In a week marked by heightened economic uncertainty, investors poured $158.73 billion into global money market funds—the second-largest weekly net purchase since April 2020—according to LSEG Lipper data.

The surge was driven by mounting concerns over impending tariff hikes under the incoming U.S. administration and cautious anticipation of a pivotal job report that could reshape expectations for Federal Reserve interest rate cuts.

President-elect Donald Trump, set to take office on January 20, has promised aggressive trade policies, including a 10% tariff on all global imports and a 25% tariff targeting Canada and Mexico. This announcement has fuelled apprehension among investors, prompting a defensive shift in portfolio strategies.

Simultaneously, mixed trends across equity, bond, and commodity markets underscore the complex dynamics influencing global investment flows. Here’s a closer look at the week’s developments and what they signal for the financial landscape in 2025.

Global Investment Trends: Shifting Preferences Amid Market Uncertainty

Investors worldwide are navigating a complex financial landscape, marked by uncertainty in economic data, trade policies, and regional dynamics. Recent fund flow data reveals significant shifts in investment preferences, from surging inflows into money market funds to mixed signals in equities and commodities. These movements highlight evolving strategies as market participants weigh risk and reward in an increasingly volatile environment.

Money Market Funds Surge

Investors funnelled $158.73 billion into global money market funds, marking the highest level of inflows since the onset of the pandemic in 2020. The move reflects widespread risk aversion amid uncertainty surrounding U.S. trade policies and economic data releases.

Equities Show Mixed Signals

Global equity funds enjoyed a third consecutive week of inflows, totalling $11.36 billion. European equity funds attracted $8.7 billion, their highest in three weeks, while Asian funds gained $5.6 billion.

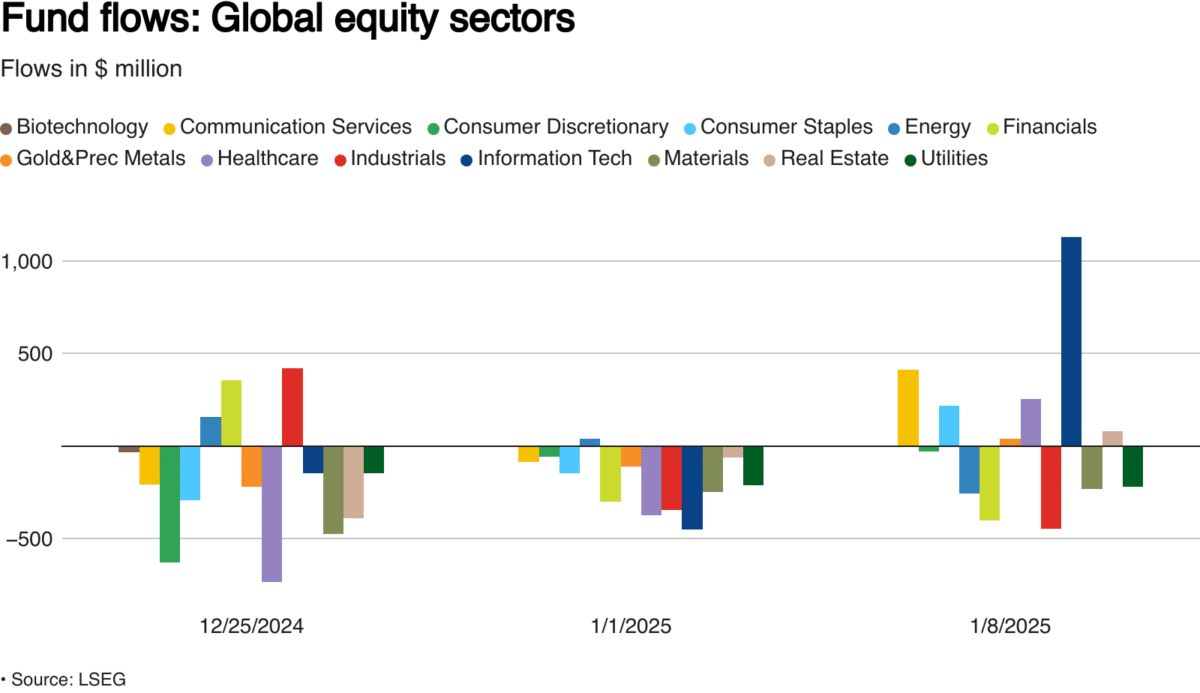

However, U.S. equity funds faced outflows of $5.05 billion, indicating selective investor caution. Sector-specific funds also saw a resurgence, with $1.13 billion channelled into technology stocks and $413 million into communication services.

Weekly flows into global equity sector funds in $ million

Bond Funds Attract Steady Inflows

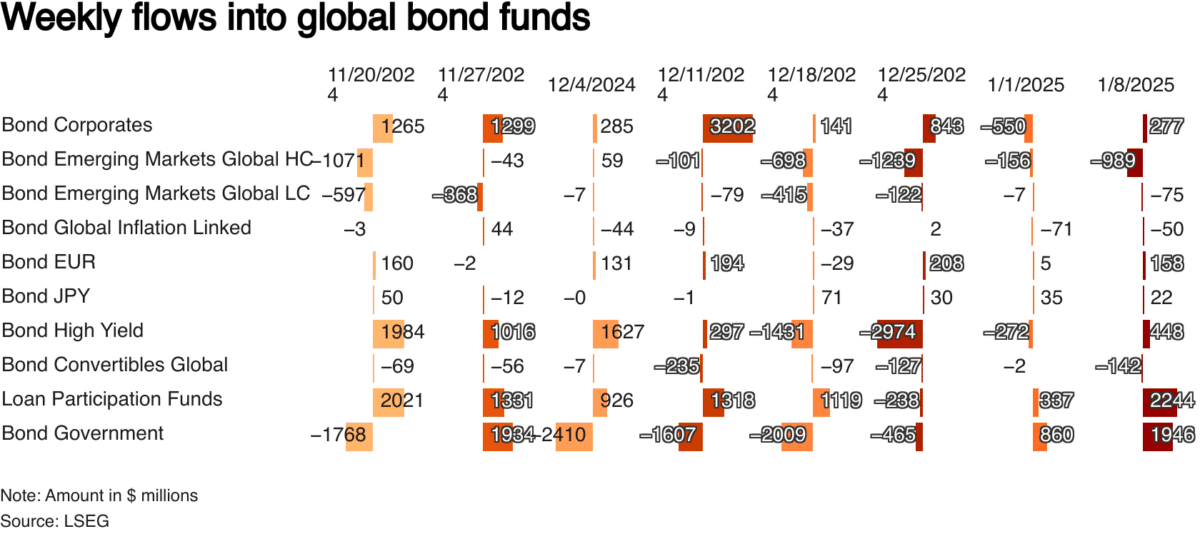

Global bond funds received $19.5 billion, marking their second inflow in four weeks. The breakdown of bond fund inflows is as follows:

- Government bond funds: $1.94 billion

- Loan participation funds: $2.24 billion

This steady inflow points to continued demand for fixed-income securities despite market volatility.

Commodity Funds Face Liquidations

Commodity funds saw a second consecutive week of outflows, with $293 million withdrawn from gold and precious metals. Despite this short-term sell-off, these funds amassed a substantial $14.32 billion in net purchases throughout 2024.

Emerging Markets Diverge

Emerging market bond funds reversed a four-week selling streak with $2.38 billion in net inflows. In contrast, equity funds experienced significant outflows, losing $973 million, reflecting heightened caution in developing markets.