautioned against campaigning on an unfunded proposal to eliminate employee national insurance, as it could create a £40 billion deficit in public finances, according to projections.

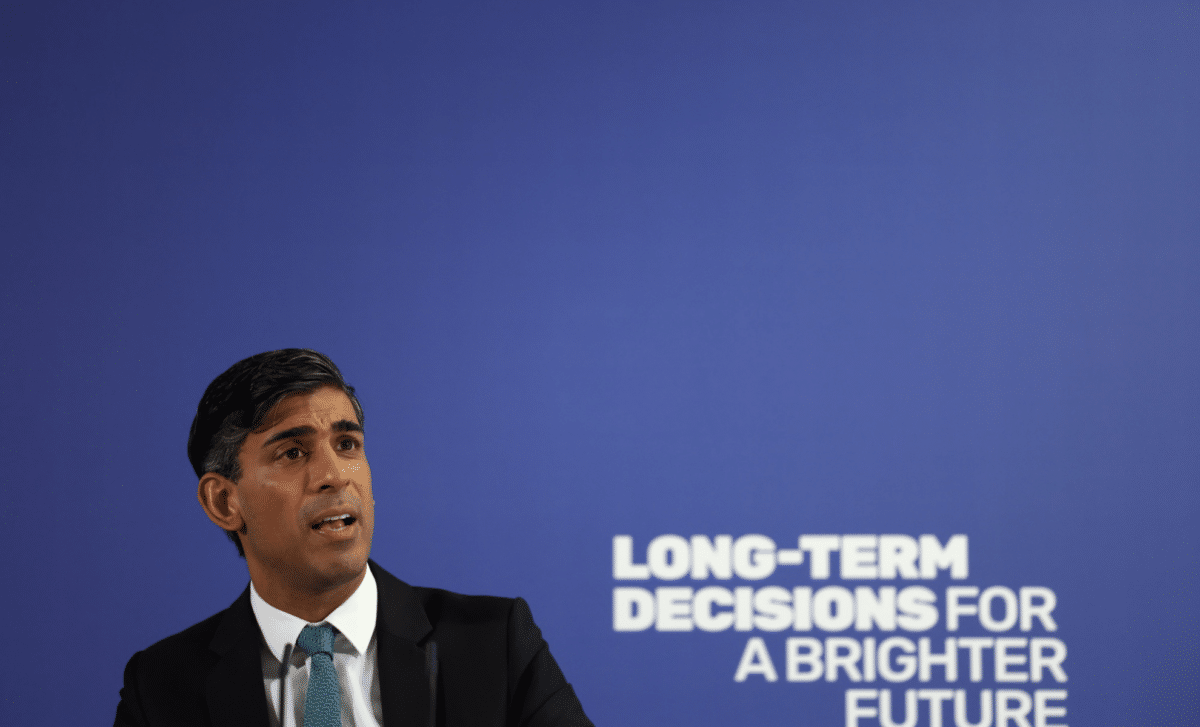

Sunak Faces Pressure on Financing National Insurance Cut Amid Election Debate

As the economic debate ahead of the election intensified between the Conservatives and Labour, the prime minister Rishi Sunak faced growing pressure on Thursday to clarify how the proposed national insurance cut would be financed, especially considering the challenges facing public services.

By establishing a 2% cut in national insurance during Wednesday’s budget, Chancellor Jeremy Hunt aspires to fund it through raised government borrowing, potential stealth tax hikes, and a cutback in public spending post-election.

Hunt expressed the Conservative Party’s ambition to eventually eliminate the tax on workers entirely. Despite the relatively modest budget giveaways, the likelihood of a snap election has diminished, although Sunak, in post-budget interviews, did not completely rule out the possibility.

Unprotected Services in England Face Annual Funding Reductions In Next Parliament

Leading economists express doubts over the feasibility of abolishing employee national insurance contributions (NICs) without further straining public services.

With projections indicating the toughest fiscal challenge for a chancellor in over 80 years, questions arise about how this measure can be sustained while reducing debt. The estimated annual cost of over £40 billion in forgone revenue, coupled with other unfunded promises, raises concerns about the overall fiscal impact.

The government’s lack of detailed plans for post-election public spending, beyond a general efficiency drive and a 1% real-terms funding increase for key departments, leaves uncertainties and potential cuts in non-ringfenced areas.

Sunak refused to reveal how the plan might be funded, notifying broadcasters instead: “I think what people can see from me, I think they trust me on these things, is that I will always do this responsibly.”

The spokeswoman for the prime minister likewise declined to say whether the government was thinking of forgoing national insurance’s whole revenue stream or if it was thinking of eliminating national insurance by combining it with income tax, which may mean raising revenue taxes.

In its denunciation against the pre-election tax and policies of expenditure suggested by both political parties, the IFS comprised Labour. Johnson claimed: “The government and opposition are joining in a conspiracy of silence in not acknowledging the scale of the choices and trade-offs that will face us after the election,”

By putting further pressure on the prime minister and chancellor and claiming that their ambitious plans for national insurance would cost more than Liz Truss’ disastrous £45 billion mini budget package, Labour attempted to divert criticism of its own ambitions. The plan’s annual cost was estimated to be £46 billion, or £230 billion over the period of a five-year parliament.

In a correspondence addressed to the prime minister, Shadow Chief Secretary to the Treasury Darren Jones stated: “Just like Liz Truss, you have so far refused to set out how you are going to pay for this latest shake of the magic money tree.”

IFS Concerned Over Tax Levels and Falling Living Standards in Chancellor’s Budget

The Institute for Fiscal Studies (IFS) delivered a critical assessment of the Chancellor’s budget, highlighting numerous unresolved issues in the Conservatives’ tax and spending plans. Questions persist about how substantial savings will be achieved through Chancellor Jeremy Hunt’s proposed public sector productivity drive after over a decade of austerity.

Despite a one-third reduction in employees’ national insurance, the IFS warns that the overall tax take is set to reach its highest level since 1948, with limited impact on reducing the national debt.

After almost two decades of real wages decline, the chief executive of the Resolution Foundation, Torsten Bell, announced that household net incomes, adapting for inflation, are expected to plummet by 0.9% from 2019 to the end of the year.

This makes it the first parliamentary term in modern history to observe a fall in living standards. According to Bell, high earners and pensioners bear the brunt of this trend. He emphasized that the notion of affording tax cuts while public services face challenges is a “fiscal fiction.”