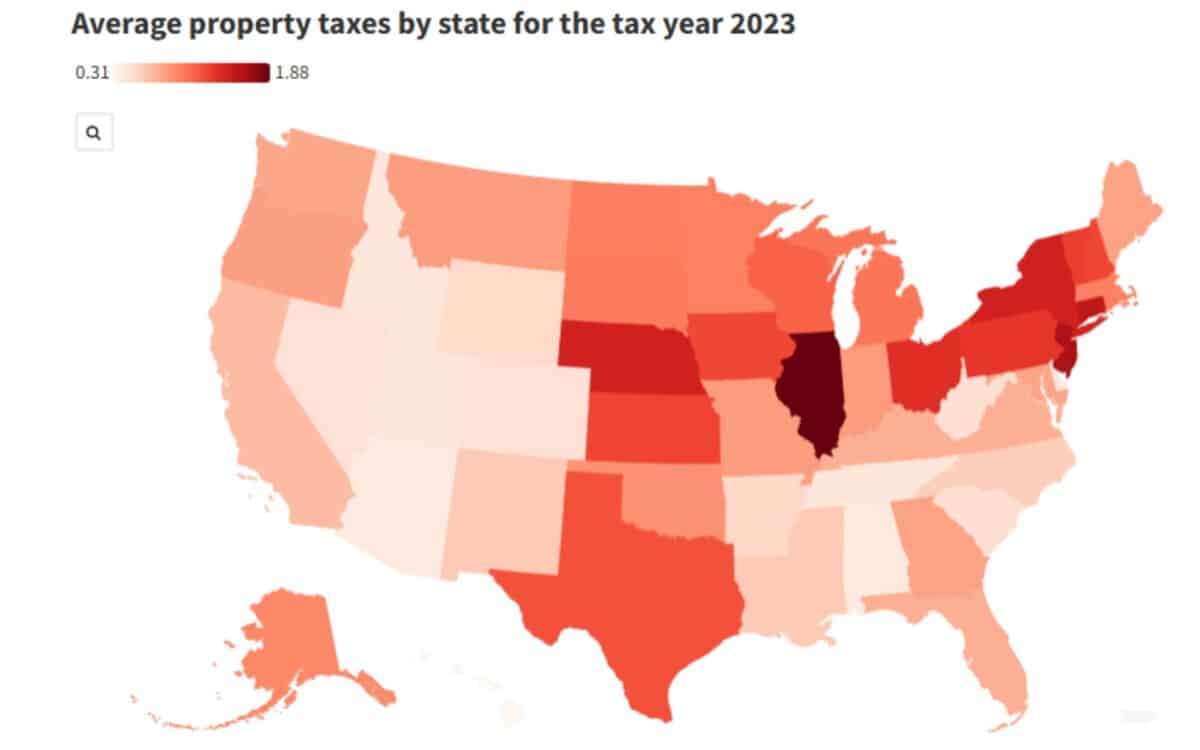

Property taxes across the United States have increased significantly over the past five years, primarily due to substantial rises in home values.

This increase has contributed to the ongoing housing affordability crisis, affecting many homeowners but placing particular financial strain on seniors who often rely on fixed incomes.

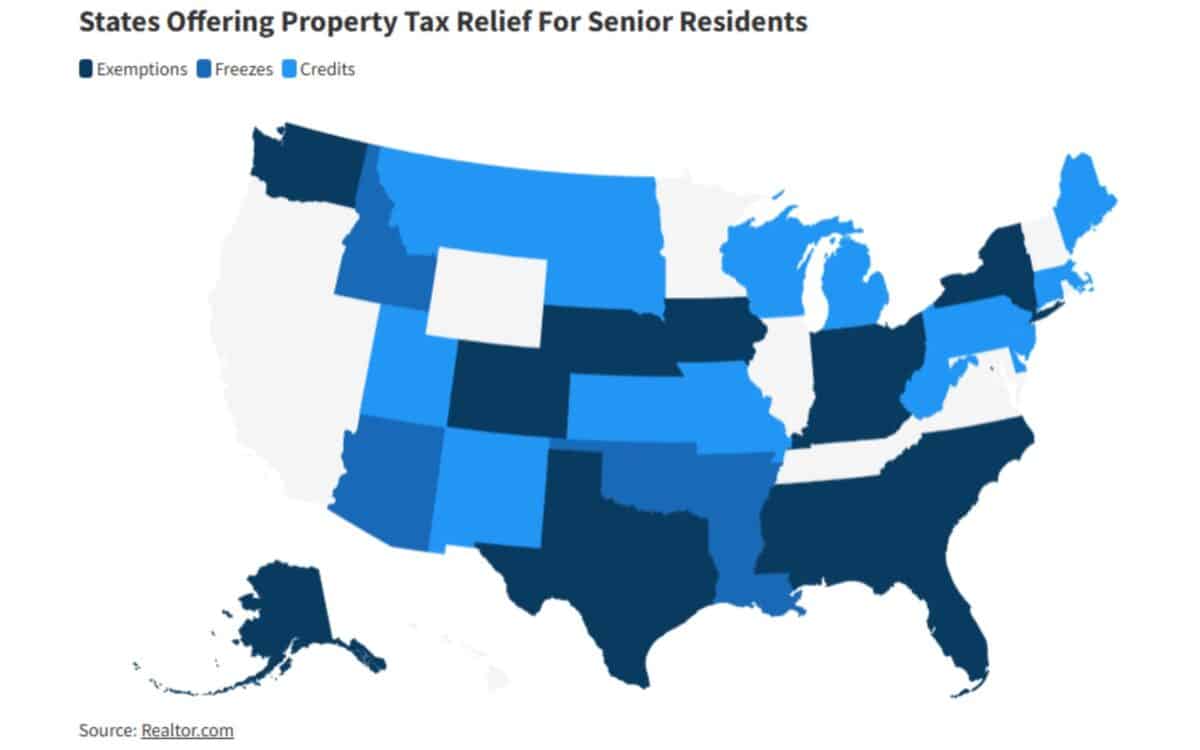

Several states and the District of Columbia have implemented various forms of relief, including exemptions, credits, and freezes, to alleviate these costs for older residents.

