Mortgage rates have seen noticeable fluctuations in recent weeks, after a prolonged period of high borrowing costs. According to a recent analysis shared with Newsweek, the recent drop in mortgage rates could present new opportunities for homebuyers, particularly in areas that rely more heavily on mortgages.

However, these changes in borrowing costs are not expected to impact all states equally. Some regions will likely benefit more from these changes, while others, where a higher proportion of homeowners own their homes outright, might not experience the same shifts in the housing market. This ongoing dynamic has raised questions about the potential long-term effects.

What’s Behind the Drop in Mortgage Rates?

Mortgage rates had historically been at record lows during the pandemic, with rates for home loans falling to between 2-3%. However, in response to rising inflation, the Federal Reserve raised interest rates aggressively throughout 2022, pushing mortgage rates between 6.5% and 7% for nearly three years.

This shift pushed homeownership out of reach for many prospective buyers, contributing to the affordability crisis.

Recently, however, things have started to change. In September 2024, the Federal Reserve made a historic move by cutting its interest rates for the first time in the year. This action led mortgage rates to fall to their lowest levels since fall 2024.

The average 30-year fixed mortgage rate has slightly increased to 6.3% for the week ending September 25, 2024, up from 6.26% the previous week, but it still remains near 11-month lows. According to Hannah Jones, Senior Economic Research Analyst at Realtor.com, this shift is providing “a meaningful boost to affordability,” especially for first-time buyers trying to stretch their budgets.

For buyers, the current rate environment is delivering a meaningful boost to affordability. At today’s levels, the monthly payment on a typical home is noticeably lower than it would have been at last year’s highs. That shift can make the difference for first-time buyers stretching their budgets, particularly in high-cost metros – she said.

Which States Will See the Biggest Housing Shift?

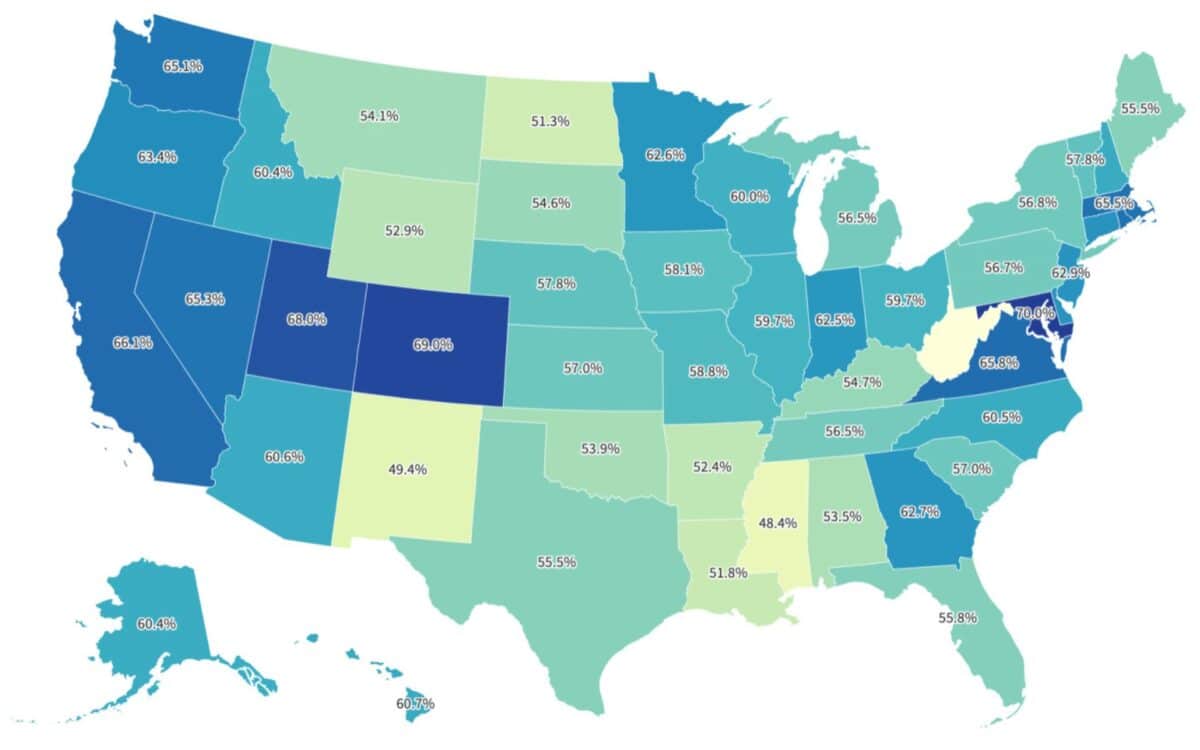

Some states are poised to experience a greater impact from falling mortgage rates. Areas like Washington D.C., Maryland, Colorado, Utah, and California, where a higher percentage of homeowners have mortgages, are likely to see a significant uptick in home-buying activity. In these areas, the lower rates will make a noticeable difference in the monthly payment for homebuyers, potentially unlocking new opportunities, particularly for first-time buyers.

On the other hand, states like West Virginia, Mississippi, New Mexico, North Dakota, and Louisiana are expected to see less of a shift. These regions have a larger share of homeowners who own their homes outright, meaning fewer residents are dependent on mortgages and, therefore, less likely to feel the effects of lower borrowing costs.

Will Mortgage Rates Keep Dropping?

Looking ahead, most experts predict that mortgage rates will remain in the 6% range through the end of 2024, with some forecasting that rates could fall below 6% by 2026. According to Nadia Evangelou, Senior Economist at the National Association of Realtors (NAR), if rates were to dip to 5.5%, approximately 5.5 million additional households would be able to afford a home. This could lead to an estimated 3% increase in sales in 2025 and a 14% surge in sales by 2026.

All this to say, should rates reach 6 percent, we expect 10 percent of these newly qualified households to actually purchase within the next 12 to 18 months – Evangelou noted.

Furthermore, Evangelou emphasizes that this potential increase in sales is contingent on rates reaching 6%. The market will likely remain fluid, with much depending on external factors like inflation and job growth.

While rates are lower recently, incoming inflation and jobs data will be key to determining whether mortgage rates move lower still or drift higher again – said Hannah Jones.

For now, the market is offering buyers and refinances a window of opportunity that didn’t exist just a few months ago.