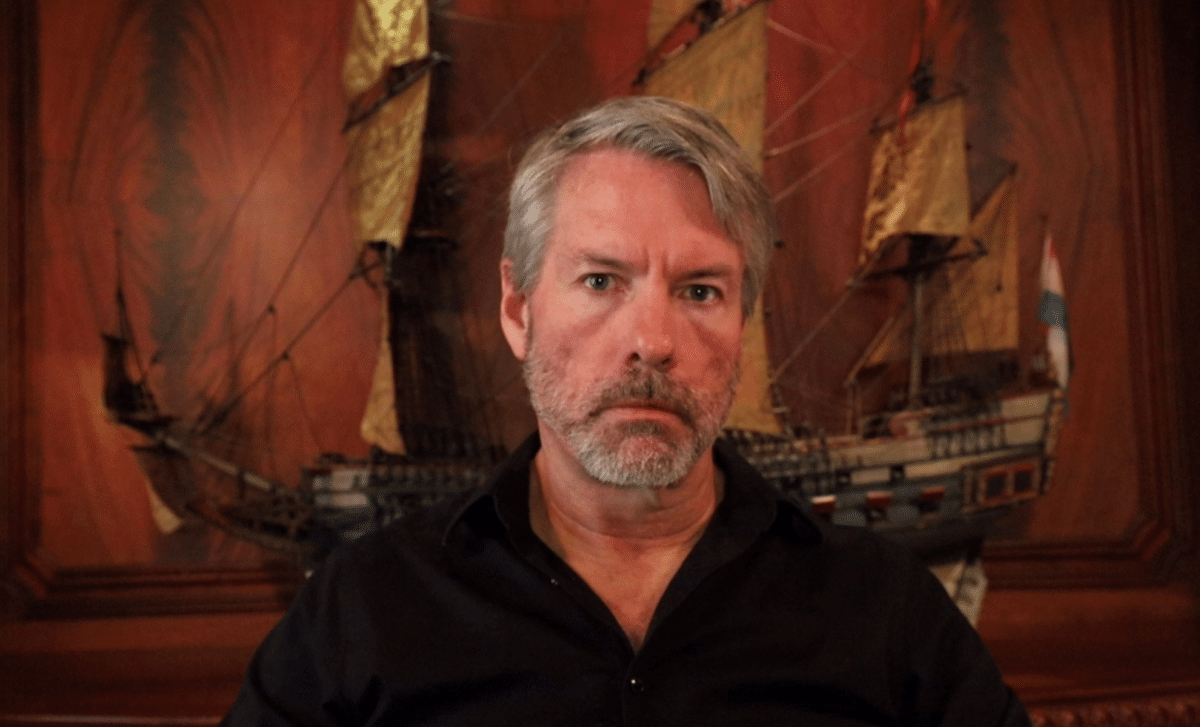

Michael Saylor, CEO of MicroStrategy and prominent Bitcoin advocate, recently discussed the cryptocurrency’s potential as the ultimate property and the most dependable investment asset in an interview with Julie Hyman of Yahoo Finance.

MicroStrategy’s Insights into Bitcoin Assets

In a statement that underscores MicroStrategy’s commitment to prioritize Bitcoin accumulation over more traditional assets, Michael Saylor passionately declared, “Well, we think Bitcoin is the highest form of property, the apex property in the world, and it’s the best investment asset, so the end game is to acquire more Bitcoin. Whoever gets the most Bitcoin wins. There is no other end game.”

While addressing questions about the company’s long-term strategy for its Bitcoin stock, Saylor did not hesitate to draw a correlation to the long-lasting New York City real estate value. The CEO emphasized: “Let’s take New York City in 1776 didn’t have an endgame, they’ve been raising capital to invest in New York City real estate at the all-time high for 300 years. If you’ve ever talked to a person that owned an apartment in New York City […] They put it in their will. They give it to their children.”

This comparison points out Saylor’s confidence in Bitcoin’s strong value and in its likeliness to act like a cross generational asset.

Saylor argued against the use of fiat currency as a store of value, rejecting the idea of trading Bitcoin stock for profit, arguing: “People that use fiat currency as a store of value, there’s a name for them. We call them poor. Anybody that’s rich in the world, they own property […] The royal family of England didn’t sell all of its property in central London […] nor did the royal family of Japan, nor did the royal family in the Middle East.”

This highlights Saylor’s strong conviction that Bitcoin’s potential is not limited to its sale, as the cryptocurrency represents true wealth and ownership in a rapidly evolving financial landscape.

Michael Saylor’s Bitcoin Growth Predictions

According to Saylor’s perspective, the limited supply of Bitcoin will maintain its value as demand rises, as he remarked: “There’s $900 trillion of wealth in the world. As people migrate from every other form of property and assets into cyberspace, you’re going to see the Bitcoin network go from a trillion dollar network to a 10X that to 100X that, and there really is nowhere else to go.”

Saylor reaffirmed his position that it is pointless to sell the “winning” asset to the “losers,” saying, “Bitcoin is going to appreciate in value faster than the S&P index. It’s going to appreciate in value faster than commercial real estate […] and so we’re just going to keep acquiring Bitcoin with our cash flows, with equity or capital raises, any other accretive method that comes to mind.”