A recent study reveals an unexpected trend in the U.S. housing market: in some cities, buying a home is actually more affordable than renting.

The analysis, conducted by Construction Coverage, examined data from sources like Zillow, the U.S. Census Bureau, and Freddie Mac to compare monthly mortgage payments with monthly rent payments across 343 cities.

This surprising finding provides potential buyers with new opportunities, particularly in cities where home prices remain relatively low.

According to Live Now Fox, the affordability of buying a home in certain markets presents a compelling alternative to the soaring cost of rental housing in these areas.

The Cost of Housing Across the U.S.

While home prices have surged in recent years, making homeownership difficult for many Americans, rental costs have also escalated.

The nationwide average shows that typical mortgage payments are now 21% higher than renting. This disparity has pushed many to opt for renting instead of buying, even in markets where the cost of purchasing a home seems relatively lower.

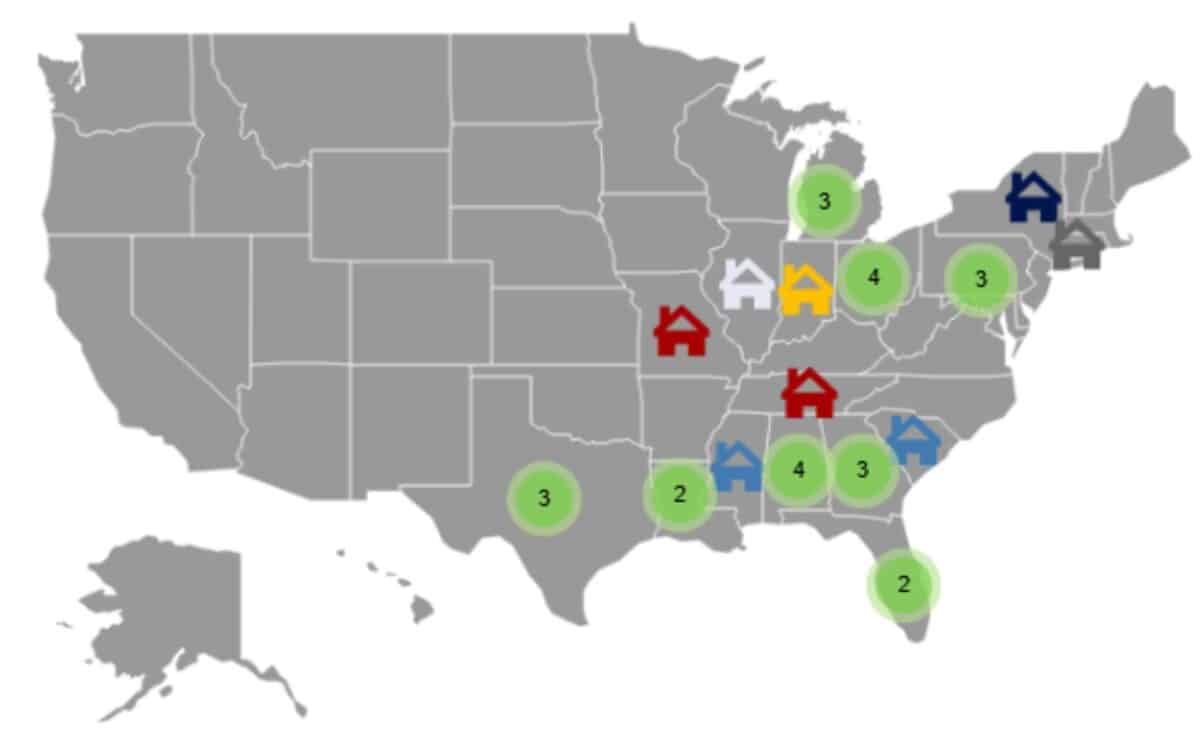

However, the study highlights 32 cities where purchasing a home is more economical than renting. These cities are scattered mainly across the South and Rust Belt regions of the U.S., where lower home prices make buying a home a more viable option than paying high rent.

Cities such as Detroit, Michigan and Jackson, Mississippi top the list with huge differences in affordability—homes in these areas can be as much as 60% cheaper to purchase than to rent.

Here are the 32 cities where buying a home is more affordable than renting, with the percentage difference between buying and renting:

- Detroit, Michigan: -60.1%

- Jackson, Mississippi: -59.8%

- Cleveland, Ohio: -39.3%

- Birmingham, Alabama: -36.3%

- Montgomery, Alabama: -31.1%

- Baltimore, Maryland: -23.6%

- Memphis, Tennessee: -20.8%

- Shreveport, Louisiana: -20.2%

- Toledo, Ohio: -19.4%

- Akron, Ohio: -16.9%

- Philadelphia, Pennsylvania: -16.4%

- Columbus, Georgia: -13.2%

- Augusta, Georgia: -13%

- Peoria, Illinois: -12.6%

- Beaumont, Texas: -12.5%

- Tuscaloosa, Alabama: -12.3%

- Hartford, Connecticut: -12.2%

- Dayton, Ohio: -10.3%

- St. Louis, Missouri: -10.2%

- Brownsville, Texas: -9.1%

- Macon-Bill County, Georgia: -8.6%

- New Orleans, Louisiana: -7.8%

- Mobile, Alabama: -7.5%

- South Bend, Indiana: -7.4%

- Waco, Texas: -7%

- Dearborn, Michigan: -4.8%

- Syracuse, New York: -4.7%

- Columbia, South Carolina: -3.9%

- Lansing, Michigan: -2.8%

- Pompano Beach, Florida: -2.2%

- Pittsburgh, Pennsylvania: -1.6%

- Lehigh Acres, Florida: -1.2%

Cities That Stand Out

Among the 32 cities identified, many are concentrated in states like Alabama, Georgia, and Texas. For instance, Detroit, Michigan, shows a 60.1% savings for homebuyers over renters, while Jackson, Mississippi follows closely at 59.8%.

Other cities like Cleveland, Ohio, and Birmingham, Alabama also reflect significant savings for buyers. The low home prices in these cities allow potential homeowners to build equity rather than pay rising rent prices.

The rapid rise in housing costs has been driven by several factors, including increased competition, limited housing supply, and historically low mortgage rates in the past few years. Although mortgage rates have risen recently to cool the market, high home prices persist.

In fact, despite a slight deceleration in price growth, the median home price is still approximately 33% higher than it was in 2020.

The 2025 Rental Affordability Report by ATTOM confirms that both owning and renting a home remain financially challenging for average American workers, with housing costs eating up 25 to 60% of their wages.

Despite this, in certain cities, the dream of homeownership may still be within reach, thanks to the affordability of purchasing a home over renting.