According to Newsweek, seven states are currently pursuing legislative measures to further expand or even abolish property taxes for seniors, reflecting a broader political effort, largely driven by Republican lawmakers.

The Impact of Rising Property Taxes on Senior Homeowners

The sharp increase in home prices during the pandemic, fueled by historically low mortgage rates and competitive bidding, caused property tax assessments to climb.

Since property taxes are based on home values, many homeowners have seen their tax bills rise sharply.

Although these homeowners benefit from increased equity, seniors on fixed incomes face growing financial strain because their income does not increase to match higher taxes. This has prompted states with significant retiree populations, such as Florida, to pursue expanded tax relief programs.

Assaf Harpaz, assistant professor at the University of Georgia School of Law, noted that property tax bills “typically rise over time due to higher assessed property values” and can become particularly burdensome for seniors.

He also explained that these pressures are often worsened by other age-related costs, such as increased healthcare expenses. Harpaz emphasized the importance of property taxes in funding

“vital public services such as education, law enforcement, local government, health, and infrastructure.” He added that exempting a large population from these taxes reduces the tax base, which usually results in either higher taxes on remaining taxpayers or cuts to public services.

States Offering Specific Exemptions and Relief Amounts

Currently, fifteen states and the District of Columbia provide property tax exemptions for seniors, with conditions and amounts varying widely:

- Alaska exempts the first $150,000 of assessed home value for homeowners aged 65 and older.

- Colorado exempts 50% of the first $200,000 of the primary residence’s value.

- Georgia offers a $4,000 exemption on county taxes for qualifying seniors.

- Indiana allows a reduction of $14,000 in assessed home value.

- Iowa exempts $6,500 of taxable property value.

- Kentucky provides a $49,100 exemption.

- Mississippi offers an exemption of $7,500.

- New York allows exemptions up to 50% of assessed value.

- North Carolina exempts either $25,000 or 50% of assessed value, whichever is higher.

- Ohio exempts $26,200.

- South Carolina exempts the first $50,000 of fair market value.

- Texas does not impose a state property tax, but school districts must offer at least a $10,000 exemption for seniors, with local governments potentially adding at least $3,000 more.

- Washington has three exemption tiers based on combined disposable income.

- District of Columbia reduces property tax by 50% for qualifying seniors.

Additional forms of relief include property tax freezes available in Arizona, Arkansas, Louisiana, Oklahoma, and Idaho, which protect seniors from increases in their tax bills.

Seventeen other states provide property tax credits to older homeowners, including Connecticut, Delaware, Kansas, Maine, Massachusetts, Michigan, Missouri, Montana, New Jersey, New Mexico, North Dakota, Pennsylvania, South Dakota, Tennessee, Utah, West Virginia, and Wisconsin.

Ongoing Legislative Efforts to Expand Relief for Seniors

Seven states are actively considering bills to increase property tax relief for seniors, reflecting growing political momentum:

- Maine has introduced LD 1541, a proposal to abolish property taxes entirely for seniors.

- Michigan is considering SB 292, which would exempt seniors over 70 years old.

- Minnesota proposes HF 403, a homestead tax credit for homeowners aged 65 and older.

- In Ohio, a grassroots group called Citizens for Property Tax Reform seeks a constitutional amendment to eliminate property taxes.

- Oklahoma’s SB 1144 aims to freeze property taxes for an estimated 100,000 senior homeowners.

- Oregon introduced HB 3755, which would grant a 5% exemption to seniors.

- Texas is considering SB 4 and SB 23 to increase the existing exemption for seniors from $100,000 to $140,000.

Christopher Berry, a professor at the University of Chicago, commented that while property tax relief for seniors is common, full exemption for residents over a certain age is rare.

He explained that such exemptions protect seniors from rising taxes that might otherwise force them to sell their homes.

Berry emphasized that many seniors live on fixed incomes that do not keep pace with increasing property values and related tax bills, making this protection critical to housing stability.

Balancing Tax Relief and Public Service Funding

Experts stress that property taxes support crucial local services including education, law enforcement, health, and infrastructure.

Large-scale exemptions or abolitions could shrink the tax base, potentially increasing the tax burden on other residents or forcing reductions in public services.

At the same time, protecting seniors from rapidly rising property taxes helps ensure they can remain in their homes without facing financial hardship. This ongoing policy debate illustrates the challenge of balancing affordable housing needs for older adults with sustainable local government funding.

The current landscape of property tax relief reflects a patchwork of state programs with varied eligibility criteria and benefits.

Legislative initiatives underway in multiple states highlight continued efforts to address the financial pressures on senior homeowners in a housing market marked by rising values and taxes.