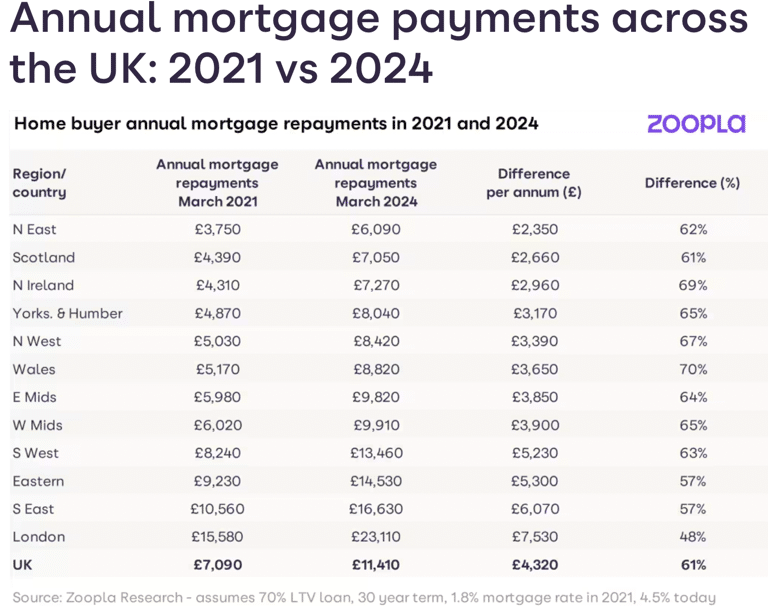

As of 2024, the UK’s mortgage payments had risen by a staggering 60% compared to 2021, giving a clear idea of the financial pressure homeowners are under.

This significant jump means that the average buyer has to pay an extra £4,320 annually, raising the average mortgage payment per year from £7,000 in 2021 to £11,400 in 2024.

Mortgage Rates Disparities

The hike in mortgage rates has hit the south of England the hardest. In London, average annual mortgage repayments have risen from £15,000 in 2021 to a staggering £23,000 in 2024.

Similarly, the South East and South West have seen their annual mortgage repayments rise by £6,000 and £5,300 respectively.

However, the rest of the UK has seen a less dramatic increase. Buyers in the Midlands had to find an extra £3,900, while those in the North East saw an increase of £2,350.

“At a region and country level, there has been a 50% to 70% increase in mortgage repayments for a typical buyer between 2021 and 2024.” stated Richard Donnell, Executive Director of Research at Zoopla.

Impact of Market Volatility and Inflation

Mortgage rates surged amid market uncertainty following the launch of Liz Truss’ controversial mini-budget in September 2022. Almost all two- and five-year mortgages on the market averaged over 6% before gradually falling.

In addition, inflation fell to 3.2%, but analysts felt that a cut in the Bank of England’s base rate was unlikely before June, with some predicting a later date.

Adding fuel to the fire, leading mortgage lenders such as Natwest and Santander have announced further rises in their mortgage rates. Barclays, HSBC, NatWest, Accord and Leeds Building Society have also increased rates on some of their mortgages.

“Two of the biggest mortgage lenders announcing rate hikes is not a great start to the week. This is not good news for borrowers.” According to Amit Patel, advisor at Trinity Finance.

The surge in mortgage rates has been a major challenge for homebuyers. But, the future of the market remains uncertain. Although the rise in mortgage rates is worrying, it is essential to note that this trend is part of a wider and complex economic landscape.

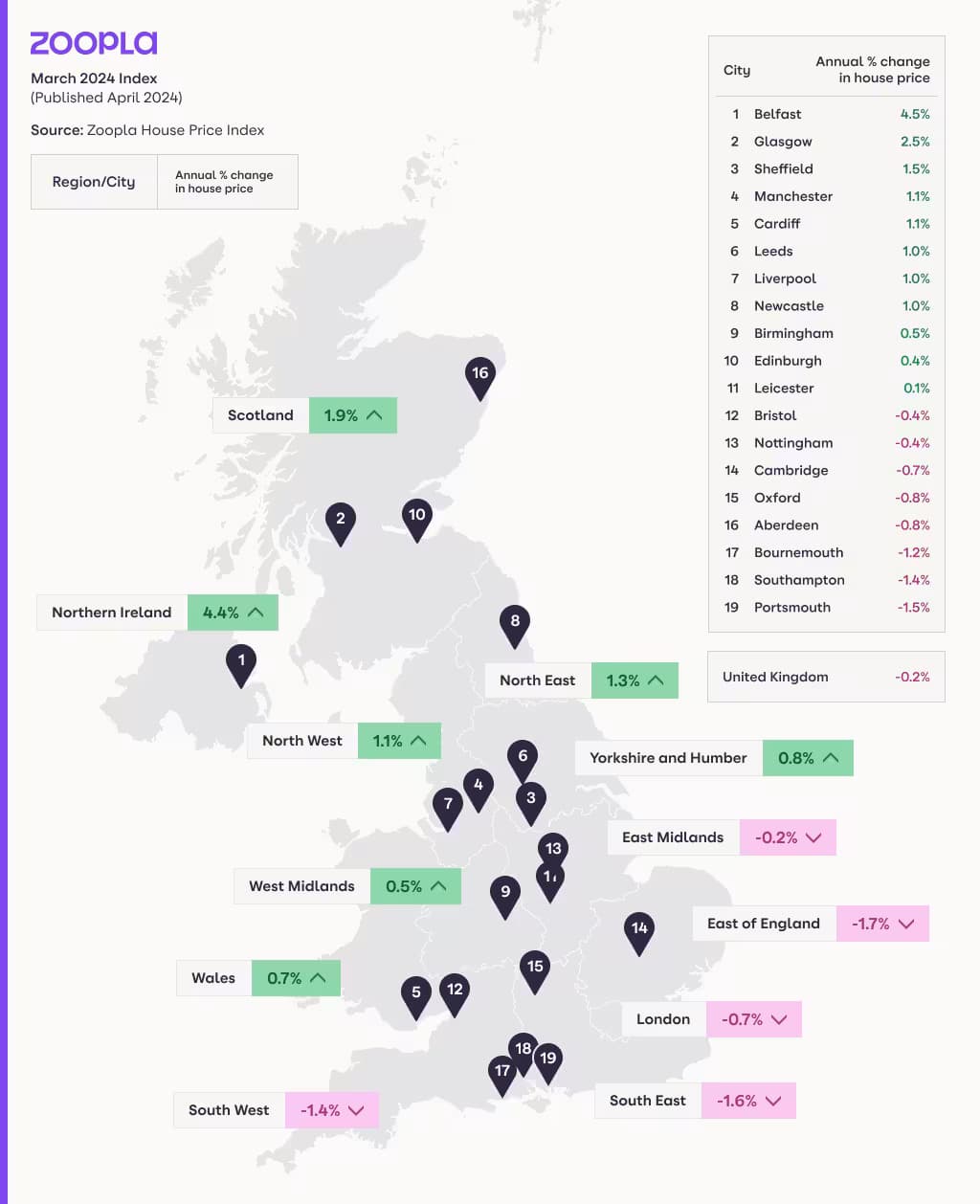

Home Buyers Move to Other Regions for Better Value

One could easily speculate that purchasers are turning to smaller homes because of the rising cost of mortgages. Yet, sales patterns by property type and number of bedrooms remain largely unchanged. Rather, buyers are looking further afield to get what they want at the right price.

According to the latest consumer research, a third of households looking to move are considering leaving their local area to find their next home.