Economic optimism is faltering for many American households, as rising debt levels, inflation and job market uncertainty deepen financial stress. Despite indicators of economic growth in some sectors, a new report shows consumers are increasingly turning to legal services to navigate personal financial crises.

According to a report by legal services provider LegalShield, the number of Americans seeking legal advice around bankruptcy and debt reached near-record levels in the third quarter of 2025. These findings underscore the widening gap between national economic indicators and the everyday reality for millions of families.

Legalshield Index Shows Steep Rise in Bankruptcy-Related Enquiries

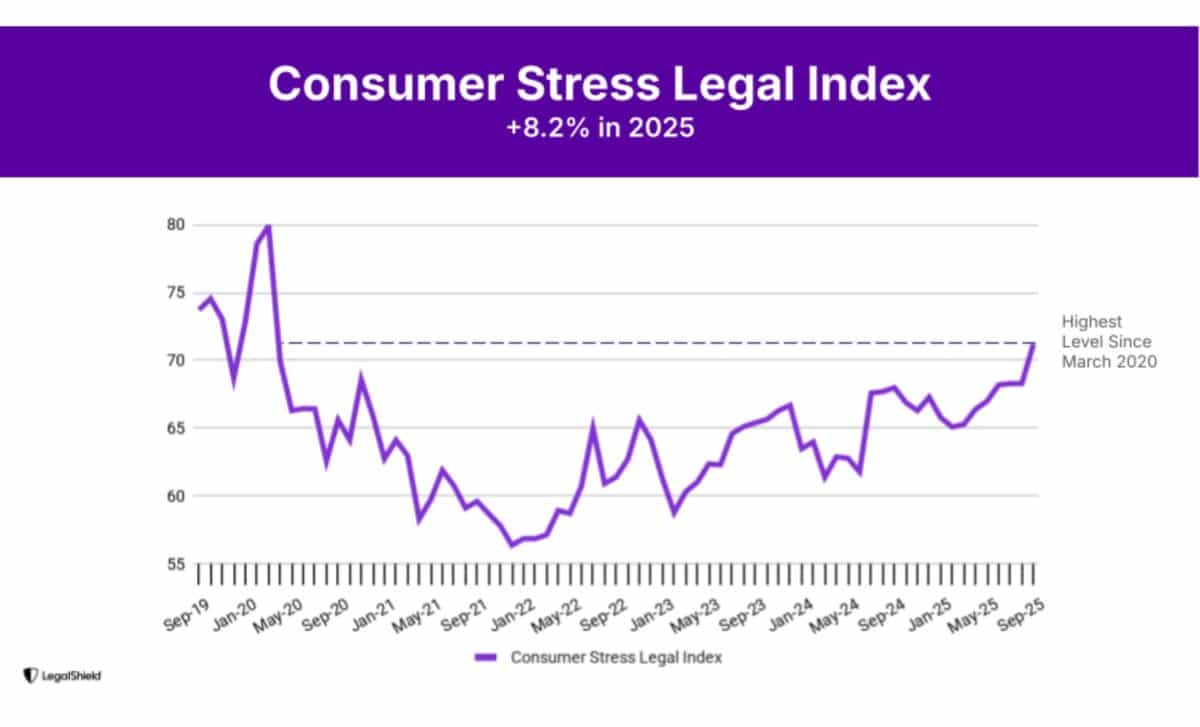

The Consumer Stress Legal Index, maintained by LegalShield, rose 4.4 percent between June and September—its seventh consecutive monthly increase. The index, which is based on more than 150,000 monthly consumer legal enquiries, reached its highest point since March 2020. The most notable uptick was a 17 percent rise in bankruptcy-related calls during the third quarter alone.

According to LegalShield, the increase reflects a growing reliance on legal support to manage housing concerns, unsecured debt, and financial instability. “We’re seeing families hit crisis mode heading into the holidays,” said Matt Layton, senior vice president of consumer analytics at LegalShield, in an interview with Newsweek. “Especially around unsecured debt and rising housing costs.”

Attorney Christopher Peoples, who contributes to the report, observed a consistent trend across states like Kansas, Utah and Idaho. “People are drowning in this economic state we’re in,” he said, citing inflation and credit card interest as compounding factors. “Bankruptcy is their last lifeline.”

Inflation, Borrowing Costs and Weak Hiring Add to Financial Burden

Inflationary pressure continues to burden households, with the annual inflation rate ticking up to 3 percent in September, still above the Federal Reserve’s 2 percent target. At the same time, private sector data points to ongoing weakness in the labour market, with hiring showing signs of stagnation.

Amidst these conditions, alternative forms of credit are becoming more prevalent. A separate LegalShield study revealed that a growing number of consumers are turning to buy now, pay later schemes for everyday essentials, with nearly half of users missing payments. The report characterises this behaviour as symptomatic of deeper economic strain, not discretionary overspending.

While GDP and corporate earnings figures suggest broader economic resilience, household-level indicators paint a more cautious picture. “Financial pressure on American households is deepening just as the holiday season begins,” Layton noted.

Legal experts warn that if borrowing costs remain elevated and wages continue to lag, the surge in legal enquiries could translate into a spike in actual bankruptcy filings in early 2026.