The US Securities and Exchange Commission (SEC) has asked exchanges to accelerate their 19b-4 filings for cash Ether ETFs, as reported by CoinDesk.

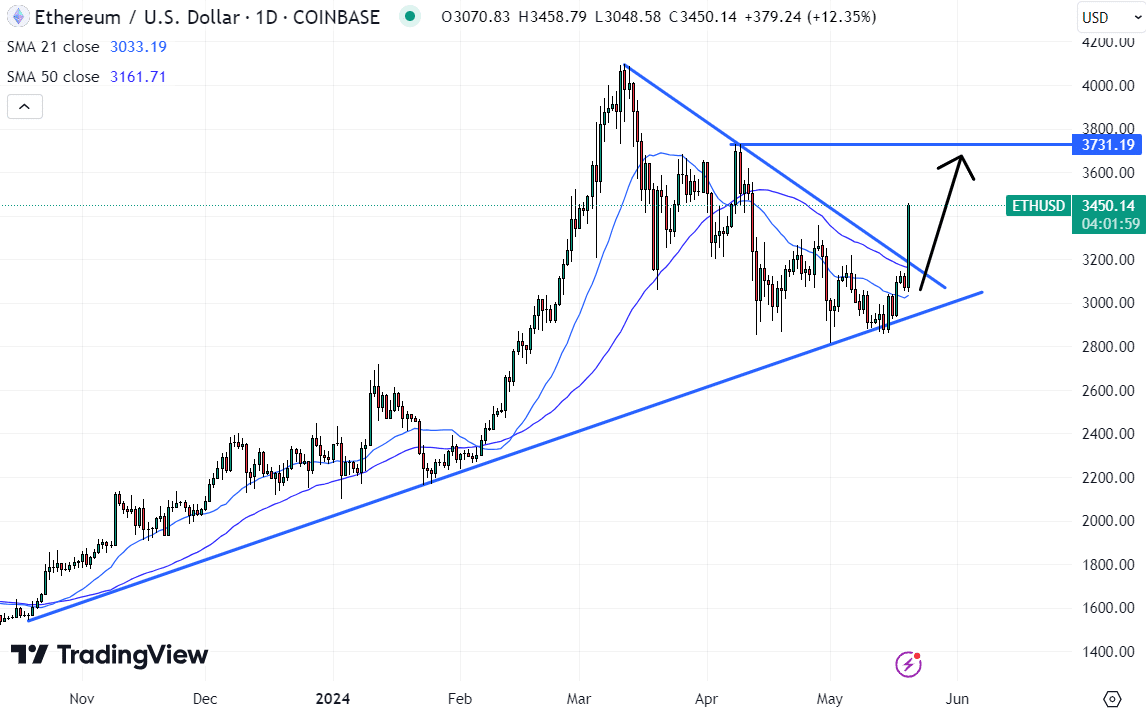

The move comes amid growing speculation about the SEC’s potential approval of spot Ether ETFs. On 20 May 2024, Ether (ETH) saw a notable 14% rise from $3,000 to $3,500.

SEC Calls to Accelerate 19b-4 Filings for Spot Ether ETFs

Bloomberg ETF analysts Eric Balchunas and James Seyffart have adjusted their probability estimate for the approval of spot Ether ETFs from 25% to 75%.

The adjustment follows rumours suggesting a possible reversal of the SEC’s position, which is seen as being increasingly influenced by political factors. Analysts have seen an increase in new applications for spot Ether ETFs in response to this speculation.

Seyffart emphasised the importance of Form 19b-4 in the approval process, citing in particular the case of VanEck, which has a filing deadline of 23 May 2024.

Form 19b-4 is submitted by national stock exchanges to propose rule changes or introduce new products, such as the Ether ETF. While approval of this form is crucial for ETF trading, it does not authorise public marketing until Form S-1 is also approved.

Implications of S-1 Approval

Approval of Form S-1 is essential for the public offer of new securities. It contains detailed information about the fund’s structure, management and strategy to reflect the performance of the underlying asset, in this case Ether.

Analysts believe that if the SEC gives the green light to 19b-4 filings, S-1 approvals are likely to follow, so the launch of Ether spot ETFs will be more a matter of timing than possibility.

Nate Geraci, president of the ETF Store, highlighted the potential impact of the SEC’s decision on the adoption and regulation of cryptocurrencies.

The approval process for these ETFs involves a thorough review, with the SEC legally having 240 days to rule on 19b-4 filings.

This cautious approach underscores the SEC’s commitment to ensuring regulatory compliance and protecting investors from the volatility and risks inherent in cryptocurrencies.

Still, even with the potential approval of Forms 19b-4, the SEC may defer S-1 approvals due to the current low level of participation. This cautious stance is intended to take into account the complexities and risks associated with crypto-assets.

The SEC’s meticulous assessment aims to understand market conditions and the specific structures of ETFs before granting approval, which may result in delays but ensures a sound regulatory framework.

Market Transformation Opportunities

Approving an Ether spot ETF could potentially reshape the cryptocurrency investment landscape by providing a regulated and accessible route to invest in Ether, attracting both institutional and retail investors.

It could also pave the way for other financial products based on cryptocurrencies, improving market liquidity and stability.

Conversely, significant rejection or delays could signal lingering regulatory apprehensions, which could dampen investor enthusiasm and slow the wider adoption of digital assets.