U.S. consumer sentiment dropped sharply in early April, reaching its lowest level since mid-2022. This decline is attributed to escalating trade tensions, particularly between the United States and China, which have reignited concerns over inflation.

The uncertainty surrounding these trade conflicts has significantly impacted financial markets, triggering fears of higher prices and a potential economic slowdown. As inflation expectations surge, consumers and businesses alike are bracing for a turbulent economic environment.

According to Reuters, the rising trade tensions and their impact on inflation have contributed to a deepening sense of insecurity among U.S. consumers, adding to market volatility.

Sentiment Hits Three-Year Low as Inflation Expectations Surge

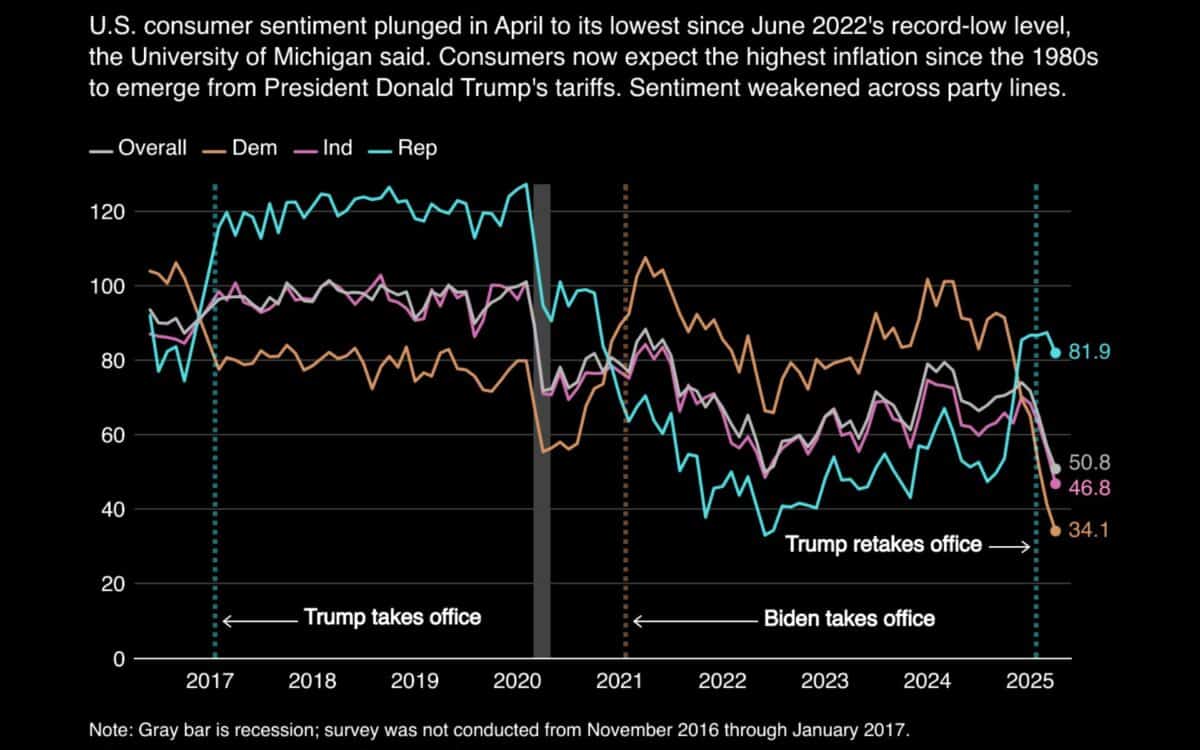

The University of Michigan’s Consumer Sentiment Index fell to 50.8, down from 57.0 in March, marking the lowest reading since June 2022. Economists polled by Reuters had expected a more moderate decline to 54.5. The university described the sentiment slump as “pervasive and unanimous” across age, income, education, geographic region, and political affiliation.

“Consumers have spiraled from anxious to petrified,” said Samuel Tombs, chief U.S.

Economist at Pantheon Macroeconomics. The decline was more pronounced among Democrats and Independents, though morale also fell among Republicans.

The survey, conducted before the latest round of tariff announcements, revealed that 12-month inflation expectations jumped to 6.7%, the highest level since 1981, from 5.0% in March.

It marked the fourth consecutive monthly increase of 0.5 percentage points or more and was evident across political lines. Over the next five years, inflation was expected to run at 4.4%, the highest since June 1991, up from 4.1% in March.

Tariffs Intensify, Raising Uncertainty and Consumer Fears

President Donald Trump escalated trade tensions by raising tariffs on Chinese goods to 125%, while delaying tariffs on other partners by 90 days. The White House has also kept a 10% blanket duty on nearly all imports and maintains a 25% tariff on vehicles, steel, and aluminum. In response, China announced reciprocal 125% tariffs.

The tariffs have rattled markets, wiping billions of dollars from retirement accounts and generating apprehension about future price increases.

The University of Michigan survey noted a continued decline in job market confidence, with the share of consumers expecting higher unemployment in the year ahead rising for the fifth straight month—reaching the highest level since 2009, during the Great Recession.

“This lack of labor market confidence lies in sharp contrast to the past several years, when robust spending was supported primarily by strong labor markets and incomes,” said Joanne Hsu, Director of the Surveys of Consumers.

Fed Faces Dilemma as Inflation Outlook Worsens

The persistent rise in inflation expectations challenges the narrative that inflation remains anchored. Some economists believe this will delay the Federal Reserve’s plans to resume rate cuts.

“The rise in long-term inflation expectations should catch the Fed’s attention,” said Ryan Sweet, chief U.S. economist at Oxford Economics.

Financial markets currently price in a possible rate cut by June, but the tone from analysts has turned more cautious.

Producer Prices Decline, but Goods Inflation Mixed

The Producer Price Index (PPI) for final demand fell by 0.4% in March, the first monthly decline since October 2023, after a 0.1% gain in February. This compares to economists’ expectations of a 0.2% increase. On a 12-month basis, the PPI rose 2.7%, slowing from 3.2% in February.

A 0.9% drop in goods prices accounted for over 70% of the monthly PPI decline. The sharpest fall came from gasoline prices, down 11.1%, while wholesale food prices decreased 2.1%, led by lower prices for eggs, beef, and vegetables. In contrast, prices for steel mill products rose 7.1%, likely reflecting the impact of tariffs.

Excluding food and energy, core goods prices increased 0.3% for a second consecutive month.

Softer Service Prices Suggest Mixed Inflation Signals

The PPI also showed a 0.2% drop in services prices, after remaining flat in February. Wholesale airline fares fell 4.0%, while hotel and motel prices declined 1.2%. These categories, along with portfolio management fees and healthcare, are key components of the core Personal Consumption Expenditures (PCE) price index, the inflation measure closely followed by the Federal Reserve.

Economists estimate that the core PCE rose only 0.1% in March, compared with 0.4% in February, which would bring the annual core inflation rate down to 2.6% from 2.8%.

“Although the core PCE estimates are a welcome relief, we don’t think we can extrapolate much from this,” said Pooja Sriram, economist at Barclays.