Tax cuts set to take effect in 2026 will play a major role in shaping the financial landscape for many Americans. These changes, part of a broader reform introduced under recent legislation, are expected to affect workers and employers alike. At the same time, the global workforce continues to adapt to the growing trend of remote work, with many companies opting for hybrid or fully remote models.

According to CBS News, both the evolving work environment and the potential savings from these tax cuts will have far-reaching consequences for how individuals manage their time, money, and overall well-being in 2025 and beyond.

Remote Work: The Growing Trend

We’ve heard it for years, but it seems truer now than ever: remote work is here to stay. According to the Tax Foundation, a typical filer could see a tax cut of $3,752 in 2026, thanks to new provisions in the tax law. This change signals a greater opportunity for workers, especially those with flexible schedules or who can work from home.

However, just as remote work comes with perks—such as saving time on commuting—there are challenges too. Mental health experts highlight that isolation and blurred lines between work and personal life can lead to burnout.

Still, remote work has proven to be a game-changer for many employees. As Garrett Watson, director of policy analysis at the Tax Foundation, pointed out,

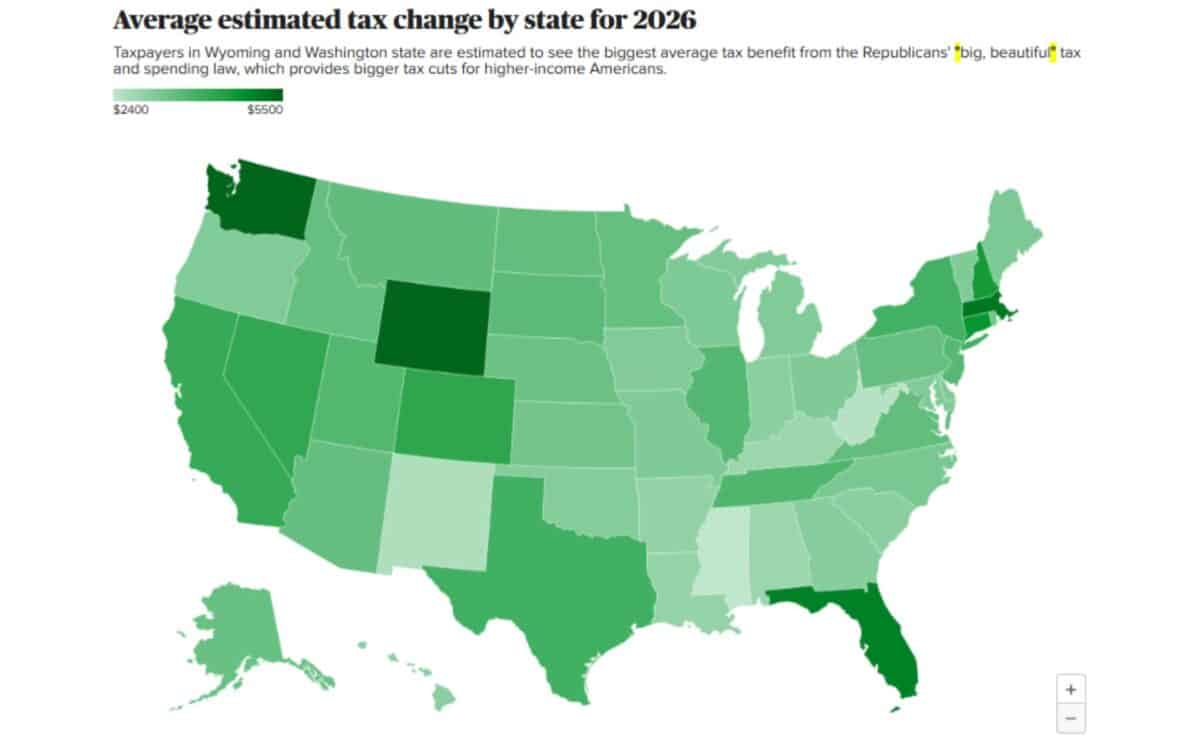

Places with higher incomes are going to have higher nominal tax cuts. The largest tax benefits are going to the mountain states — it’s due to a subgroup of higher-income business owners.

This means that higher-income earners in places like Wyoming are more likely to see larger tax cuts than others, a reality that speaks to the growing divide between income levels in different regions.

How States Will See Different Tax Cuts

In 2026, the biggest tax cuts will go to states with higher average incomes and larger tax deductions. For instance, Wyoming will see the most substantial tax cut at an average of $5,374. Additionally, residents of states with higher property taxes, like New Jersey and New York, will benefit more due to the increased deduction cap for state and local taxes.

However, this won’t be the case for all Americans. In states like Mississippi and West Virginia, where median household incomes are lower—about $55,000 in Mississippi and $60,000 in West Virginia—residents can expect smaller tax cuts, with these figures falling well below the national median of $80,600. According to Watson,

If a taxpayer isn’t taking tips or overtime or new car loan deduction, they may see a lower benefit.

The tax cuts will also be particularly favorable for the wealthiest Americans. The top 1%—those earning over $1.1 million—could receive $75,410 in annual tax breaks by 2026, while those in the lowest 20% of income earners will see a modest average tax cut of around $150. Households with earnings between $66,801 and $119,200 will benefit from a tax break of about $1,780.

The Role of Tax Deductions for Seniors and Low-Income Workers

One of the most notable changes is the $6,000 deduction for seniors over 65. This could lead to larger refunds for older Americans, further enhanced by the overall increase in the standard deduction. In addition, new provisions, such as the “no tax on tips” and “no tax on overtime”, are expected to benefit low-income workers who receive tips or work overtime, potentially resulting in significant tax cuts for those in these job categories.

Despite these improvements, the tax system is far from perfect. As Mark Steber, chief tax officer at Jackson Hewitt, advised,

Having this much time left in the year allows taxpayers to make any necessary adjustments to help increase a refund or lower an amount due, and can be as simple as adjusting the withholding on a W-4.

Taxpayers should carefully track any new sources of income, like tips or overtime, to maximize their tax cuts when filing in 2026.