The Telegraph quotes Rachel Reeves, who recently stated that households might suffer an additional income tax of £16,500 if she extends the frozen threshold further. This freeze, initially expected to end in 2028, may now be expected to end in 2030 with the implication of generating an additional £7 billion for the treasury every year.

Tax Implications of the Income Tax Threshold Freeze

The Chancellor’s decision to maintain the income tax thresholds without explicit tax increases is seen as a strategy to sidestep the Labour manifesto’s promise not to raise taxes on “working people.” As wages rise, more individuals will find themselves subject to higher tax rates, effectively transforming wage growth into a stealth tax.

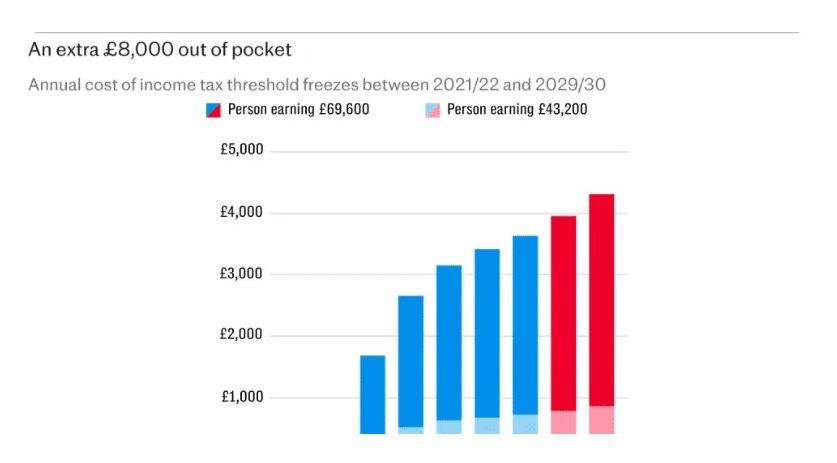

According to the analysis, the freeze would cost a person earning just under £70,000 nearly £15,000 in the 2024/25 tax year. If the freeze is extended for two additional years, this figure would increase by over £8,266, resulting in an overall cost that exceeds £23,000.

Historically, the £12,570 personal allowance and basic rate thresholds have been adjusted annually according to the previous September’s inflation rates. Typically, these adjustments round the personal allowance up to the nearest £10 and the basic rate threshold to the nearest £100.

The Office for Budget Responsibility (OBR) has provided projections for the Consumer Price Index (CPI) and nominal earnings. Consistent growth rate planes which follow along with the potential increased rate of income liability taxation should the freeze be lifted now offers clearer alternatives. To illustrate, should the freeze persist, a high-earning couple’s tax burden would increase by 55 percent from £29,856 up to £46,388.

Impact on Average and High-Earning Taxpayers

For individuals on average wages, currently pegged at £43,200, the Conservative freeze is projected to increase their tax bills by nearly £3,000 over its duration, with the extension further adding £1,654. Overall, the stealth tax implications are expected to escalate by almost 36% for the majority of taxpayers.

The long-term effects of the freeze are particularly pronounced, given that both the 20% and 40% tax rates are anticipated to rise significantly by 2030. Without the freeze, the personal allowance would ideally have increased from £12,570 to £16,870, and the threshold for higher-rate taxpayers would have risen from £50,270 to £67,500.

Workers at Risk of Higher Tax Brackets

It is anticipated that the current taxation freeze will raise millions to the higher tax rates. In a case, police officers, whose median salary is currently £44,342 annually, may become higher-rate taxpayers by 2030 with the freeze on pay for Sergeants and lower ranks. It is expected that by the end of the freeze, average annual salaries in that sector would grow to £51,930.

In similar situations, professionals in fields such as accounting, architecture, cybersecurity, and civil engineering may also face increased tax burdens as salaries evolve differently across industries.