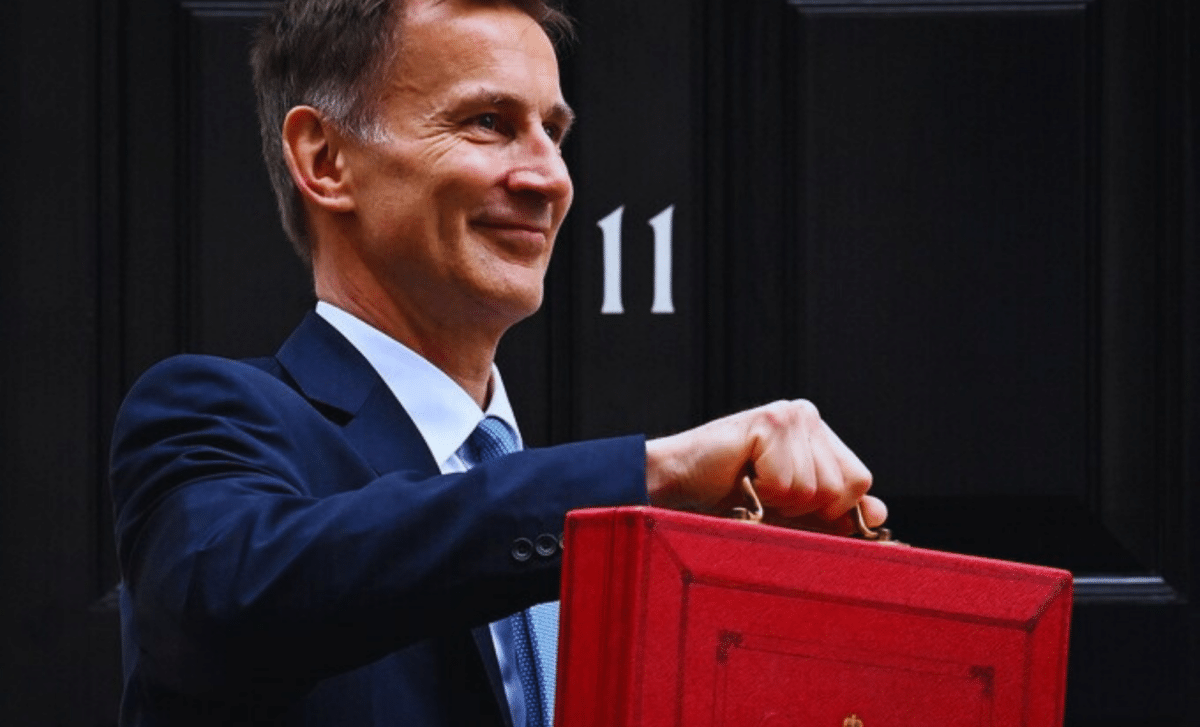

Jeremy Hunt received a pre-budget boost with the latest government borrowing figures revealing that the UK achieved a monthly budget surplus in January, marking a record since modern record-keeping began over three decades ago.

Jeremy Hunt Sees Record UK Budget Surplus: Insights from January’s Fiscal Triumph

According to data from the Office for National Statistics, the public sector was able to collect £16.7 bn more in tax than in monthly spendings.

The ONS attributed the surplus to factors including the deadline for self-assessed income tax payments at the end of the preceding month, coupled with decreased interest payments on government debt. This surplus more than doubled the £7.5 billion recorded in January 2023.

Financial markets anticipated an £18.7 billion surplus, anticipating substantial gains for the UK. Yet, due to revisions in previous data, borrowing for the first ten months of the 2023-24 fiscal year totalled £96.6 billion, nearly £10 billion less than forecasts from the Office for Budget Responsibility, the spending watchdog, and government tax projections.

Jessica Barnaby, Deputy Director of the Public Sector Division at the ONS, highlighted, ‘January’s surplus is the largest in nominal terms since monthly records began in 1993, although borrowing in the year to January is only slightly lower than the same period last year.’ Barnaby’s statement underscores the historical significance of the surplus but also acknowledges the ongoing challenges in reducing borrowing.

Factors Contributing to the Surplus

Jessica Barnaby, Deputy Director of the Public Sector Division at the ONS, shed light on the seasonal nature of tax receipts, stating, “Tax receipts are always higher in January than other months owing to self-assessed taxes, which often leads to a surplus.”

Barnaby emphasized that the decline in inflation rates, as measured by the Retail Prices Index, resulted in lower payments for individuals holding government loans. Additionally, the cessation of energy bill support in 2023 contributed to reduced government spending.

Economic Analysis and Government Stance on Fiscal Policy

Ruth Gregory, analyst at Capital Economics, offered a nuanced perspective on January’s public finance figures, acknowledging the positive news they brought for Jeremy Hunt ahead of the budget.

The analyst highlighted: “January’s public finances figures delivered some much-needed good news for the chancellor in the lead-up to the budget. But we doubt this will pave the way for a big pre-election splash.

“We think the chancellor will be handed ‘headroom’ of just £15bn (0.5% of GDP), limiting his ability to unveil big unfunded tax cuts if he wishes to adhere to the fiscal rules.”

Treasury’s chief secretary, Laura Trott, remarked: “We provided hundreds of billions to pay wages, support business and protect lives during Covid, and to pay half of people’s energy bills after Putin’s invasion of Ukraine.

“But we can’t leave future generations to pick up the tab, which is why we have taken tough decisions to help reduce borrowing versus what the OBR expected in March. While we will not speculate over whether further reductions in tax will be affordable in the budget, the economy is beginning to turn a corner, with inflation down from over 11% to 4%.”